Pony.ai and WeRide, vying for the title of "first Robotaxi stock," became "brothers in misfortune" on their first day of listing on the Hong Kong Stock Exchange.

On November 6, Pony.ai (02026.HK) and WeRide (00800.HK), both intelligent driving technology companies, officially listed on the Hong Kong Stock Exchange. Both stocks opened below their issue price and closed down more than 9%.

Specifically, Pony.ai closed at HK$126.1 per share, down 9.28%, with a total market capitalization of HK$54.7 billion. WeRide closed at HK$24.4 per share on the 6th, down 9.96%, with a total market capitalization of HK$25 billion, less than half that of Pony.ai.

According to official announcements, Pony.ai has fully exercised its offering adjustment option in this Hong Kong IPO, issuing approximately 48.25 million shares. If the underwriters' over-allotment option is fully exercised (i.e., after the greenshoe option), the fundraising amount could reach HK$7.7 billion, making it the largest IPO in the global autonomous driving industry in 2025.

On November 6, 2025, at the Hong Kong Stock Exchange, WeRide CEO Han Xu (left) attends the company's listing ceremony. (Visual China photo)

WeRide, a Hong Kong-listed company, offered a total of 88.25 million shares globally (before the greenshoe option). After triggering the clawback mechanism, the number of shares offered to the public was 17.65 million, and the number of shares placed internationally was 70.6 million. The price per share was HK$27.1, and the total amount raised (before the greenshoe option) reached HK$2.39 billion.

The two companies that went public on the same day have always had an "inextricable connection".

The two companies share a similar development pace and business logic. Pony.ai was founded in 2016 and is committed to providing autonomous driving technology and solutions for the global market in the fields of mobility and logistics. Its core businesses cover three major segments: autonomous driving mobility services (Robotaxi), autonomous driving truck services (Robotruck), and technology licensing and application business.

Founded in 2017, WeRide focuses on three major application scenarios: smart mobility, smart freight, and smart sanitation. It has developed a product matrix of five major products: Robotaxi (autonomous taxis), Robobus (autonomous minibuses), Robosweeper (autonomous sanitation vehicles), Robovan (unmanned logistics vehicles), and ADAS (Advanced Driver Assistance Systems) solutions.

In terms of their listing processes, the two companies are also close in pace. WeRide listed on the Nasdaq Stock Exchange on October 25, 2024. In November 2024, Pony.ai successfully listed on the Nasdaq in the United States under the stock code "PONY". On October 28 this year, Pony.ai and WeRide launched their IPOs in Hong Kong on the same day.

Regarding regulatory approvals, Pony.ai stated that it is the only autonomous driving technology company that has obtained all the necessary regulatory approvals to provide public autonomous driving mobility services in four first-tier cities in China.

In China, WeRide's Robotaxi has achieved fully driverless commercial operation in Guangzhou and Beijing, and has launched 24/7 autonomous driving services at transportation hubs such as airports and train stations. Both companies have also begun their globalization process.

In terms of industry collaboration, Pony.ai launched three seventh-generation Robotaxi models jointly developed with Toyota, BAIC Group, and GAC Group, respectively. The new generation of models has achieved a major breakthrough in cost efficiency: the bill of materials (BOM) cost of the autonomous driving kit has decreased by 70% compared to the previous generation, with the cost of the autonomous driving computing unit (ADC) decreasing by 80% and the cost of solid-state LiDAR decreasing by 68%, laying a solid foundation for large-scale commercialization.

WeRide has built a strategic ecosystem that includes Uber, Nvidia, Bosch, Grab, Renault-Nissan and others, and has received a joint investment commitment from ride-hailing giants Uber and Grab.

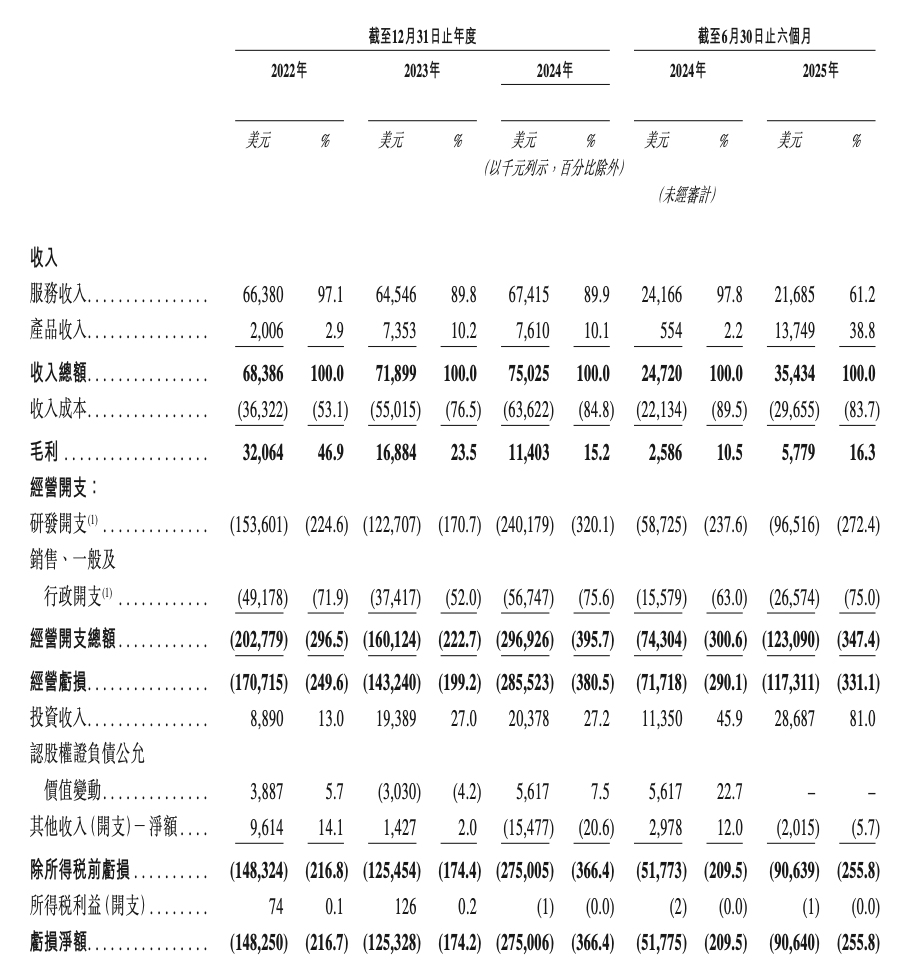

In terms of performance, Pony.ai's total revenue in the first half of 2025 was approximately US$35.434 million, representing a year-on-year increase of 43.3%. WeRide's total revenue in the first half of 2025 was US$27.865 million, representing a year-on-year increase of 32.8%.

It's worth noting that the two sides recently clashed again, drawing public attention. According to CNR Finance, on the evening of October 30th, WeRide CFO Li Xuan published a lengthy post in an analyst group, claiming that Pony.ai made several false accusations against WeRide in its investor materials during its Hong Kong roadshow, containing numerous biased, untrue, and deliberately derogatory statements. However, neither party has publicly responded to the matter.

Robotaxi (driverless taxis) is a fiercely contested area in the entire autonomous driving industry, representing the commanding heights of the industry. Currently, the main players in the Chinese market include Pony.ai, WeRide, Baidu Apollo, and SAIC Saike. However, at the same time, OEMs including XPeng Motors, as well as ride-hailing platforms such as Didi and Caocao Mobility, have also begun to enter this market.

A recent report by Goldman Sachs states that the potential market size for Robotaxi in China is expected to grow from $54 million in 2025 to $12 billion in 2030.