In recent months, BYD has made great progress on its globalization journey. In the European electric vehicle market, which has been led by Tesla for many years, BYD has finally gained a place; in Asia, BYD's sales have also been soaring, and even set a new record in the more conservative Japanese market...

Now, BYD, which has been deeply involved in the Brazilian market for twelve years, will also make new breakthroughs in the new energy vehicle industry in Latin America. On July 1, 2025, the first car of BYD's Camacari plant in Brazil officially rolled off the assembly line. The two models that rolled off the assembly line for the first time were Song Pro and Seagull. Song Pro is one of BYD's best-selling models in Brazil, and Seagull won the title of "World Urban Car" at the 2025 World Automobile Award, and is also the first Chinese brand model to win this honor.

The first car rolled off the assembly line at the Brazilian factory marks another milestone for BYD overseas. Starting with Tang EV, BYD has been making great strides in Brazil and has now become a household name. In the minds of Brazilians, BYD is a brand that is synonymous with reliability and cutting-edge technology. According to the latest sales data, in May 2025, BYD set a new record of more than 9,000 monthly registrations and a 9.7% market share, ranking fourth in Brazil.

BYD's overseas expansion in Brazil is an important microcosm of the globalization process of many Chinese brands. On the road to becoming a world-class automobile brand, all glory is always accompanied by thorns. For BYD, the challenges may be complex and ever-changing rules or the prejudice of public opinion, and breaking them is by no means just the courage to ride the wind and waves.

Remarkable: BYD opens a new era of localized manufacturing in Brazil, further consolidating its leadership position

Since opening its first office in Sao Paulo in 2013, BYD has been deeply rooted in Brazil for more than ten years, with business covering photovoltaics, buses, batteries, rail transportation and other fields. In this process, BYD has gradually won the trust of Brazilian consumers.

In 2022, BYD Auto's annual sales in Brazil were 260 vehicles; in 2023, BYD Auto's total annual sales in Brazil jumped to over 17,000 vehicles, more than 68 times that of last year; in 2024, BYD continued to break records, with annual sales exceeding 76,000 vehicles, a year-on-year increase of more than 328%, winning the title of "Fastest Growing Car Brand in 2024"; from January to May 2025, BYD's sales in Brazil exceeded 39,000 vehicles, with pure electric vehicles accounting for 92.16% of the local market share, and plug-in hybrid vehicles accounting for 35.8%, continuing to maintain its lead, further consolidating its leadership position in the local market.

A key factor in BYD's success in the Brazilian market is the continuous growth of its dealer network. Today, there is at least one BYD dealership in the capital of each state in Brazil. BYD's strategy is to always be close to customers and respond quickly to market demand for electric vehicles. BYD has a presence in all regions of Brazil and is expanding to major inland cities. Currently, BYD has more than 180 dealerships in Brazil and plans to expand to 240 by the end of 2025.

At the same time, BYD's localized manufacturing in Brazil is also an important step for BYD to enhance its brand influence in Latin America. As BYD's largest passenger car factory outside of China, the initial new energy vehicle production line of the Camacari factory has the capacity to produce 150,000 vehicles per year. This production base, which cost 5.5 billion reais (about 7.1 billion yuan), will become the largest electric vehicle manufacturing center in Latin America and will also inject strong momentum into the development of Brazil's local industry.

It’s not easy: BYD is determined to move towards becoming a world-class automobile brand, with both glory and thorns

