In late September 2025, pedestrians on the streets of Turin had already put on light coats, but the atmosphere inside the Turin courthouse was unusually intense.

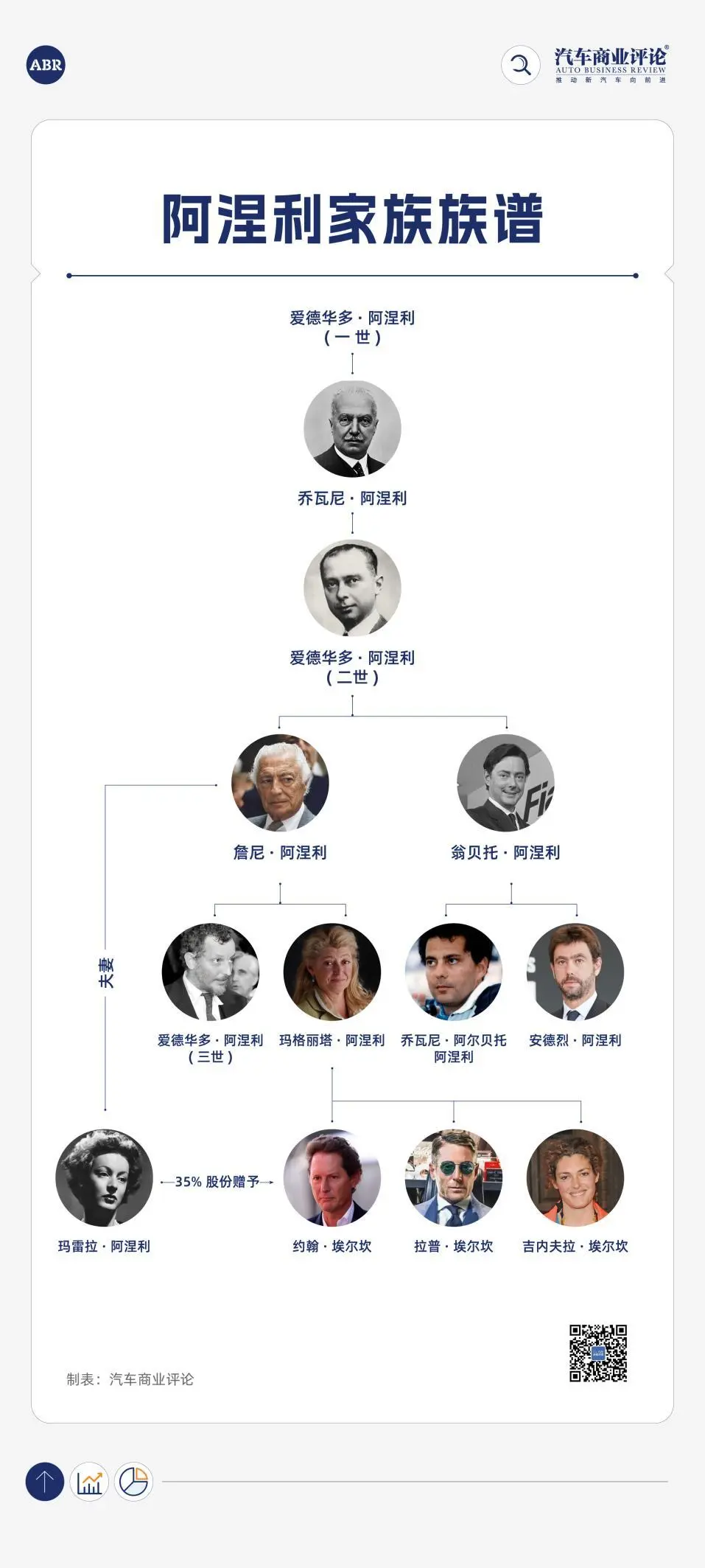

John Elkann, chairman of Ferrari and Stellantis and heir to the Agnelli family, which controls the lifeline of Italian industry, had just settled an €800 million tax investigation brought on by his mother, Margherita Agnelli, but before he could catch his breath, he was now being betrayed by his mother.

