The latest data released by the China Passenger Car Association recently showed that the domestic passenger car market experienced an unexpected growth of 10.8% from January to June this year.

Among them, the national passenger car market retailed 2.084 million vehicles in June 2025, an increase of 18.1% year-on-year and 7.6% month-on-month. The cumulative retail sales this year reached 10.901 million vehicles, an increase of 10.8% year-on-year.

The China Passenger Car Association believes that the price war in the auto market has become somewhat mild, but hidden preferential measures such as adding new features to new models and adjusting car owners' rights and interests are emerging in an endless stream.

At the same time, in June, the wholesale share of domestic brand passenger cars was 67.1%, a year-on-year increase of 2.2%, and the domestic retail share was 64.2%, a year-on-year increase of 5.6%, and the performance of joint ventures has improved significantly; in addition, the domestic retail penetration rate of new energy vehicles rose to 53.3% in June, showing a strong growth of new energy under the background of inclusive policies such as scrapping and renewal, old for new, and exemption of purchase tax for new energy.

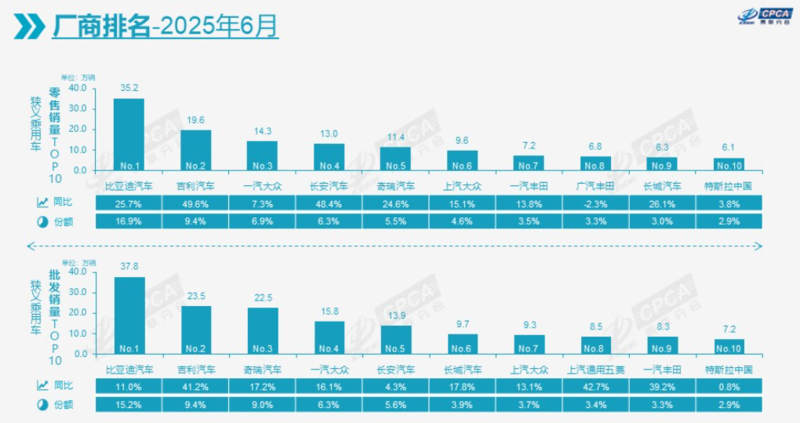

In terms of different camps, domestic brands sold 1.34 million vehicles in June, up 30% year-on-year and 7% month-on-month. Domestic brands had a 64.2% share of retail sales in the month, up 5.6 percentage points year-on-year. From January to June, domestic brands had a 64% share of retail sales, up 7.5 percentage points from the same period last year. Domestic brands have gained significant growth in the new energy market and export market. The transformation and upgrading of leading traditional automakers have performed well, and traditional automakers such as BYD Auto, Geely Auto, Chery Auto, and Changan Auto have significantly increased their brand share.

In June, mainstream joint venture brands sold 510,000 vehicles, up 5% year-on-year and 6% month-on-month. In June, the retail share of German brands was 16.1%, down 2.4 percentage points year-on-year, and the retail share of Japanese brands was 12.0%, down 2.3 percentage points year-on-year. The market share of American brands was 5.8%, down 0.5 percentage points year-on-year.

In June, according to the wholesale volume, mainstream joint venture automakers wholesaled 553,000 vehicles, an increase of 11% year-on-year and 17% month-on-month. Joint venture brand production increased by 9% year-on-year and 12% month-on-month. The data has rebounded.

Luxury car retail sales in June were 230,000 units, down 7% year-on-year and up 18% month-on-month. The retail share of luxury brands in June was 11.0%, down 3 percentage points year-on-year, and the retail share of traditional luxury car market performed well.

In terms of specific sales, BYD sold 377,628 passenger cars in June, with a total annual sales of 2,113,271 units, an increase of 11% year-on-year; among them, the sales of pure electric models were 206,884 units, with a total annual sales of 1,023,381 units. The sales of plug-in hybrid models were 170,744 units, with a total annual sales of 1,089,890 units. Overseas passenger cars and pickup trucks sold 89,699 units, with a total annual sales of 470,086 units.

Chery Group sold 233,607 vehicles in June, up 16.6% year-on-year. Among them, Chery Automobile sold 219,044 vehicles per month, up 15.9% year-on-year. The group sold 71,582 new energy vehicles, up 59.6% year-on-year; and exported 106,330 vehicles, up 9.6% year-on-year.

Geely Auto's sales in June were approximately 236,000 vehicles, up approximately 42% from the same period last year; cumulative sales in the first half of the year were 1.409 million vehicles, up 47% year-on-year.

Changan Automobile sold 235,098 vehicles in June, up 4.48% year-on-year. From January to June 2025, Changan Automobile sold 1,355,256 vehicles, of which 299,426 were sold overseas.

As the large-scale joint venture auto companies gradually complete their "elephant turn", these traditional giants begin to "catch up".

From the retail sales list of manufacturers from January to June released by the China Passenger Car Association, we can see that there are only two joint venture brands with cumulative sales of more than 500,000 vehicles, namely FAW-Volkswagen and SAIC Volkswagen. Among them, FAW-Volkswagen sold 743,543 vehicles, but it fell 3.6% year-on-year. Thanks to the strong performance of Passat, Tiguan L and Lavida, SAIC Volkswagen sold 522,883 vehicles in June, a year-on-year increase of 2.3%. In other words, SAIC Volkswagen is the only joint venture automaker with sales exceeding 500,000 vehicles in the first half of the year and maintaining positive growth. It is worth noting that this joint venture giant will also launch a number of new cars in the second half of the year, covering fuel and new energy fields.

In addition, the "North and South" Toyotas are also gradually finding their way in the process of accelerating localized research and development, and their market performance has stabilized. Among them, FAW Toyota's sales in June exceeded 72,000 vehicles, a year-on-year increase of 14%, setting a new record; the cumulative sales in the first half of the year exceeded 370,000 vehicles, with a growth rate of 16%. GAC Toyota's terminal sales in June reached 68,000 vehicles, a month-on-month increase of 5.6%, and the cumulative sales in the first half of the year reached 344,000 vehicles, a year-on-year increase of 15.8%.

Looking ahead to the second half of the year, the China Passenger Car Association analyzed that as the anti-involution work continues to deepen, automakers will strive to maintain the relative stability of market prices, and the production rhythm will show a further stable trend. As the interest rate spread between bank deposits and loans decreases, the high-interest and high-return auto loan policy is under control. The original high interest returned by banks to dealers will partially subsidize the car price. After the significant reduction in auto loan rebates, dealers' profit pressure has further increased, indirectly leading to a deepening of conflicts among manufacturers. With relatively high inventories, manufacturers' sales growth has slowed down.

On the other hand, the housing market price data is going down, the local fiscal pressure is becoming more obvious, and the pace of promoting consumption in the auto market will be more stable. In view of the above reasons, it is expected that the production and sales in July will show a rapid growth state with a gradual deceleration.