NIO has given relatively optimistic expectations for the fourth quarter and next year.

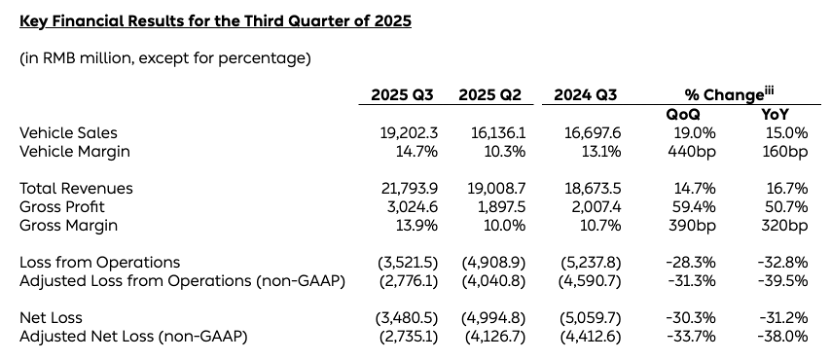

On November 25, NIO released its Q3 2025 financial report, showing that the company achieved revenue of RMB 21.79 billion in the third quarter, a year-on-year increase of 16.7% and a quarter-on-quarter increase of 14.7%, setting a new record. The net loss in the third quarter was RMB 3.481 billion, narrowing by 31.2% year-on-year; the adjusted net loss was RMB 2.735 billion, narrowing by 38% year-on-year; and the cash reserves in the third quarter were RMB 36.7 billion, an increase of nearly RMB 10 billion compared to the end of the previous quarter.

It is worth mentioning that NIO's gross margin indicators in the third quarter both reached new highs in nearly three years: the overall gross margin was 13.9% and the gross margin of whole vehicles was 14.7%.

The revenue growth was mainly driven by increased new vehicle deliveries. NIO delivered 87,100 vehicles in the third quarter, a year-on-year increase of 40.8% and a quarter-on-quarter increase of 20.8%, setting a new record.

Looking ahead to the fourth quarter, NIO expects to deliver 120,000 to 125,000 vehicles, representing a year-on-year increase of 65.1% to 72%; revenue guidance is RMB 32.76 billion to RMB 34.04 billion, representing a year-on-year increase of 66.3% to 72.8%, both of which are record highs.

Next year, a purchase tax will be levied on new energy vehicles, and battery leasing may become an advantage for NIO.

During the earnings call, Li Bin reiterated that NIO is confident of achieving profitability in the fourth quarter of this year, which remains the company's operating goal.

Li Bin explained that the company's high-margin models will contribute to the fourth-quarter profit target, such as the very strong orders for the new ES8, and there are still a lot of inventory orders.

He also admitted that the sales of the lower-priced Ledao cars were significantly affected by the reduction in trade-in subsidies, but the impact on overall gross profit was within expectations.

Regarding the fourth-quarter sales guidance, Li Bin responded that the reduction in trade-in subsidies has indeed affected car sales, and the year-end "boom effect" will not be as pronounced as in previous years. For NIO, the impact is on "long-term models," meaning models whose initial sales period has ended, which is also an impact on the entire industry.

Regarding the policy of halving the purchase tax on new energy vehicles next year, Li Bin stated that the impact on NIO will be relatively small. This is because over 80% of NIO's users choose the BaaS (Battery as a Service) model, where the price of the leased battery is not included in the tax calculation, which is an advantage for NIO.

He believes that the market and users have already largely absorbed the impact of the policy reduction. From January to October this year, the growth rate of pure electric vehicles far exceeded that of other power forms. In the Chinese auto market, the development of the electric vehicle industry is no longer policy-driven.

Li Bin expects to achieve annual profitability next year, with a gross profit margin of 20%.

The financial report shows that in the third quarter, NIO's overall gross margin was 13.9%, and the gross margin for complete vehicles was 14.7%. Li Bin said that this gross margin level was higher than NIO's previous expectations. Considering current costs and the delivery volume of the high-margin ES8 model, the gross margin for complete vehicles is expected to further climb to 18% in the fourth quarter.

NIO's CBU (Central Business Unit) reforms have also shown cost reduction effectiveness. In terms of expenses, NIO's expenses in the third quarter were RMB 6.546 billion, a 10% decrease compared to RMB 7.245 billion in the same period last year.

Among them, R&D expenses were RMB 2.391 billion, a year-on-year decrease of 28% and a quarter-on-quarter decrease of 20.5%. NIO stated that the decrease in R&D expenses was mainly due to the reduction in R&D personnel costs resulting from organizational optimization, as well as the reduction in design and development costs at different stages of the development of new products and technologies.

Li Bin expects that R&D expenses will remain at around 2 billion yuan in the next few quarters, with no plans for further reduction. The main goal in terms of R&D expenses will be to continuously improve sales volume and make the 2 billion yuan investment more productive.

Looking ahead to the full year of 2025, Li Bin gave the full-year profit forecast for Non-GAAP (non-GAAP accounting standards) and a gross margin of 20%.

Regarding "open source," on the one hand, he believes that China's new energy vehicle market has ushered in a golden age of development for "pure electric large vehicles." On the other hand, based on the Ledao L90 and NIO ES8, NIO will release three more large vehicles next year, and combined with the advantages of battery swapping, it is expected to seize more market share.

Regarding cost reduction, Li Bin explained that with the increase in sales, there is still room for cost reduction in the supply chain. As for expenses, the results in the third quarter have already demonstrated the efficiency improvement brought about by the CBU system, and he is full of confidence in future cost control.