Chongqing, Shenyang, Zhengzhou and Luoyang have suspended car replacement subsidies since June, but with the allocation of the third batch of national subsidy funds at the end of July, the scrapping and renewal subsidy policy continues to drive transaction volume in the automotive terminal market.

It is precisely because of this that, although the domestic automobile market has gradually entered the traditional off-season in June, in order to catch the last train of "national subsidies", a large number of consumers are still actively buying cars, and car companies and dealers have also made a large number of announcements, so the car market in July remains hot.

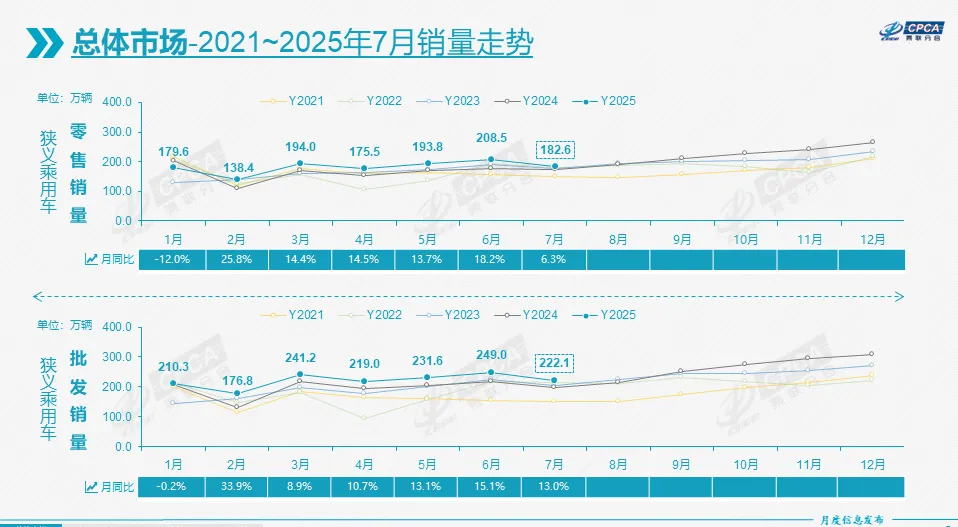

Data released by the China Passenger Car Association on August 8th showed that retail sales of domestically produced narrow passenger cars reached 1.826 million units in July, a year-on-year increase of 6.3%. While the growth rate in July narrowed significantly compared to the double-digit figures in the previous five months, sales of over 1.82 million units set a new record for the same period, slightly higher than the 1.818 million units in July 2022. This marks the third consecutive month of record-breaking sales since May this year.

This brought the total retail sales of domestically produced narrow passenger vehicles in the first seven months of this year to 12.728 million units, a year-on-year increase of 10.1%.

At the same time, driven by market demand and policies, domestic auto dealers actively increased their inventories and exports continued to rise. As a result, wholesale sales of domestic passenger cars in July also hit a historical high of 2.221 million units for the same period in July. Total wholesale sales this year increased by 12.4% year-on-year to 15.503 million units.

Among them, the export volume of domestically produced passenger cars (including complete vehicles and CKD) reached 475,000 units in July, only slightly lower than the monthly record high of 480,000 units just set in June. The export volume of independent brands reached a record high of 415,000 units.

BYD and Geely monopolize the first and second places

The reason behind the continued heat of the overall auto market is naturally the increase in sales of major automakers, especially the leading automakers.

According to the China Passenger Car Association (CPCA), domestic brands sold 1.21 million vehicles in July, a year-on-year increase of 14%. Their market share reached a record high of 65.9%, a 4 percentage point increase year-on-year. Meanwhile, among joint ventures, only Japanese brands maintained their market share at 12.9%, while German and American brands continued to decline, reaching 14.5% and 4.7%, respectively.

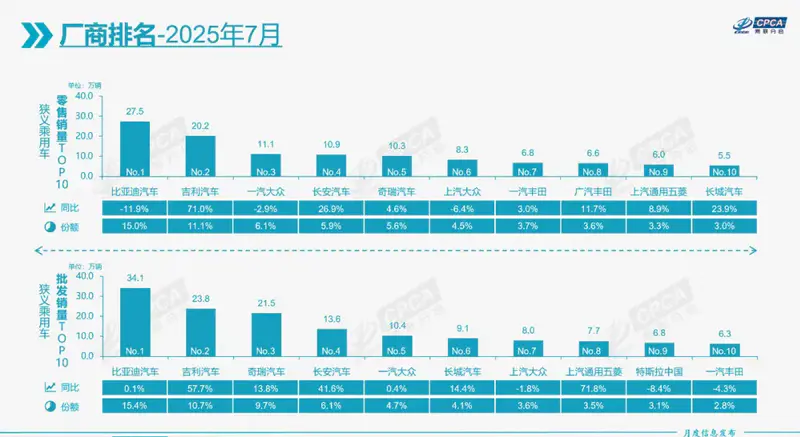

Therefore, in July, domestic automakers still occupied the majority of seats in the list of top automakers.