All eyes turned to the plaintiff's side, where Margarita's lawyer submitted a handwritten will note that had reportedly never been made public, dated January 20, 1998.

Margarita's father, Gianni Agnelli, the founder of the Fiat dynasty, wrote that his approximately 25% stake in the family holding company Dicembre should belong to his son, Edoardo Agnelli.

Gianni Agnelli with his son Edoardo Agnelli

Eduardo Agnelli, Gianni's only son, also known as Eduardo III, committed suicide in 2000.

Based on this, Margarita filed her own appeal demanding a redistribution of the enormous inheritance left by her father, Gianni, and that she and her mother, Marella Agnelli, should retain the portion originally intended for Eduardo.

This is not the first time the mother and son have faced off in court. For years, Margarita has harbored doubts about the proportion of the inheritance and firmly believes that her father has intentionally concealed many assets that have not been included in the inheritance.

The root of all the conflicts occurred nearly 23 years ago.

In January 2003, Jenny died of prostate cancer at the age of 81.

Six days later, Margarita, still grieving the loss of her father, was shocked to learn from a phone call by her family lawyer that the will had been read aloud without her presence.

When she rushed to the notary office, another piece of news enraged her even more: her mother, Marella, wanted to transfer her shares in Dicembre to John to ensure that he would become the undisputed heir to the family business.

"Why did you do this?" Margarita angrily questioned her mother, Marella, at the notary office.

From that moment on, the pursuit of the truth about the distribution of the inheritance became an obsession she could not let go of. This obsession seeped into the vast business empire of the Agnelli family like an undercurrent, shrouding the entire empire in the shadow of an unresolved succession war.

A will that could trigger an "earthquake".

“This document constitutes an additional element that could determine a complete overhaul of Dicembre’s ownership structure and morally demonstrates that Gianni Agnelli’s wishes were ignored and betrayed,” Margarita’s lawyer said.

Those familiar with the Agnelli family know that Dicembre is a simple company with advantages such as flexible operation, simplified procedures, and low management costs. It is mainly used for holding shares, but it is not an ordinary company. Controlling Dicembre is equivalent to holding the "key" to the Agnelli family's business empire.

Dicembre sits at the top of the Agnelli family's investment chain, controlling a 38% stake in Giovanni Agnelli BV, a Netherlands-based company that, as of December 31, 2024, owned a 55.07% stake in the diversified investment holding group Exor.

Exor controls a majority stake in the sports car brand Ferrari, the global automotive giant Stellantis Group, Juventus Football Club, The Economist, and the Italian newspaper La Repubblica, making it arguably the powerful "business heart" of the Agnelli family.

Looking back over the past century, the rise of the Agnelli family is a legend in itself.

At the end of the 19th century, the visionary Giovanni Agnelli founded the Turin Automobile Company in Italy, which later became the renowned Fiat.

Gianni and his grandfather, Giovanni, the founder of Fiat, in 1940.

In 1927, he established IFI Holdings, which tightly bound Fiat to industries such as food, finance, aviation, real estate, and news, creating an unparalleled commercial trust.

There was once a saying in Italy: "Agnelli is Fiat, Fiat is Turin, and Turin is Italy," which fully demonstrates the immense power of this family.

Subsequently, the family established IFINT in 1964 to consolidate its expanding international investments. By the end of the 20th century, IFINT had completed its acquisition of Exor and, through its presence in Asia, truly extended its influence globally.

However, even the most fortified empires can be battered by storms. At the beginning of the 21st century, Fiat was mired in crisis. The Agnelli family decided to simplify its complex holding structure to create a clearer and stronger new image.

Ultimately, Exor emerged victorious, becoming the sole flagship overseeing all its assets. This marked the beginning of a new chapter for this century-old family business.

Currently, John holds 60% of Dicembre's shares (the remaining 40% is split equally among his siblings), which is the source of his confidence in sitting firmly as chairman of both Ferrari and Stellantis.

