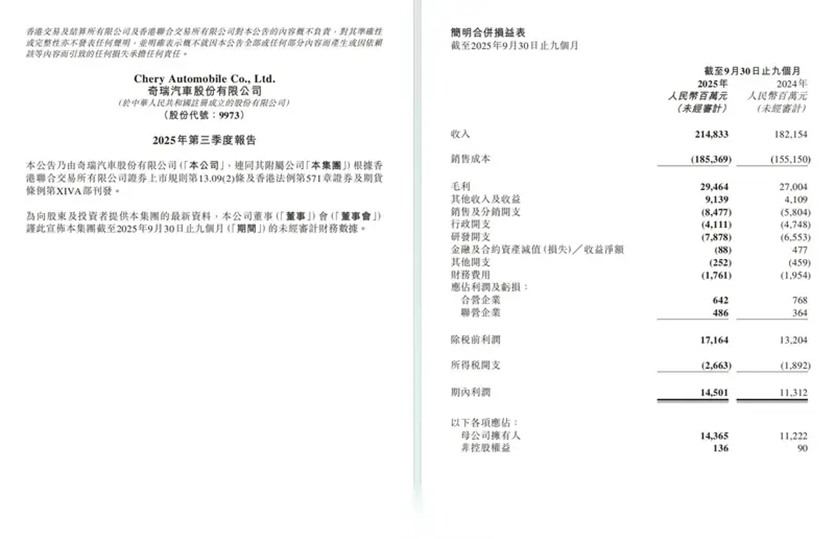

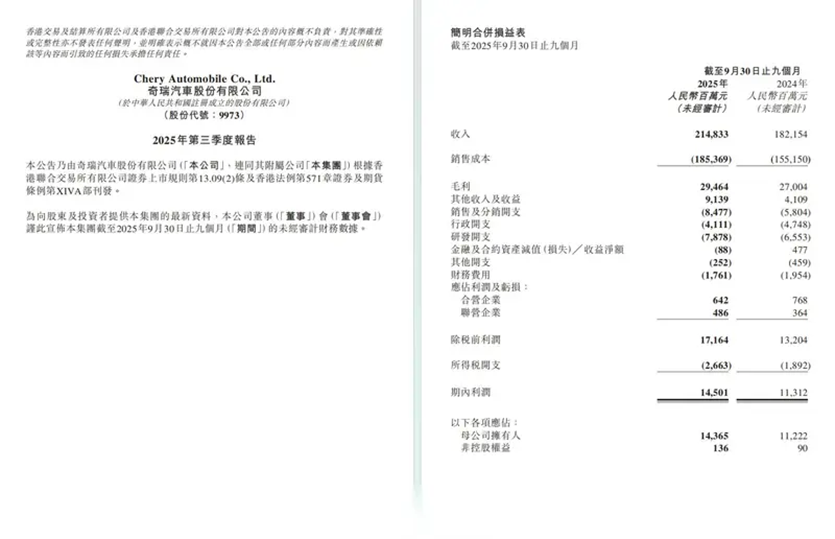

While the entire Chinese auto industry is mired in a profit quagmire of "increased production but not increased revenue," with the industry's profit margin hitting a near ten-year low in the first half of the year, Chery Automobile, in its first financial report after its Hong Kong listing, delivered a report showing revenue of 214.833 billion yuan, a year-on-year increase of 17.94%, and net profit of 14.365 billion yuan, a year-on-year increase of 28%.

This company, which prides itself on the spirit of "working hard like an ox," is demonstrating to the market, through its unique strategic resolve, that "making a fortune quietly" is not just a posture, but a replicable business logic.

An "unconventional" high-quality financial report

At a time when the automotive industry is generally struggling with meager profits, Chery's financial report exhibits a remarkable "counter-cyclical" characteristic. While also facing the objective environment of rising raw material prices and fierce competition, both its net profit and year-on-year growth rate far exceed those of its peers. Its net profit of 14.365 billion yuan not only ranks among the top domestic automakers but also far surpasses many joint venture automakers.

Some details in the financial report also demonstrate Chery's "high-quality" development. For example, its net profit growth of 28% year-on-year far exceeded its revenue growth of 17.94% year-on-year, showing that its growth quality is better than its scale expansion. This contrast is particularly prominent in the industry—according to data from the China Passenger Car Association, the profit margin of the national automobile industry in the first half of 2025 was only 4.8%, while Chery's gross profit margin reached 13.71% during the same period, and continued to climb for three consecutive quarters.

The core driver of profit growth lies in the synergistic effect of increased sales volume and cost control. In the first three quarters, Chery Group's cumulative sales exceeded 2 million vehicles, setting a new record for the same period. Not to mention the increased R&D investment, which rose from 6.553 billion yuan to 7.878 billion yuan. This counter-trend increase in R&D spending, resulting in technological advantages, has also indirectly driven further profit growth. Furthermore, Chery's IPO raised HK$8.879 billion, injecting capital momentum into technological R&D and market expansion, further solidifying its profit foundation.

Looking across the industry, while many automakers are trapped in the cycle of "the larger the scale, the thinner the profit," Chery, with its strategic vision and precise planning, has avoided the predicament of "trading volume for price" and embarked on a virtuous cycle of high-quality development. Such performance is rare in the current automotive industry.