In the retail list, BYD and Geely continued to occupy the first and second places with 275,000 and 202,000 vehicles respectively. FAW-Volkswagen, a joint venture giant, could only rank third.

Looking back at earlier data, it was found that the last time Beijing Volkswagen won the runner-up title was in June 2024. Since then, Geely has always been following BYD, and the gap between it and Beijing Volkswagen has continued to widen.

Geely's continued runner-up status is mainly due to the increase in sales of new energy vehicles.

Although Geely Galaxy was only officially upgraded to an independent brand in March of this year, its models (excluding the Geometry and Panda mini) began to be sold as early as 2023. Sales began to explode in 2024 with the release of models such as the Galaxy E8, Galaxy E5, and Star Wish. Powered by Galaxy, Geely Auto's monthly sales reached 217,000 units in November 2024, marking its first monthly sales exceeding 200,000 units, a trend that has become a regular feature for Geely since the beginning of this year.

Changan Automobile failed to make it into the top three, but it is only 2,000 vehicles behind FAW-Volkswagen and may overtake it at any time.

And it's not just Changan. Relying on the continuous enrichment of its product matrix, the sales of brands such as Chery, Jetour, iCAR, Zhijie and Xingtu have continued to rise. Chery Automobile's monthly sales in China have gradually stabilized at around 100,000 vehicles. In the future, it and Changan will become strong contenders for the podium of the retail list.

Although SAIC-GM-Wuling and Great Wall Motors ranked relatively low, their year-on-year growth in July was 8.9% and 23.9% respectively, both exceeding the overall auto market's 6.3%.

Leading domestic automakers were even more dominant in the wholesale rankings, with BYD maintaining its position above 300,000 units, while Geely and Chery both exceeded 200,000 units. Thanks to exports, Changan surpassed FAW-Volkswagen to move into fourth place with 136,000 units.

Pure electric cars become the "new favorite" for export

From the perspective of market segments, new changes occurred in the most important new energy market in July.

Data shows that domestic retail sales of new energy vehicles reached 987,000 units in July, a year-on-year increase of 12.0%. Among them, domestic pure electric vehicle sales increased by 24.5% year-on-year to 607,000 units in July, but plug-in hybrid sales fell slightly by 0.2% to 278,000 units, and extended-range electric vehicles fell further by 11.4% to 102,000 units. This is the first time in recent years that domestic plug-in hybrid sales have turned negative year-on-year, and extended-range electric vehicle sales have continued to decline since January of this year.

Policy changes are likely a major factor in this situation. As mentioned at the beginning of the article, to catch the last train of the subsidy policy, a large number of consumers are actively purchasing cars. Among them, new energy vehicles that enjoy free purchase tax are particularly popular, especially small pure electric models with high cost performance.

It is worth mentioning that although both plug-in hybrid and extended-range vehicles have declined, thanks to the pull of pure electric vehicles, the domestic new energy penetration rate hit a historical high of 54% in July.

Considering that the purchase tax for new energy vehicles will be completely exempted this year and will be halved in 2026, the "national subsidy" may also end at that time. Therefore, the proportion of new energy vehicles in retail sales will most likely continue to rise, and may even reach around 60% by the end of the year.

Thanks to strong performance in the first half of the year, total sales of plug-in hybrid and extended-range electric vehicles (EPE) in the first seven months of the year still increased by 25.2% and 12.1% year-on-year, respectively, while pure electric vehicles saw a 35.2% increase. As a result, total sales of new energy vehicles in China in the first seven months of this year reached 6.455 million units, a further year-on-year increase of 29.5%, and the new energy vehicle penetration rate further increased to 50.7%.

Thanks to dealers' active purchasing and export efforts, wholesale sales of new energy vehicles continued to grow by 24.4% year-on-year to 1.181 million units in July, reaching a record high of 53.2% of the total passenger car market. Pure electric sales saw a 44.8% increase, plug-in hybrids saw a 3.3% increase, and extended-range electric vehicles saw a 6.2% decrease. Cumulatively, wholesale sales of new energy vehicles increased by 35.2% year-on-year to 7.629 million units.

It's worth noting that according to statistics from the China Passenger Car Association, A00+A0-class pure electric vehicles accounted for 43% of all pure electric vehicle exports in July, compared to just 26% in the same period last year. This means that pure electric small cars were not only hot sellers in the domestic market in July, but also became a favorite in the export market.

Looking at the three traditional segments differentiated by body type, sedans, SUVs and MPVs all achieved growth in China in July, and the growth rates were very close at 5.8%, 6.7% and 6.7% respectively.

Although the popularity of pure electric small cars should bring a lot of growth to the sedan market, a large number of domestic consumers still prefer SUVs, so the latter still became the largest domestic market segment with 901,000 vehicles in July, and the same is true for overseas markets.