Geely Automobile believes that the reduction in purchase tax for new energy vehicles next year will benefit the company's sales of gasoline-powered vehicles.

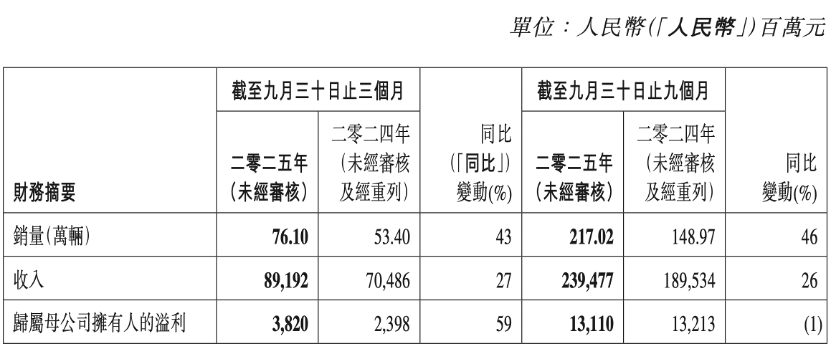

On November 17, Geely Automobile Holdings Limited (Geely Automobile, 00175.HK) announced that its revenue for the third quarter was RMB 89.192 billion, a year-on-year increase of 27%, setting a new record for single-quarter revenue; net profit attributable to shareholders of the listed company was RMB 3.82 billion, a year-on-year increase of 59%.

In the first three quarters, the company's revenue was 239.477 billion yuan, a year-on-year increase of 26%; net profit attributable to shareholders of the listed company was 13.11 billion yuan, a year-on-year decrease of 1%.

The announcement further stated that, excluding foreign exchange tax, net income attributable to owners of the parent company, impairment losses on non-financial assets, gains from the deemed sale of subsidiaries, and impairment losses on assets classified as held for sale, the company's core net profit attributable to owners of the parent company for the first three quarters of this year was RMB 10.62 billion, an increase of 59% year-on-year.

In terms of sales volume, the company sold 761,000 vehicles in the third quarter, a year-on-year increase of 43%; and 2,170,200 vehicles in the first three quarters, a year-on-year increase of 46%. Geely disclosed that its market share in the first three quarters reached 10.2%, a year-on-year increase of 28.1%.

As of the end of October 2025, Geely Automobile had achieved annual sales of 2.477 million vehicles, reaching its annual sales target of 3 million vehicles, achieving 82.6% of its target.

Geely has also provided an explanation regarding the merger between Geely Automobile and JK, which has attracted much attention from the capital market.

At the earnings conference, Gui Shengyue, CEO and Executive Director of Geely Automobile Holdings Limited, explained that there are no legal obstacles to the delisting and merger of Jike into Geely Automobile, and the process is currently proceeding according to procedure.

He mentioned that many investment institutions had invested in JiKr before its IPO, but converting those investments into investments in Geely Automobile now requires relevant approvals. Due to the complexity of the approval process, many investors are still in the approval stage and are temporarily unable to complete the share swap.

Gui Shengyue stated that the merger is expected to be completed by the end of this year.

Starting next year, the vehicle purchase tax on new energy vehicles will be halved, meaning it will be levied at an actual tax rate of 5%, with a tax reduction of no more than 15,000 yuan per new energy passenger vehicle. Industry insiders generally believe that this is a significant factor influencing car sales performance.

In response to the impact of subsidy reduction, Geely Automobile's management stated that the gradual reduction of subsidies is a good thing for the industry. For Geely itself, since about 40%-45% of Geely's overall sales are still gasoline vehicles, the policy changes in the first quarter of next year will benefit Geely's gasoline vehicle segment. As for the new energy vehicle segment, many of Geely's new models are currently in short supply with substantial order volumes. Since deliveries cannot be completed this year, Geely has also introduced a guarantee policy for these orders, which will contribute to next year's orders.

In addition, next year will still be a big year for Geely Automobile's products, with new products being launched from the first to the fourth quarter, which will further stimulate demand growth.

Going global has transformed from an "optional" to a "must-do" for Chinese automakers. Like other Chinese car brands, Geely is actively expanding into overseas markets and promoting its own brand internationally. In the first three quarters of this year, Geely's overseas sales reached nearly 300,000 vehicles, with exports of new energy vehicles increasing by 214% year-on-year.

At its earnings conference, Geely Automobile's management revealed that profit margins in overseas markets are higher than in the domestic market, and that as overseas sales continue to grow, they will contribute more significantly to Geely's performance. Geely plans to exceed 1 million vehicles in export sales by 2027.

According to Dazhihui VIP, Geely Automobile closed down 1.88% on the 17th, at HK$17.2 per share.