The three Elkan siblings

Supporting all of this is another document left by Gianni in 1996. At that time, he clearly stated that he wanted to leave the shares to his grandson John and chose him as his successor, which was also the reason why Marella transferred the shares back then.

Therefore, although Stellantis and Ferrari are not directly involved in the case, if Margarita wins, Exor's shareholding structure may be shaken, and it may even rewrite the governance structure of Italy's most influential industrial conglomerate.

Faced with his mother's onslaught, John did not sit idly by. His legal team responded forcefully: "This so-called new document is unrelated to the 2004 agreement regarding Gianni Agnelli's estate."

After all, Eduardo had already passed away when his father died in 2003, so the share allocation note pointing to him seemed to have lost its direct beneficiary from a legal perspective.

Margarita's lawyer continued to argue: "When Jenny's will was made public in February 2003, the heirs only had information related to the 1996 document."

It is worth noting that this inheritance battle surrounding the "handwritten will" may have only just entered its most intense phase.

Sources familiar with the matter revealed that the controversy surrounding whether Jenny's "handwritten note will" is legally valid and whether it can be accepted by the court continues to escalate.

Meanwhile, Margarita's legal team is actively preparing new evidence and will be calling a new batch of witnesses. The list may even include John Elkann himself.

If the current head of the Agnelli family were to stand in the witness stand, this battle between family and power would undoubtedly reach a new climax.

A woman who goes against her family

Margarita Agnelli, the mother who betrayed her son

Regarding Margarita's claim to the inheritance, her cousin Lupo Rattazzi stated in a 2008 interview with Vanity Fair: "Italian journalist Oriana Fallaci once said that there is no moment in life when you feel more 'alive' than during wartime. Margarita probably felt very 'alive'."

He continued, “In Turin, people will tell you that she found a role for herself. She said, ‘I am not someone’s daughter or someone’s wife, nor am I this or that’s relative. I have finally become myself.’ So I think this struggle provided her with a role—a warrior.”

Although Latazzi's comments were subtly ironic, it must be admitted that his words remarkably foreshadowed the future. This is because Margarita truly possessed a very "fighting" spirit.

Margarita signed the Geneva Accords in 2004 after her father's death, which marked a turning point in her relationship with the family fortune.

Under the agreement, Margarita relinquished her shares in Dicembre, the core holding company of her family—which she and her mother, Marella, each inherited 37.5% after Gianni's death.

She transferred her shares in the company to her mother, Marera, in exchange for a huge sum of approximately €1.2 billion.

These include: a sprawling country estate near Turin, a summer villa on the island of Corsica, and partial rights to an art collection containing works by Francis Bacon and Andy Warhol, valued at up to $1 billion.