Going global is "fiercely competitive," with globalization becoming a major driver of profit growth.

Chery's quiet but significant profits in 2025 largely stem from its phenomenal performance in overseas markets. From January to October this year, Chery Group's cumulative sales reached 2.2889 million vehicles, a year-on-year increase of 13%, while cumulative vehicle exports alone reached 1.06 million vehicles, a year-on-year increase of 12.9%, accounting for nearly half of the group's total sales. This means that a Chery-made vehicle is shipped overseas every 25 seconds, making Chery the fastest Chinese automaker to achieve one million units exported this year.

Chery's outstanding overseas performance is reflected not only in sales volume but also in profits. Particularly in the European market, Chery experienced explosive growth, with sales reaching 171,000 vehicles in the EU and UK from January to October, a 2.4-fold increase year-on-year. Considering that the average selling price and profit margin of vehicles in Europe are far higher than in China, this further confirms that Chery's significant increase in net profit this year largely stems from its overseas expansion.

Chery's success in penetrating high-premium markets like Europe is attributed to its deep localization strategy. As one of the first Chinese brands to achieve localized production in Europe, Chery has entered markets such as Spain, Italy, and the UK, and is expanding into core markets like France and Germany. Simultaneously, through its globalization philosophy of "In somewhere, For somewhere, Be somewhere," Chery is gradually upgrading from "product export" to "ecosystem implementation."

Taking the Spanish market as an example, Chery has established a joint venture factory with Spanish automaker EV MOTORS to revitalize its local brand EBRO and continue to deepen its presence in the Spanish market. The brand has already launched four models and has become one of the fastest-growing automotive brands in Spain.

Similarly, there are many other examples of Chery's deep cultivation of overseas markets. For instance, Chery's OMODA & JAECOO brands have achieved sales of over 650,000 units in just two and a half years, entering 55 markets, including 28 left-hand drive markets, 13 right-hand drive markets, and 14 EU markets.

A series of rapid overseas developments and initiatives to cultivate local markets have led the French newspaper Les Echos to describe Chery as a "low-key yet powerful" Chinese automaker, demonstrating the success of Chery's globalization strategy. In 2024, Chery's overseas revenue exceeded 100 billion yuan for the first time, and currently accounts for nearly 50% of its total revenue, becoming a revenue pillar on par with the domestic market.

Building a moat for future growth through systemic capabilities

For Chery, achieving sustainable growth through quiet accumulation ultimately hinges on its technological foundation and product competitiveness. It is precisely through its long-term dedication to quality and technology that Chery has achieved rapid growth in the new energy vehicle sector. From January to October, Chery Group's new energy vehicle sales reached 698,000 units, a surge of 73.1% year-on-year, ranking among the top in the industry in terms of growth rate. Behind this data lies Chery's strategic shift from "single-point breakthroughs" to "comprehensive development" in its product matrix, and is a concentrated manifestation of the growth moat built by Chery's systemic capabilities.

Regarding quality, Chery has always held itself to the highest industry standards, even proactively benchmarking against the most stringent global standards. Beyond meeting national standards, Chery has developed over 100 unique corporate standards that exceed national standards, covering seven major areas: active safety, battery safety, collision safety, rescue safety, health safety, information security, and functional safety. It is precisely this high standard that enabled Chery to sweep awards in sales satisfaction and after-sales service satisfaction in the JD Power 2025 China Vehicle Series Study. This high-standard quality endorsement further strengthens the brand's premium capabilities, contributing to Chery's high-quality development.

The increasing R&D investment reflected in its financial reports clearly demonstrates Chery's unwavering commitment to technology. At its 2025 Global Innovation Conference, Chery unveiled over 10 globally leading technologies, including an AI intelligent vehicle architecture, the Rhino battery, and an axial flux motor. These technologies not only build a world-class technological innovation system but also enhance user experience and increase product premium.

At the same time, Chery is also accelerating its layout in areas such as embodied intelligence, AI large model applications, and computing centers. The MoJia robot has been commercialized and delivered to markets in Southeast Asia, the Middle East, and South Africa, becoming a new growth engine for Chery Group in the era of "intelligent electric vehicles".

Through a closed loop of "technology research and development – product implementation – quality assurance – ecosystem expansion," Chery has built a comprehensive competitive advantage that is difficult to replicate. This transformation from "manufacturing" to "intelligent manufacturing" is its deepest moat, enabling it to continue to "make a fortune quietly."

In conclusion

While the industry was mired in a price war and engaged in cutthroat competition, Chery, with its tireless and diligent work ethic, forged a path to profitability driven by globalization and technology. Behind its financial reports lies not only numerical growth, but also a microcosm of the transformation of the Chinese automotive industry from "scale-driven" to "quality-driven."

Under the logic of "making a fortune quietly," Chery has proven one point: profits come not only from market share, but also from adhering to long-term value. In the face of unprecedented changes in the global automotive industry, Chery's development path may offer a valuable model for Chinese brands: true profits always come from continuous investment in core competitiveness, rather than short-term market maneuvering.