Today, the Beijing Municipal Tax Service of the State Taxation Administration announced a tax evasion case. An investigation revealed that Chen Zhen, an online car reviewer, evaded a total of 1.1867 million yuan in personal income tax between 2021 and 2023 by underreporting income and changing the nature of his income. Recently, the tax authorities imposed penalties on him according to law. What are the details of the case? Let's take a look at the reporter's investigation.

Exposing the tax evasion case of online car reviewer Chen Zhen: Hidden tricks in the income declarations of top car review influencers.

CCTV reporter Li Xia: Chen Zhen, a well-known car reviewer with over ten million followers on online video platforms, primarily posts car reviews and lifestyle sharing videos, making him a top influencer in the car review field. However, an investigation by the tax authorities revealed that from 2021 to 2023, Chen Zhen declared only slightly over one million yuan in comprehensive income each year, a figure significantly inconsistent with his online popularity.

Subsequently, the tax inspection department interviewed Chen Zhen for the first time regarding the income issue. Chen Zhen claimed that he had completed the self-assessment and tax payment for previous years. However, after the inspectors retrieved the asset information under Chen Zhen's name, they found that this was not the case.

Liu Han from the Third Inspection Bureau of the Beijing Municipal Tax Service, State Taxation Administration: Our investigation revealed that the so-called self-inspection and tax payment only applies to income in 2023. Are there any issues in other years? We then began to review and analyze the overall income earned by Chen Zhen from 2021 to 2023.

An investigation revealed that Chen Zhen established a short video account on a certain platform in 2021, primarily generating income by posting product promotion videos. However, after reviewing the account's financial records, tax authorities discovered that withdrawals were not recorded in the bank account linked to the account until 2022.

Huang Shan, Third Inspection Bureau of Beijing Municipal Tax Service, State Taxation Administration: Based on past experience in investigating high-income individuals, Chen Zhen, as an influential online influencer, should have generated income after posting short videos. However, there have been no withdrawal records for nearly a year. We believe that he most likely used other withdrawal channels.

The investigators further obtained information on all of Chen Zhen's bank accounts and the fund transactions of third-party payment platforms in accordance with the law, and indeed made new discoveries.

Huang Shan, Third Inspection Bureau of Beijing Municipal Tax Service, State Taxation Administration: We found that from 2021 to the beginning of 2022, Chen Zhen withdrew a total of RMB 1.5725 million in advertising service fees transferred from a certain online video platform through a third-party payment platform, and failed to declare and pay taxes.