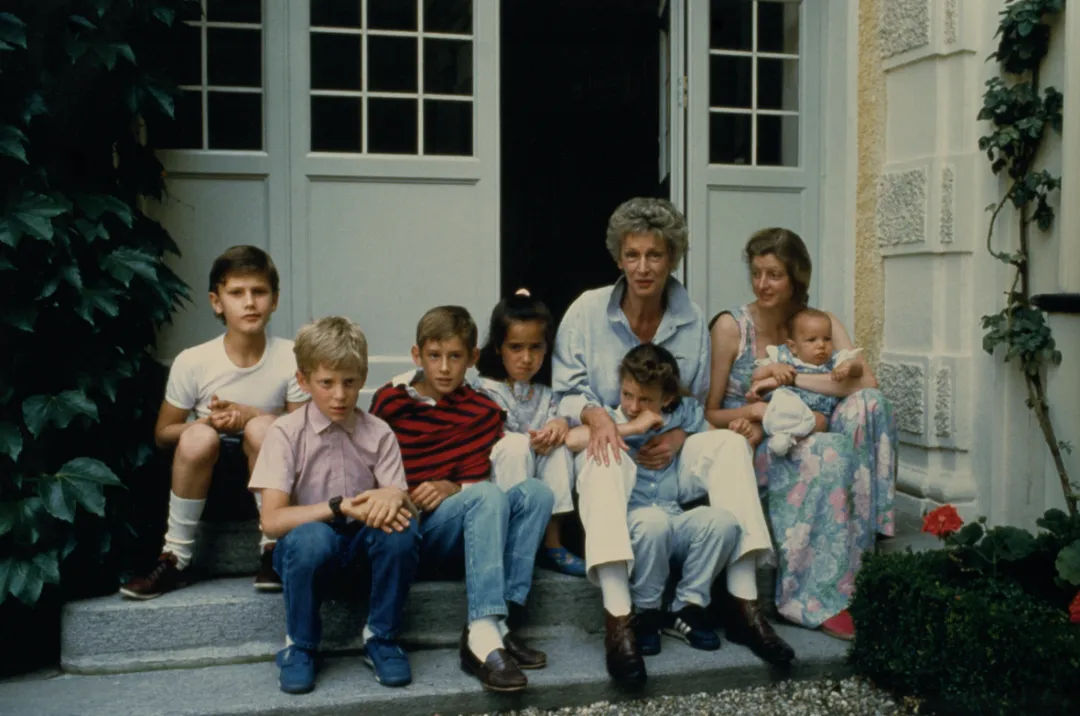

Her mother, Marella, signed a will bequeathing her estate to her three grandchildren—Margarita's three siblings born to her first husband, Alain Elkann.

Marella with her daughter Margarita and her grandchildren, 1986

The three siblings are John, his brother Lapo Elkann, and his sister Ginevra Elkann.

Lap and Ginevra each received 20% of the company's shares, while John received the remaining 35% from Marera.

Marella passed away in 2019 at the age of 91.

In 2021, Margarita challenged the agreement, arguing that the amount received was insufficient. She claimed that the sum was too low, given the increase in share value.

It is worth noting that when Margarita relinquished her shares, the family business was in dire straits, and the Fiat Group was heavily indebted and on the verge of bankruptcy.

However, under the leadership of her son John, the value of the family investment company Exor subsequently increased by an astonishing 2,700%, reaching €33 billion.

Furthermore, Margarita believes that her five children with her second husband, Serge De Pahlen, a former Fiat executive who had infiltrated Paris for the KGB, were swindled out of their inheritance.

Margarita and her second husband attend their mother Marella's funeral.

A close associate of Margarita explained, "Margarita didn't sign the agreement; she started questioning it the very next day."

More precisely, in 2007, three years after the agreement was signed, "she discovered that her mother had hundreds of millions of euros in wealth in Switzerland, but this wealth was not in the official accounts. Moreover, many of her father's assets were not included in the distribution when he died."

In the same year, she filed a lawsuit in court demanding an investigation into the full contents of Gianni's estate, but the lawsuit was dismissed.

Those close to the Elkann family scoffed at the idea, believing that Margarita's claim was an attempt to gain illicit further financial benefits.

Meanwhile, Margarita's claims were met with indifference and even contempt within the family. This inheritance battle even turned Margarita into an "outcast" within the family.

Latazi has publicly stated his opinion that Margarita's behavior reflects "the seller's remorse."

“I remember her telling me that Fiat would eventually end up like Parmalat,” he told the Financial Times, referring to Parmalat as the Italian food group that went bankrupt in 2003. “She wouldn’t have broken the settlement agreement if it hadn’t been for the significant increase in value after she sold her Dicembre shares.”

John, the direct opponent of the confrontation, also stated that his mother's actions "hurt and surprised him as a son." He argued that his mother signed the agreement when the family business was in dire straits, showing no concern for the company's future, and now wanted to reclaim the shares she had relinquished.

Rapp and Ginevra also sided with their brother John and severed ties with their mother and half-siblings.

However, Margarita denied the "greed" claim. She stated that she agreed to sign the agreement in 2004 and choose to withdraw simply to achieve inner peace and restore peace to her family.

