Japanese automakers are beginning to aggressively promote pure electric vehicles in their domestic market.

From October 30th to November 9th, the biennial Tokyo Motor Show, the Japan Mobility Show, was held at the Tokyo Big Sight. As the last major global auto show of the year, Japanese automakers made a collective appearance. Unlike two years ago when they hesitated and observed the trend towards electrification, this year Japanese automakers can be said to have rushed to accelerate their efforts in electrification.

At the auto show, in addition to Chinese brands such as BYD K-EV and BYD RACCO, pure electric concept cars from Japanese automakers such as Toyota and Honda also attracted the attention of the media and visitors.

Of particular note was Toyota's unveiling of the technologically advanced Corolla concept car, along with its announcement of a pure electric version. As Toyota's best-selling model ever and a flagship product, the Corolla's electric version undoubtedly signals a strong commitment from Toyota and the broader Japanese automotive industry to electrification.

BYD, a Chinese company, attracted significant attention at the Japan Mobility Show.

Electric Vehicle Lowland: Japan's electrification penetration rate has long hovered around 2%.

As the world's fourth-largest auto market, Japan's transition to electric vehicles has been quite unique: hybrid electric vehicles (HEVs, characterized by charging the battery through engine operation and kinetic energy recovery systems without external charging) dominate the market. In contrast, the development of pure electric vehicles in Japan has encountered bottlenecks, with penetration rates remaining extremely low for a long time.

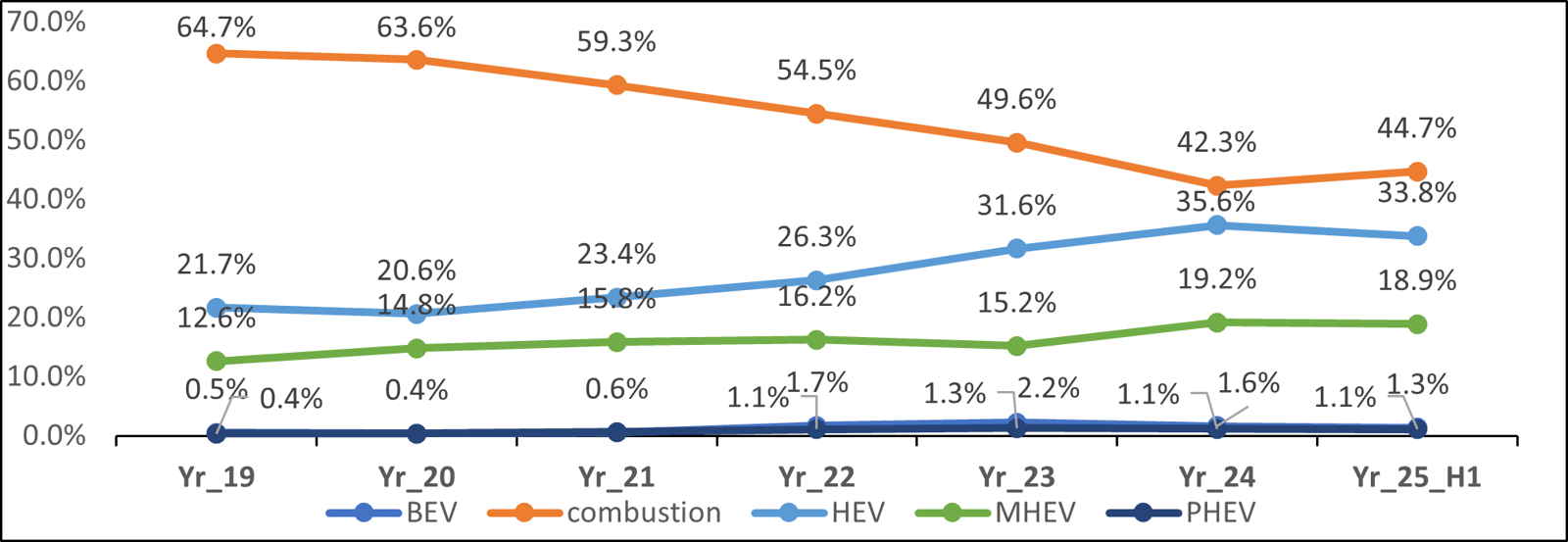

Data released by JATO Dynamics, a provider of automotive industry data and consulting services, shows that in 2019, the market share of pure electric vehicles in Japan was only 0.5%. After climbing to 2.2% in 2023, it fell back to 1.3% in the first half of 2025, the lowest among developed countries.

A comparison of registration volumes for different powertrain models in the Japanese market, sourced from the JATO Dynamics website.

On the one hand, the Japanese domestic market has long relied on hybrid electric vehicles. As one of the world's leading automotive nations, Japan's automotive industry has built a vast industrial chain around internal combustion engine technology, and leading companies such as Toyota and Honda have accumulated a strong competitive advantage in the field of hybrid electric vehicles. For example, of Toyota's annual sales of around ten million vehicles, more than 40% are hybrid electric models. This technological advantage has also shaped the cultural recognition of the traditional automotive industry's strengths in Japanese society.

