BYD (02594.SZ; 01211.HK) officially responded to the news that "Oracle of Omaha" Buffett was liquidating his holdings.

On September 22, Li Yunfei, General Manager of BYD Group's Brand and Public Relations Department, responded to Buffett's liquidation of his holdings in a statement, saying, "In August 2022, Berkshire Hathaway began to gradually reduce its holdings of the company's stock, which it purchased in 2008. In June of last year, its holdings were already below 5%. Stock investment, there are buys and sells, this is a very normal thing!"

"Thank you Munger and Buffett for your recognition of BYD! Thank you also for your investment, help and companionship over the past 17 years! Thumbs up for all long-termism!" Li Yunfei wrote.

On the evening of September 21st, foreign media reported that Warren Buffett's Berkshire Hathaway had completely divested its investment in BYD. According to statistics, during the years Buffett held BYD shares, BYD's stock price rose by approximately 3,890%.

"A Berkshire spokesman confirmed that all BYD shares have indeed been sold," the report said.

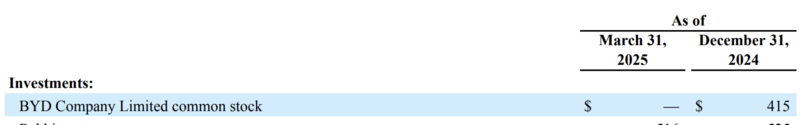

In addition, the financial report shows that at the end of the first quarter of this year, Berkshire Hathaway Energy (BHE)'s investment in BYD shares was zero.

On September 26, 2008, at the urging of Munger, Buffett subscribed for 225 million BYD H shares at HK$8 per share, representing approximately 10% of BYD's total shares after the placement. The total transaction amount was approximately HK$1.8 billion. At the time of Buffett's purchase, BYD's price-to-earnings ratio was only 10.2 and its price-to-book ratio was 1.53.

For the next 14 years or so, Buffett continued to hold a large stake in BYD until 2022.

On August 30, 2022, the Hong Kong Stock Exchange website showed that Buffett's Berkshire Hathaway sold 1.33 million BYD H shares on August 24, 2022, at an average price of HK$277.1016, cashing in HK$369 million. It still held 218.719 million shares, and its proportion of issued voting rights dropped to 19.92%.

Since then, Buffett has reduced his holdings in BYD several times.

In July 2024, the Hong Kong Stock Exchange disclosed Berkshire's reduction of its holdings in BYD for the 16th time.

After this reduction, Berkshire Hathaway's stake in BYD has dropped to 4.94%. At the time, some analysts said that Buffett might be planning to sell off his holdings.

From its first divestment to its last disclosed divestment, Berkshire Hathaway reduced its holdings in BYD Hong Kong by approximately 171 million shares, reducing its holdings from 225 million to 54.2 million shares, and its stake from 20.04% to 4.94%. The average price of its divestments, as disclosed, ranged from a high of HK$277.1 per share to a low of HK$169.87.

According to Hong Kong Stock Exchange regulations, major shareholders are only required to disclose increases or decreases in their holdings if they exceed a certain percentage. Buffett has reduced his holdings far more than 16 times.

In addition, according to the Hong Kong Stock Exchange regulations, shareholders holding less than 5% of the shares do not need to disclose their share reduction.

In an interview in 2023, Buffett responded to the reduction of BYD holdings by saying, "We will find a better use for these funds."

According to the financial report, BYD achieved revenue of 371.28 billion yuan in the first half of the year, a year-on-year increase of 23.3%. Net profit attributable to shareholders of the listed company was 15.51 billion yuan, a year-on-year increase of 13.79%. In terms of sales, BYD sold 2.146 million vehicles in the first half of this year, compared to 1.613 million vehicles last year, a year-on-year increase of 33.04%.

As of press time, BYD's A shares fell 1.35% and its Hong Kong stocks fell 2.2%.

vjkzduqnkrtsrkuzgqfvogjdkklofn