19 directors and executives will increase their holdings in Changan Automobile.

On the evening of August 11, Chongqing Changan Automobile Co., Ltd. (Changan Automobile, 000625) announced that certain directors and senior executives of the company and its indirect controlling shareholder, China Changan Automobile Group Co., Ltd. (hereinafter referred to as "China Changan Automobile"), plan to increase their holdings of the company's A shares through centralized bidding on the Shenzhen Stock Exchange trading system within six months from August 12, 2025. Each individual is expected to increase their holdings by no less than RMB 300,000, for a total of no less than RMB 5.7 million.

The announcement stated that the purpose of this increase in holdings is based on full recognition of the company's long-term investment value and future sustainable development prospects, and at the same time to enhance investor confidence and protect the interests of the majority of investors through practical actions.

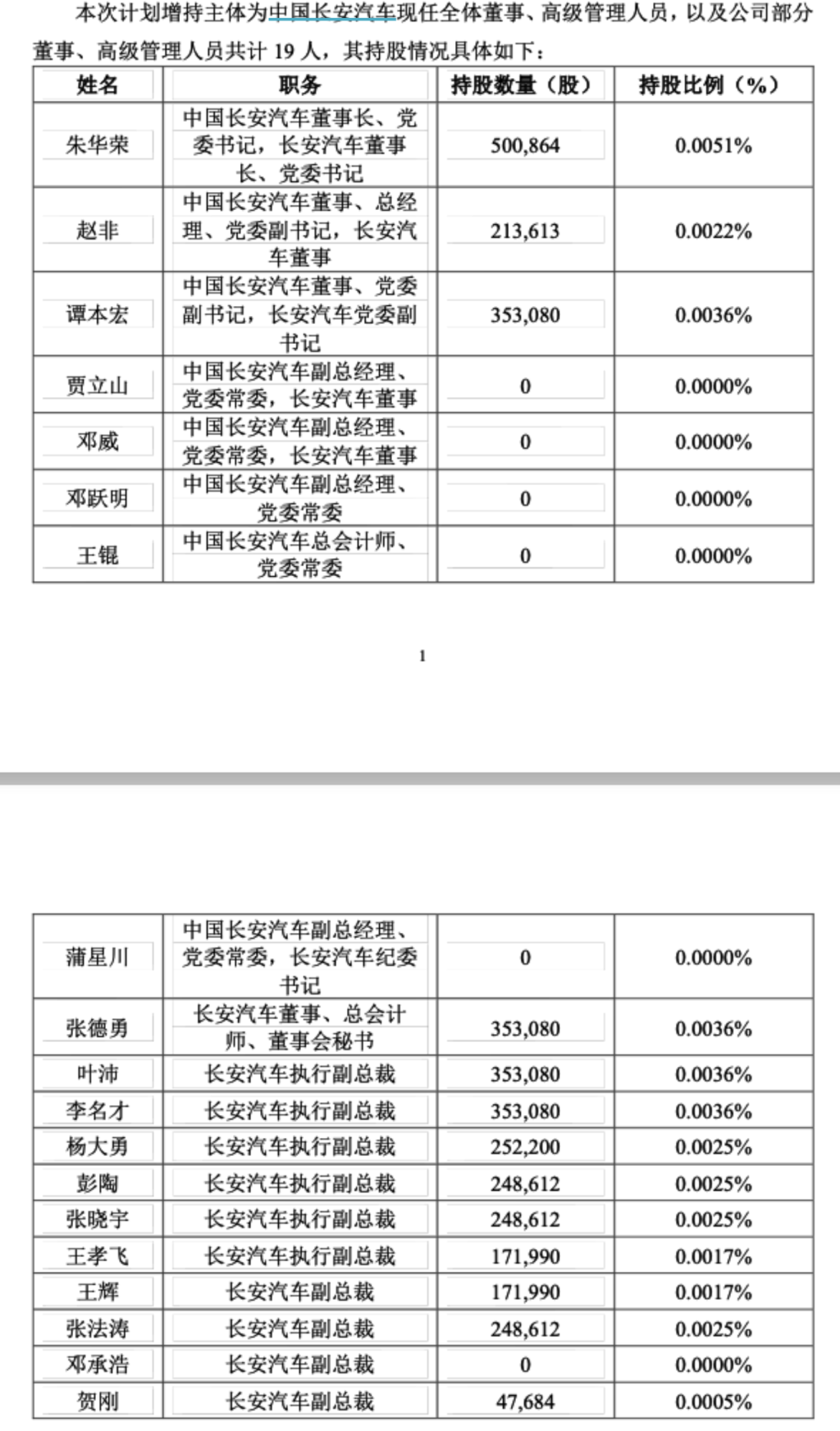

The announcement shows that the entities involved in this planned share purchase are all current directors and senior management of China Changan Automobile, as well as some directors and senior management of the company, totaling 19 people.

Among them are Zhu Huarong, Chairman and Party Secretary of Changan Automobile; Zhao Fei, Director, General Manager and Deputy Party Secretary of Changan Automobile; Tan Benhong, Director and Deputy Party Secretary of Changan Automobile.

China Changan Automobile is China's third central state-owned automobile enterprise. It was recently separated from China North Industries Group Corporation Limited (hereinafter referred to as "North Industries Group") to become an independent central state-owned enterprise.

On June 5, Changan Automobile (000625) announced that China North Industries Group Corporation (NORINCO) had received a notice from the State-owned Assets Supervision and Administration Commission (SASAC) of the State Council, approving the spin-off of the group. The auto business will be spun off into an independent central enterprise, with SASAC acting as the investor. SASAC will inject the equity of the split NORINCO Group into China North Industries Group Corporation (NORINCO) in accordance with established procedures.

On July 29, China Changan Automobile was officially established. The company has a registered capital of 20 billion yuan and total assets of 308.7 billion yuan. It was reorganized from 117 branches and subsidiaries including Changan Automobile.

On the evening of July 29, Changan Automobile (000625) announced that China North Industries Group Corporation (NORINCO) has signed an agreement with China Changan Automobile to transfer all of the 14.23% stake in Changan Automobile directly held by NORINCO before the separation and 100% of the equity of Chenzhi Automotive Technology Group Co., Ltd. (hereinafter referred to as "Chenzhi Group") to China Changan Automobile Group.

After the change, China Changan Automobile will hold 14.23% of Changan Automobile's shares, and indirectly hold 20.81% of Changan Automobile's shares through Chenzhi Group and Zhonghui Futong Investment Co., Ltd., with a total shareholding of 35.04%, becoming the indirect controlling shareholder of Changan Automobile.

The China North Industries Group Corporation no longer directly holds shares in Changan Automobile, but still indirectly holds 4.65% of Changan Automobile's shares through Southern Assets and Southern Industries International Holdings (Hong Kong) Co., Ltd.

Zhu Huarong announced at a media briefing that from January to June this year, Changan Automobile achieved total operating revenue of 146.9 billion yuan, with steady growth in vehicle sales. Production and sales reached 1.355 million units, an eight-year high. Of this total, new energy vehicle sales reached 452,000 units, a year-on-year increase of 49%, while overseas sales reached 299,000 units, a year-on-year increase of 5.1%.

By 2030, China Changan Automobile's target vehicle production and sales volume is 5 million vehicles, of which global new energy vehicle sales will account for more than 60% and overseas sales will account for more than 30%. The company strives to become one of the top ten global automotive brands and a world-class automotive brand.

At the close of the market on the 11th, Changan Automobile rose 1.25% to close at 12.95 yuan per share.