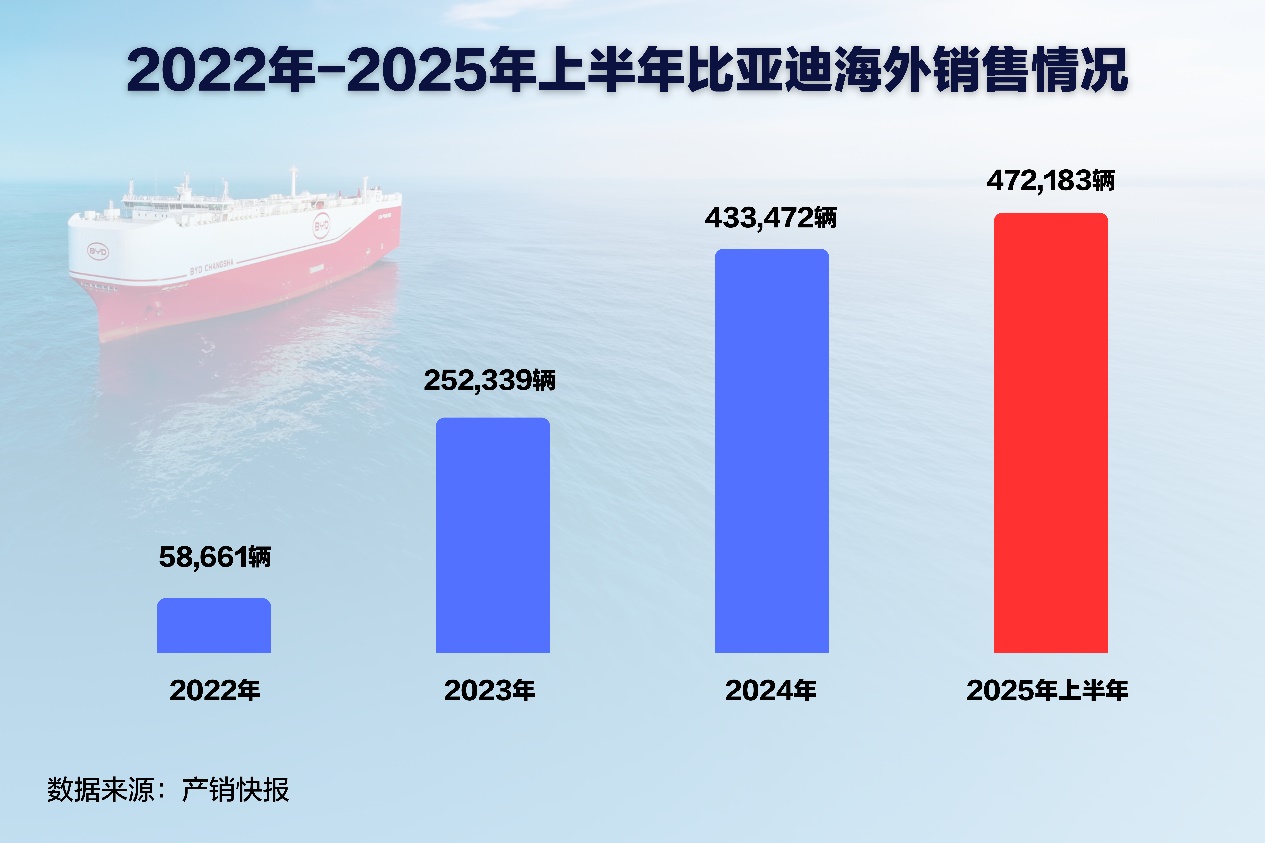

BYD is accelerating its globalization with strong momentum. Its new energy vehicles have spread across 112 countries and regions around the world and have become a leading brand in many markets. In the first half of 2025, BYD's overseas sales reached 472,100 vehicles, setting a record high.

However, BYD, like all Chinese brands, has never had a smooth success in overseas markets. BYD's opportunity to start localized manufacturing in Brazil may have a lot to do with the high uncertainty of trade policies. The tariffs and non-tariff barriers set up by overseas markets in the name of "fair competition", "protecting local industries" and "national security" are a major external obstacle facing China's electric vehicles going overseas. Not only in Europe, but also in Brazil, the government has announced a step-by-step increase in import tariffs on new energy vehicles to protect local industries.

For example, the preferences, aesthetics, and car-use scenarios of overseas consumers are significantly different from those in the Chinese market. If these differences are ignored, it will be impossible to win the trust of local consumers. Take Brazil as an example. According to data from 2023, Brazil has an average of about 360 cars per 1,000 people, or 1 car for every 3 people. This level is already leading in Latin America. This means that the Brazilian auto market is relatively mature, and Brazilian car users have a huge demand for electrification, high-tech and sustainable vehicles. After capturing these needs, BYD launched the BYD Tang EV in November 2021. As of the end of May 2025, BYD has sold more than 130,000 vehicles in Brazil, which is the result of its long-term and robust strategy tailored for the Brazilian market.

In addition, the rise of Made in China has also triggered ideological vigilance and suppression from some politicians and public opinion in recent years, which has also created public opinion barriers for the localization operation and market expansion of Chinese brands, including BYD. For example, during the construction of BYD's Brazilian factory, due to factors such as cultural differences, it was magnified and exploited by some people with ulterior motives, which had a certain negative impact on the company's overseas construction and development. With the first car rolling off the production line at the Camacari factory, BYD has made a commitment to creating jobs and promoting local economic development. The factory will create about 20,000 direct and indirect jobs for the local area, and will actively integrate into Brazil's warm and inclusive culture, focus on work-life balance, and make the company more diverse and dynamic.

In the long run, Chinese brands still face the challenge of insufficient brand awareness. German, Japanese, and American brands have a deep historical accumulation and consumer trust. Chinese brands such as BYD need to invest heavily in brand building to reverse the stereotype of "cheap and low quality" and prove their competitiveness in technology, quality, and safety. In the Brazilian market, BYD's long-term investment has paid off. In 2024 alone, BYD won 36 awards in 13 different automotive awards, including the title of "Automaker of the Year" at the UOL Carros Awards and was recognized as the "Top of Mind" in the "Electric Vehicle" category, making it the preferred brand for Brazilian consumers.

However, no challenge will stop BYD from moving towards a world-class automobile brand. To support global business expansion, BYD has established production bases in Brazil, Thailand, Uzbekistan and Hungary, and built a complete global supply chain network. In addition, BYD has also established its own ro-ro fleet, of which 6 have been officially put into operation, to help new energy vehicles set sail for globalization.

at last

The market predicts that by the end of 2025, more Chinese brands will enter the Brazilian market. Market barriers, protection barriers, political risks, each challenge means huge investment and uncertainty. It is better to say that it is by facing challenges that BYD has been able to initially gain a foothold in the international market and achieve outstanding results.

The road to overseas expansion for Chinese enterprises is by no means an easy one, but a long journey that requires strategic determination, strong strength and sustained resilience. Every breakthrough made by BYD is accumulating valuable experience for the global leap of Made in China to “Made in China Intelligence” and “Chinese Brands”.