“Because my children were told not to talk to me. My mother was also told not to talk to me… Of course, I lost my father, and worse still, my mother, and my children. I would rather accept a peaceful treaty with them than continue to hold shares.”

No one knows how long this tug-of-war will last, but everyone can see clearly that as long as Margarita's insistence on "fairness" is not achieved, her struggle will not stop.

Perhaps the documents in the Turin courthouse, the Italian financial headlines, and the casual conversations in cafes will continue to resonate around this surname for a long time to come.

A major uproar caused by a "byproduct"

The most dramatic twist in the whole affair is that the note, which Margarita considered crucial evidence, turned out to be a "byproduct" of the Elkan siblings' previous tax evasion scandal.

A criminal investigation by the Turin prosecutor's office brought this long-forgotten handwritten will to light, pushing a dispute that should have been temporarily quelled back to a climax.

Margarita's mother, Marella, was born in 1927 into a noble family in Naples, Italy. She was the second child of Prince Filippo Caracciolo di Castagneto, a diplomat, and Margaret Clarke, an American.

This fashionable and beautiful woman enjoys collecting art and gardening. She is considered the "most elegant and well-mannered" member of the "Swan" circle (a synonym for New York high society socialites, signifying top-notch taste, elite social interaction, and cultural sophistication), and has been given the exclusive nickname "The Last Swan".

This woman probably never imagined that one day she would go from being a top socialite to a "criminal".

Following Marella's death, Margarita's lawyer submitted a document to the Turin court to prove that her mother spent 80% of her time in Italy, not Switzerland, from 2003 to 2019, and therefore should not be eligible for Swiss residency.

Therefore, Marella should be considered an Italian tax resident, and her estate should be subject to back taxes in Italy. Margarita's move aims to completely overturn the previously signed Geneva Accords.

Her legal team in Turin pointed out that the core basis for the agreement was that Marella was a resident of Switzerland, but Margarita's side disputed this crucial fact.

Because Italian law does not allow the renunciation of inheritance rights before death, Margarita's ability to prove that her mother's official residence is in Italy rather than Switzerland could alter the inheritance terms.

Her claims successfully drew the attention of Italian authorities. In 2024, the authorities launched a formal investigation into Marella's estate on suspicion of tax fraud.

Turin prosecutors say that Marella owes €42.8 million in taxes on her lifetime annuity and financial assets, as well as €32 million in taxes on inherited assets, including artwork and jewelry.

The Elkan siblings, however, argue that their grandmother's estate is located in Switzerland and, according to local law, is not required to pay any taxes to Italy.

The Elkan siblings' lawyer told Reuters, "We reiterate that Marella Caracciolo (her maiden name) has lived in Switzerland since the early 1970s, long before the Elkan siblings were born. She has always longed to live in Switzerland and has never wavered in that desire."

In an effort to gain the moral high ground in public opinion and the law, both sides launched accusations against each other.

John's legal team criticized Margarita's more than two decades of legal battles, saying she "persistently persecuted her parents and three children throughout all proceedings, even bringing family disputes to the public eye."

They emphasized that the Elkan siblings were "the only ones who provided meticulous care during the final stages of their grandmother's life."

Margarita's lawyer countered that all her actions were in self-defense.

The lawyer pointed out: "On the day Marella died, the three Elkan siblings filed a lawsuit against their mother in Switzerland—at that time, the will had not yet been published, and the inheritance dispute had not yet surfaced."

According to public reports, in 2019, the three siblings filed a lawsuit against their mother in Switzerland, and their specific demands revolved around two points—confirming the validity of their grandmother Marella's Swiss will and the 2004 Swiss agreement (including the "Geneva Agreement/Inheritance Agreement").

Margarita felt that the three siblings had offended her first. Now, Margarita's accusations against her mother, Marella, for alleged tax fraud are "fatal" because they could put the three Elkan siblings at risk of criminal prosecution.

In addition to tax and criminal proceedings, civil cases concerning inheritance disputes between the two parties were also underway at the time.