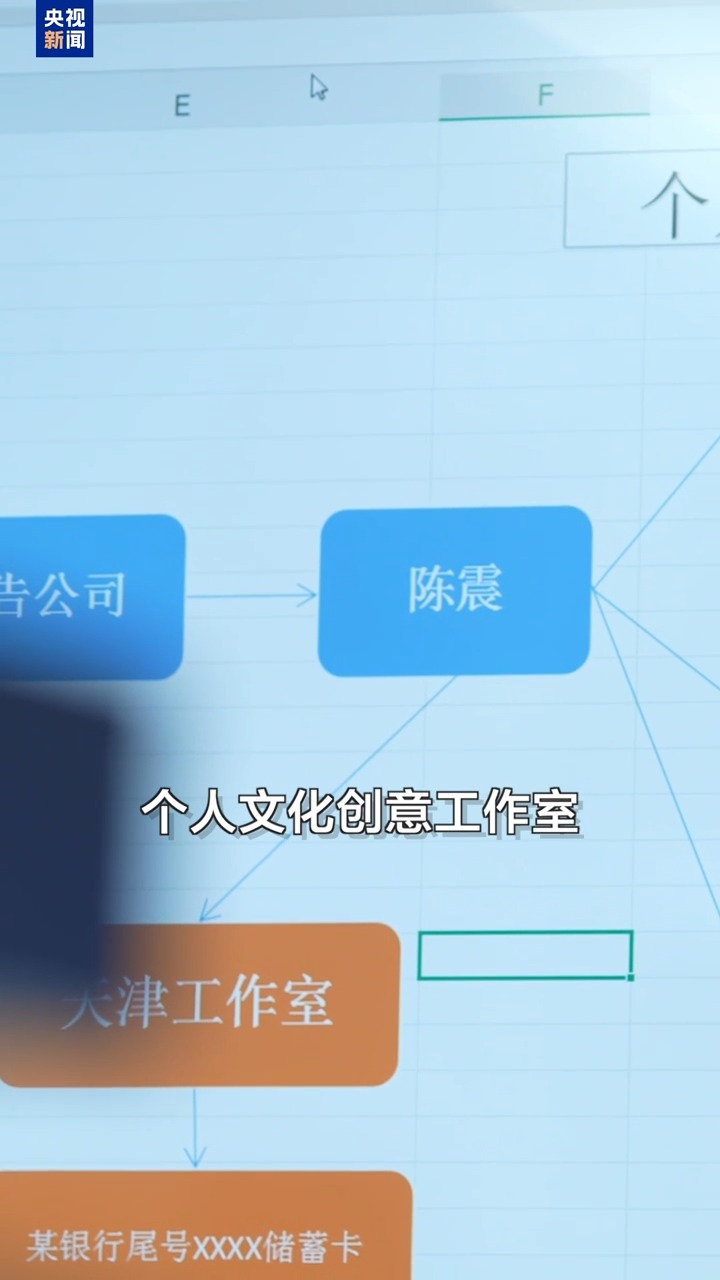

However, the case did not end there. Underreporting income was only one aspect. A thorough investigation by the tax authorities uncovered a more covert method of tax evasion. In 2022, Chen Zhen established a personal cultural and creative studio in Tianjin and declared and paid personal income tax as income from production and business operations of a sole proprietorship.

Liu Han, from the Third Inspection Bureau of the Beijing Municipal Tax Service, State Taxation Administration: We understand that this studio has no actual office space and no employees; it's a shell company. The so-called production and operating income is essentially labor remuneration obtained by Chen Zhen through his platform account.

Using this as a starting point, the inspection team investigated the income of Chen Zhen's studio one by one. It was found that, starting in April 2022, Chen Zhen withdrew short video advertising revenue from the platform into the bank account corresponding to his studio, declaring it as the studio's operating income, but not recognizing it as his personal labor remuneration income.

Huang Shan, Third Inspection Bureau of Beijing Municipal Tax Service, State Taxation Administration: Chen Zhen declared 2.3 million yuan of personal income as income from a shell studio, using the studio to make false declarations in order to pay less tax. This is a very typical illegal act of "changing the nature of income".

The tax authorities summoned Chen Zhen again. Faced with a complete chain of evidence, Chen Zhen finally admitted to the illegal acts and actively cooperated by providing complete bank statements and transaction records.

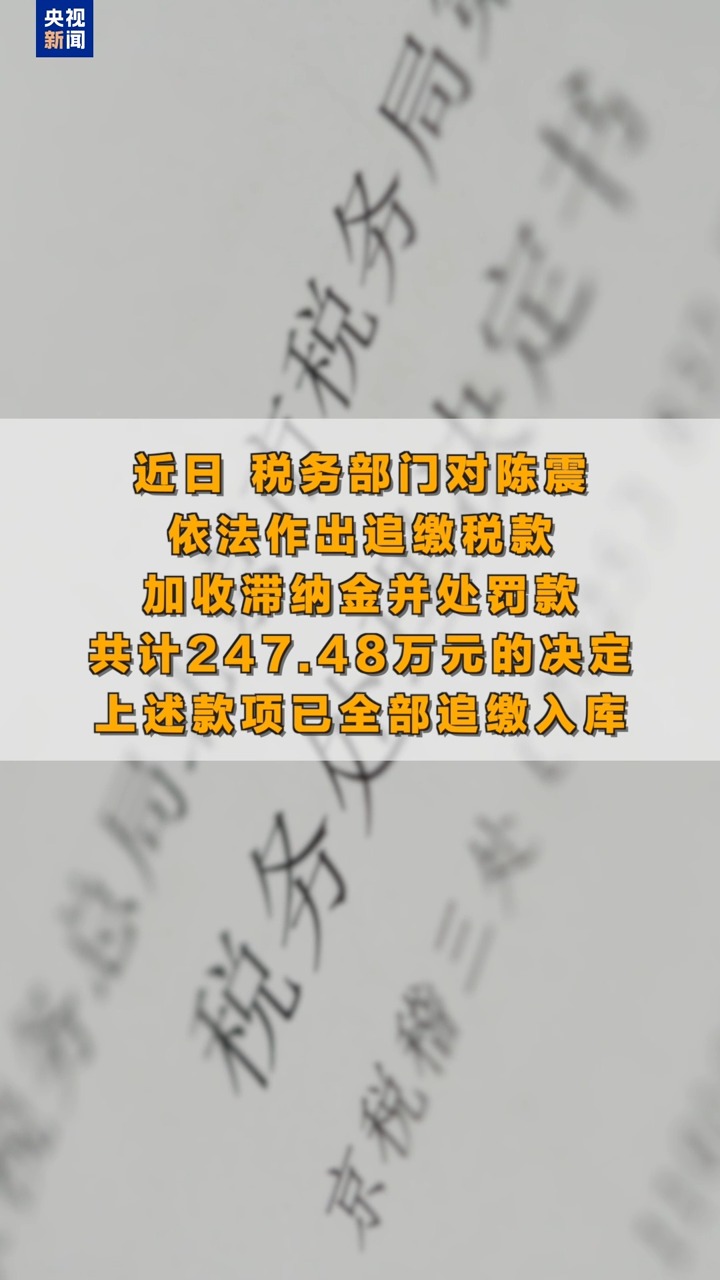

Recently, the tax authorities made a decision to recover taxes, impose late payment fees, and impose a fine on Chen Zhen, totaling 2.4748 million yuan. All of the above funds have been recovered and deposited into the treasury.