The technological status between new car manufacturers and traditional overseas giants is undergoing evolution.

The recent announcement by Xpeng Motors and Volkswagen Group that their cooperation will extend to plug-in hybrid and fuel vehicles has become one of the landmark events of this transformation, meaning that the technology of new forces is beginning to feed back to the traditional field of fuel vehicles.

Xpeng and Volkswagen have a long history of collaboration. In July 2023, the two parties signed a strategic cooperation framework agreement, taking the first step in their collaboration and marking the traditional auto giant's recognition of the technological strength of emerging companies.

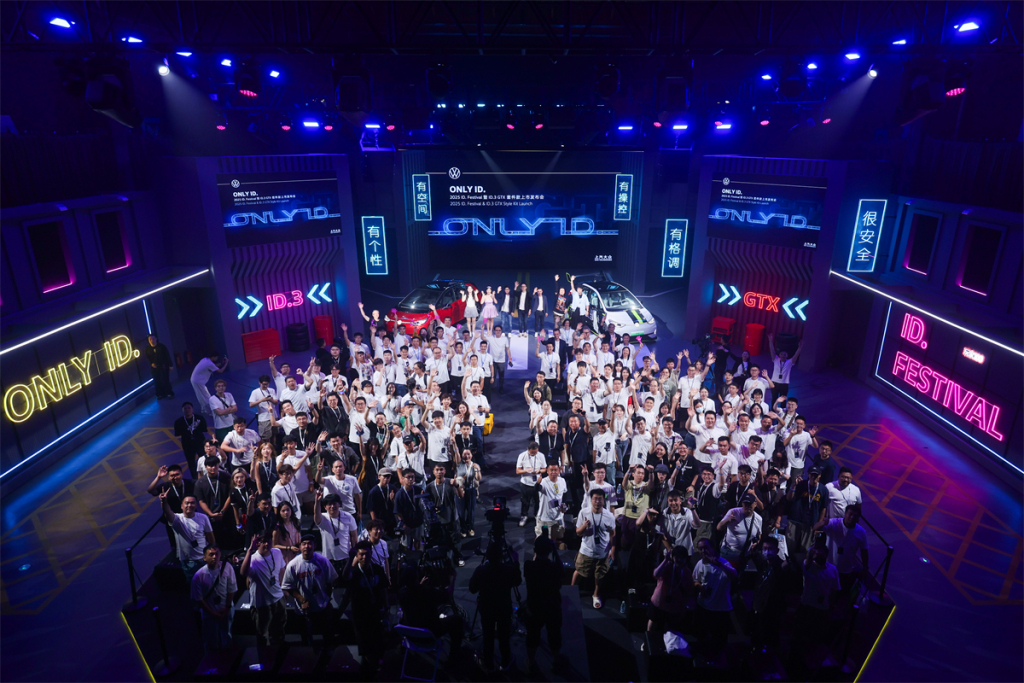

The expanded strategic cooperation agreement on electrical and electronic architecture technology, signed on August 15, 2025, marks another important milestone in the collaboration. According to the agreement, the jointly developed electrical and electronic architecture will be integrated not only into Volkswagen's pure electric vehicle platforms in China, but also across its gasoline and plug-in hybrid vehicle platforms in China. Furthermore, the strategic technical cooperation between the two parties will be expanded to encompass even broader markets.

In addition to the collaboration between Xpeng and Volkswagen, the collaboration between Leapmotor and Stellantis Group is also a typical example of technology output from emerging forces. On October 26, 2023, Stellantis Group invested 1.5 billion euros to acquire a 20% stake in Leapmotor and established a joint venture with Leapmotor, Leapmotor International.

Through this partnership, Stellantis has acquired the rights to use Leapmotor's components and certain technologies, such as the LEAP 3.0 four-leaf architecture. This partnership not only provides Leapmotor with funding and broader market access, but also further enhances its brand influence. It also demonstrates that the technologies of China's emerging powerhouses are beginning to be recognized and applied globally.

In the early days of new energy vehicle development, traditional overseas giants, leveraging their deep technical expertise in fuel vehicles, extensive R&D systems, and mature supply chains, held a dominant position. They possessed core technologies such as engines and transmissions, as well as extensive experience in automotive manufacturing processes and quality control. Emerging market forces, however, mostly entered the market only after the rise of the new energy vehicle market, and were relatively weak in both technology and resources, remaining in the role of technological followers.

However, with the rise of electric vehicles and intelligent connected vehicles, market demand and technological development have undergone significant changes. New energy companies are focusing more on the research and development of electric vehicle and intelligent connected technologies, achieving a series of breakthroughs in key areas such as battery technology, autonomous driving technology, and smart cockpits.

In contrast, traditional overseas giants face numerous challenges in their transition to new energy and intelligent technologies. They need to maintain their fuel vehicle business while also investing significant resources in the research and development of new energy and intelligent technologies, often struggling to keep pace.

In addition, traditional organizational structures and R&D processes also limit their innovation speed and market responsiveness. They need to make profound internal changes to adapt to rapidly changing market demands and technological development trends.

Over the next decade, the phenomenon of technology feedback will spread from the Chinese market to the world. With the successful validation of Xpeng's electrical architecture on its fuel vehicle platform, it is only a matter of time before European factories adopt Chinese technology solutions.

The possibility of Leapmotor providing its three-electric technology for Stellantis' high-end brand indicates that Chinese technology will penetrate higher-level market segments. When Germany's Automotive Weekly lamented that "car inventors are purchasing Chinese technology licenses," traditional automakers realized that the current competition is no longer about "whether or not," but "how strong," and the balance of power in the global automotive industry has begun to tilt.