Due to the voluntary recall of some Li Auto MEGA vehicles at the end of October and the inclusion of related costs, Li Auto's gross profit margin declined in the third quarter and it incurred a loss for the quarter.

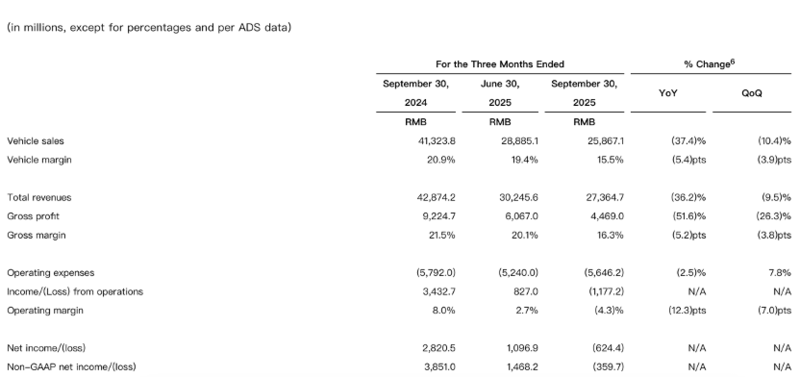

On November 26, Li Auto disclosed that it achieved revenue of RMB 27.365 billion in the third quarter of 2025, a year-on-year decrease of 36.2%, slightly higher than the market's estimated RMB 26.6 billion; the net loss in the third quarter was RMB 624 million, compared with a net profit of RMB 2.821 billion in the same period last year; the adjusted (Non-GAAP) net loss was RMB 360 million, compared with a net profit of RMB 3.851 billion in the same period last year; as of the end of the third quarter, Li Auto's cash reserves reached RMB 98.9 billion.

Looking ahead to the fourth quarter, Li Auto expects vehicle deliveries to be between 100,000 and 110,000 vehicles, a year-on-year decrease of 37% to 30.7%. Revenue is expected to be between RMB 26.5 billion and RMB 29.2 billion, a year-on-year decrease of 40.1% to 34.2%.

During the earnings call, Li Xiang, CEO of Li Auto, stated that the third quarter of 2025 is also the first quarter of Li Auto's second decade. The company has experienced various challenges brought about by product cycles, public relations and public opinion, supply chain ramp-up, and policy changes, all of which have impacted delivery and operations.

The MEGA recall is expected to lower gross margin by more than 4 percentage points.

In terms of gross profit margin, the company's overall gross profit margin in the third quarter fell to 16.3%, a decrease of 5.2 percentage points from 21.5% in the same period last year; the gross profit margin of vehicles also fell to 15.5%, far lower than 20.9% in the same period last year.

It's worth noting that the Li Auto MEGA recall had a significant impact on its profitability. Excluding the estimated costs of the Li Auto MEGA recall, Li Auto's quarterly gross margin was 20.4%.

Financial reports show that Li Auto's gross profit in the third quarter totaled 4.469 billion yuan. Based on this, the Li MEGA recall resulted in a loss of over 1.1 billion yuan for Li Auto.

On October 23 this year, a fire occurred in Shanghai involving a Li Auto MEGA 2024 model vehicle, which has drawn close attention from users, the media, and the public.

Li Auto stated that its internal investigation revealed that the coolant in the same batch of Li Auto MEGA 2024 vehicles as the accident vehicle had insufficient anti-corrosion performance. Under certain conditions, this could lead to corrosion and leakage of the cooling aluminum plates of the power battery and front motor controller in the cooling circuit, causing the vehicle to experience malfunction indicators, limited power, and inability to power on. In extreme cases, it could cause thermal runaway of the power battery, posing a safety hazard.

According to the official website of the State Administration for Market Regulation, on October 31, Li Auto voluntarily filed a recall plan with the State Administration for Market Regulation.

Li Xiang: In the next decade, cars with autonomous and proactive capabilities will be the most valuable embodied intelligent products.