Margarita's lawyers also stated that they welcomed the outcome of the tax and criminal proceedings, emphasizing that it would strengthen Margarita's claims.

"The Turin civil judge has further confirmed that the design and implementation of the estate arrangement did indeed infringe upon the legitimate rights and interests of Margarita Agnelli."

However, events did not unfold exactly as Margarita had envisioned. With the prosecution reaching a plea bargain with the Elkann family, the criminal proceedings against the three siblings officially concluded in September 2025.

The price of the settlement was that John had to complete a year of community service, and the three siblings had to jointly pay a huge sum of up to €183 million to the Italian tax authorities.

In a statement, the family lawyer spoke earnestly, hoping that the hard-won agreement would act as a remedy, helping the prominent family "completely escape the painful shadow that has shrouded them for years."

The lawyer also specifically pointed out that, under Italian law, such plea bargains do not have the effect of conviction; they are a judicial means of terminating an investigation.

Clearly, this is a war with no winners. Only the Italian tax authorities have become unexpected "beneficiaries" of this chaos, with an unexpected huge tax bill appearing in their books.

The current leader who turned the tide

Although this inheritance battle has frequently made headlines in Italy, most observers believe that John's leadership at Ferrari or Stellantis remains secure.

Shareholders, analysts, and industry insiders have only added another layer of worry for John: how will he balance increasingly complex personal affairs and corporate responsibilities in the coming year?

John was born in New York and was an avid navigator and football player. He was tall and thin with a head of messy black hair. In public, he spoke slowly and cautiously and had a childlike smile.

John and his wife Lavinia Borromeo married in 1998.

Compared to his brother Rapp and grandfather Jenny, who led colorful lives and were known as playboys, John was naturally calm and low-key. His parents' early divorce made him take on the responsibility of caring for his younger siblings, giving him a maturity beyond his years, which indirectly shaped his resilient and composed management style later in life.

At the age of 21, John was officially appointed as a member of the Fiat board of directors by Gianni, which began his systematic training in the business empire.

Jenny said at the time that his grandson, though still young, "has already shown extraordinary qualities and talents."

He recalled his grandfather Jenny's careful mentorship: "He arranged for me to start working, spending some time in the accounting, finance, and legal departments, just to learn the basic responsibilities of a board member. I had some wonderful teachers and was very, very fortunate to complete that apprenticeship."

Gianni Agnelli and John Elkann

Moreover, John also completed a series of special "undercover" operations, concealing his identity at Fiat factories in the UK, France, and Poland, and participating in production as an ordinary employee.

John's first encounter with the automotive industry was during an internship at a headlight factory in Birmingham, England. He frankly admits that the first year and a half in charge of the family's car manufacturing operations was "terrifying."

But it was precisely this "terrible" experience that became his most precious gift of growth. John gained a deep understanding of the entire manufacturing process, from raw materials to finished products.

What's even more remarkable is that this factory is a core supplier in Toyota's production system, which gives him the opportunity to have direct access to the world's top quality management standards.

“As a supplier to Japanese automakers like Toyota, we must meet the highest standards in production processes and organization,” John summarized. “This experience gave me a true understanding of every step from material input to the final production of qualified headlights.”

John's early assumption of the family empire's responsibilities is undoubtedly related to the tragic undertones that permeate the family's history.

Automotive Business Review noted that in media narratives, the Agnelli family is often referred to as the "Kennedy family" of Italy, with glamour and misfortune always going hand in hand.

Edoardo Agnelli II, the 43-year-old son of Giovanni Agnelli, died in a seaplane crash en route to Genoa.

Gianni's originally chosen successor, his nephew Giovanni Alberto Agnelli, died in 1997 at the age of 33 from a rare form of stomach cancer.

Gianni's only son, Eduardo III, ended his life at the age of 46 in 2000 by jumping off a viaduct outside Turin in his pajamas.