On the other hand, when it comes to future technologies, Japan has bet heavily on hydrogen fuel cell vehicles, while its investment in pure electric vehicles has been severely insufficient, a move jokingly referred to within the industry as "choosing the wrong technology path." These factors have directly led to the lag in Japan's domestic electrification process.

In terms of models, the number of pure electric vehicles sold in Japan will increase from 10 in 2019 to 61 in 2025. However, only 10 of these are from Japanese brands, while the remaining 51 are from foreign brands. Apart from the best-selling Nissan Sakura, only foreign brands such as the Tesla Model 3 and BYD Seal have a slight presence in the market.

Sales figures provide a clearer picture of the lukewarm reception of electric vehicles in the Japanese market: In 2024, Japanese brands held over 94% market share in their home market, wielding absolute dominance; however, in the pure electric vehicle sales rankings, foreign brands can rival domestic brands. For example, Tesla, one of the world's most popular pure electric vehicle brands, only sold 5,600 vehicles in Japan last year, ranking second among pure electric brands.

BYD only entered the Japanese passenger car market three years ago, but last year its pure electric vehicle sales rose to fourth place, surpassing local giants such as Toyota and Honda.

BYD's sales outlets in Japan

Faced with a sluggish electrification transformation in Japan's domestic market, international brands such as BYD, Tesla, and Hyundai are accelerating their penetration. However, Japanese brands still dominate the domestic market. "A significant increase in the penetration rate of electric vehicles in Japan will depend on the launch of electric vehicles by Japanese brands," said Liu Xueliang, General Manager of BYD Asia Pacific Automobile Sales Division, in an interview with The Paper and other media outlets.

Electric vehicles finally took center stage at the auto show, with domestic giants like Toyota accelerating their electrification process.

It's clear from the new cars at the Japan Mobility Show that Japanese automakers have moved beyond their half-hearted attitude towards electrification—pure electric vehicles have taken center stage at multiple booths.

Toyota, the world's largest automaker, unveiled the Corolla concept car at a media briefing during Japan's Mobility Show and expressed its intention to launch a pure electric version. This is interpreted by the industry as a landmark move by Japanese automakers toward electrification.

Toyota Corolla New Concept Car

Launched in 1966, the Corolla is a representative model of Toyota and the Japanese automotive industry, with annual sales consistently exceeding one million units. Currently, its cumulative global sales have long surpassed 50 million units, making it the best-selling model in history.

At the booth of another Japanese giant, Honda, the determination to launch its pure electric product line was also evident: the global debut of the "Honda 0 α" is a new SUV prototype of Honda's 0 series, which was displayed on the booth together with the "Honda 0 SALOON" and "Honda 0 SUV" prototypes.

In addition, Honda also globally debuted a small all-electric prototype, the Super-ONE Prototype. This model is reportedly planned for release in Japan in 2026.

Honda 0 Series Prototype

Suzuki unveiled the prototype "Vision e-Sky," a lightweight EV that it aims to mass-produce by fiscal year 2026. The company also stated that the adoption of electric vehicles in Japan will accelerate.

In addition, Lexus brought the world premiere of its LS six-wheel electric MPV concept car; Mercedes-AMG's all-electric high-performance concept car also made its Asian debut; Nissan, Hyundai and others also exhibited all-electric models or concept cars.

Among Chinese automakers, in addition to BYD, which has fully entered the Japanese market, Jike's 009 model also made its first public appearance in Japan through a dealer, attempting to enter the Japanese pure electric vehicle market.

The gradual rise of electric vehicles in the Japanese automotive market will not only benefit Chinese electric vehicle brands that intend to go global, but will also further enhance the international influence of China's automotive industry, especially the industrial chain represented by power batteries.

From raw materials to battery cells, the entire automotive battery supply chain is highly dependent on China. A survey by the Yano Research Institute in Japan shows that China holds over 90% market share in all four major materials, including cathode and anode materials. Nikkei commented, "While more and more countries around the world are vying to attract battery manufacturers to their countries, it is extremely difficult for the supply chain to break free from China."

It is worth mentioning that Nikkei analysis suggests that the key to the widespread adoption of electric vehicles in Japan is price, and the Japanese electric vehicle market has already seen a wave of price reductions.

On October 8, Nissan announced that the facelifted LEAF, its main electric vehicle, will start at approximately 5.19 million yen in Japan, a reduction of about 60,000 yen compared to the previous model. BYD implemented a limited-time price reduction for all its models in Japan in September, while also adding features and lowering the price of its newly launched Seal model. Toyota also lowered the price of its mass-produced electric vehicle, the bZ4X, by 700,000 yen in October.

In an interview with Japanese media, Suzuki President Toshihiro Suzuki said, "Japanese consumers are lowering their barriers to purchasing Chinese products. I think (BYD) is a huge threat." While stating that he would not compete on price, he also said, "We will proceed with discussions while referring to other manufacturers."