In Li Xiang's view, when products remain at the level of "electric vehicles," the competitive logic becomes a battle of specifications: is the range 20 kilometers more or less? Is the car 2cm longer or shorter? If the focus is solely on competing in the electric vehicle market, it means more space, longer range, lower prices, and copying designs that have already proven successful. However, if the focus shifts to developing smart terminals, the attention becomes more on what's on the screen, instinctively leading to the repetitive development of smartphone functions. Most of the innovation in "smart terminals" over the past few years has essentially been about porting smartphone functions to cars.

He commented, "These investments have very limited impact on improving user value, and are even just a form of self-entertainment for the companies."

Li Xiang's plan is to transform cars into embodied intelligent products of the physical world, that is, robots.

He discussed equipping car robots with the capabilities of "top-tier drivers," enabling them not only to drive but also to greet you daily, park for you, charge your car, and open and close doors for you, providing meticulous convenience, experience, and care. He believes that in the next decade, the most valuable products embodying intelligence will undoubtedly be cars with autonomous and proactive capabilities. Product competition will focus on the extent to which these autonomous and proactive capabilities are achieved, and these values will be integrated into high-frequency aspects of daily life and experiences.

With its continued investment in AI, Ideal's R&D expenses have remained high, reaching 3 billion yuan in the third quarter. Ideal expects its total R&D expenditure for the year to reach 12 billion yuan, of which more than 6 billion yuan will be invested in the field of artificial intelligence, with in-depth self-development in areas such as chips, base models, underlying operating systems, and core controllers.

Regarding recent automotive products, executives at Li Auto revealed that the L series will undergo a major redesign in 2026. This redesign is based on user feedback and the accumulation of core technologies, and its overall strategic goal is to regain its leading position in range-extended electric vehicle products by 2026.

Regarding the configuration of the L-series models, Li Auto will return to a simplified approach, aiming to eliminate the pain point of a discounted entry-level experience while balancing market coverage and supply chain efficiency.

Furthermore, in terms of overseas expansion, Li Auto's globalization entered a new phase in the third quarter. Its first overseas authorized retail center officially opened in Uzbekistan in October, and a Kazakhstan authorized retail center was established in November, initially covering the core Central Asian market and selling the Li L9, Li L7, and Li L6 to the local market. Li Auto stated that it plans to gradually expand into Latin America, Europe, and Southeast Asia by 2026, achieving full coverage of key global markets.

On organizational change: Returning to a startup

This year, Li Auto has undergone management changes, which has been seen by outsiders as a signal that Li Auto is halting its comprehensive adoption of Huawei's model. Since 2022, Li Auto has been learning from Huawei, and 2023 saw a major overhaul of its "Huawei-ization," the core of which was bringing in several "Huawei-affiliated" executives and learning Huawei's governance system.

During the earnings call, Li Xiang spent a significant amount of time analyzing and reflecting on this round of organizational changes that has garnered much attention.

In Li Xiang's view, as Li Auto faces its second decade, the first key choice is its organization. "The choice we face is whether to adopt a startup management model or a professional manager management model. For the first seven years of the past ten years, Li Auto adopted a startup management model. As the scale expanded to a revenue scale that I had never experienced before in my previous startups, around 2022, many people suggested that we move towards a professional manager management model."

He mentioned that over the past three years, the company has worked very hard to transform into a governance system for professional managers. However, in practice, they have realized that startups and professional managers are two completely different governance systems. This is not related to processes or organizational structures, but rather to differences in management philosophies and elements, as well as their respective suitability for different stages and industry environments.

He judged that, given the current state of artificial intelligence reshaping various industries, the company's environment and its own characteristics are more suitable for startups.

Li Xiang explained that the core of startup management revolves around four things: First, more dialogue, deep dialogue, rather than more reports. Second, focus on user value, not just delivery. Third, continuously improve efficiency, rather than hoarding more resources. Fourth, identify key problems, rather than creating information asymmetry.

“Over the past three years, my startup team and I have worked hard to learn the management system of professional managers and forced ourselves to accept various changes. However, we have become worse and worse versions of ourselves. Meanwhile, Nvidia and Tesla are still managed like startups. If the world’s strongest companies are managed like startups, what reason do we have to give up the way we are best at?” Li Xiang said that starting in the fourth quarter of this year, the company has firmly returned to the management model of a startup in order to face the challenges of the new era and new technologies.