Some close to the Agnelli family believe that Eduardo's leap may have been an attempt to prove to his father that he possessed the courage that had always been questioned. The father and son had a long-standing strained relationship, with Eduardo constantly living under Gianni's belittling and neglect.

This is why, when his grandfather Gianni passed away in 2003 and Fiat's finances were in jeopardy, John faced not only a corporate crisis but also a test of family succession.

“I am proud of our history, but I would not say I feel any pressure,” John once said. “What I feel is responsibility.”

The turning point came with the arrival of a key figure. In 2004, John defied public opinion and persuaded Sergio Marchionne, known for his iron-fisted reforms, to become Fiat's CEO.

Sergio Marchionne

Marchionne had previously successfully turned around Fiat's SGS company, and even earlier led the Alusuisse Group out of its predicament, demonstrating a remarkable track record in restructuring complex organizations.

John later recalled that decisive night, saying, "We spent a long night drinking many glasses of grappa, and finally convinced Marchionne to join us."

The real test came in 2005. At that time, Fiat faced two life-or-death choices:

First, the agreement with General Motors has entered its fourth year, and the terms stipulate that General Motors must acquire the remaining 90% stake in Fiat's automotive division.

Secondly, the company is burdened with 3 billion euros of bank debt. If the debt is converted into equity, the Agnelli family’s shareholding will be diluted to slightly more than 20%, thereby losing control of Fiat.

At this critical juncture, John spearheaded two decisive initiatives.

John supported Marchionne's negotiations to terminate Fiat's agreement with General Motors and to obtain a $2 billion "breakup fee" from GM, thus waiving the clause that would have forced GM to acquire the remaining shares of Fiat.

This huge sum provided Fiat, which was then mired in debt, with crucial cash flow, giving it a much-needed reprieve.

At the same time, John made a decision that demonstrated the family's responsibility. He decisively persuaded a new round of family members to collectively invest €536 million to maintain the family's controlling stake in Fiat.

John said, "In 2005, our family converted our bank loan into equity and invested a large sum of money in the company to ensure its stable development."

This series of actions stabilized Fiat's position. This not only became the first proof of his ability to save the empire, but also marked the official beginning of an era belonging to John.

He then revitalized the century-old car manufacturer three more times.

The first instance was in 2014 when it acquired Chrysler and formed Fiat Chrysler Automobiles (FCA).

At that time, Fiat was overly reliant on the European market, especially during the European debt crisis, when its capacity utilization rate in Europe once dropped to as low as 50%, resulting in significant losses. The establishment of FCA was precisely to break away from regional dependence and achieve a truly global presence.

This merger, which was initially met with skepticism, ultimately proved the market right. FCA's stock price rose from around $1.50 to over $15, and its market capitalization increased to $30 billion.

“John is not bound by the past and is leading the company in a more global direction,” said Giuseppe Berta, a professor at Bocconi University.

Berta, who previously served as the director of Fiat's archives and had a close personal relationship with Elkann, added, "John wanted to leave his mark like his grandfather. He represents a true generational shift."

The second instance was in 2021, when FCA facilitated a merger of equals with rival Peugeot Citroën (PSA) (50:50 shares) to form the Stellantis Group.

This merger created a diversified portfolio of fourteen brands, including Citroën, DS, Opel, Peugeot, Fiat, Chrysler, Jeep, Maserati, and Alfa Romeo, making it the world's fourth-largest automaker.

The third time was in 2023, when he signed an equity investment agreement with Leapmotor on behalf of the Stellantis Group, acquiring approximately 20% of the latter's shares.

This investment will accelerate the launch of cost-competitive electric vehicle products, solidify its asset-light strategy, explore new business models, profit from Leapmotor's competitiveness in China and other markets, and develop potential areas within its business model.

“We must always look to the future, anticipate the future of new inventions, and be unafraid of new things. Remove the word ‘impossible’ from our vocabulary.” John often quoted this powerful saying from his great-grandfather, Giovanni, the founder of Fiat.

Today, the head of the Agnelli family is leading Ferrari and Stellantis through this family storm with the same belief.