GAC Group Visual China data map

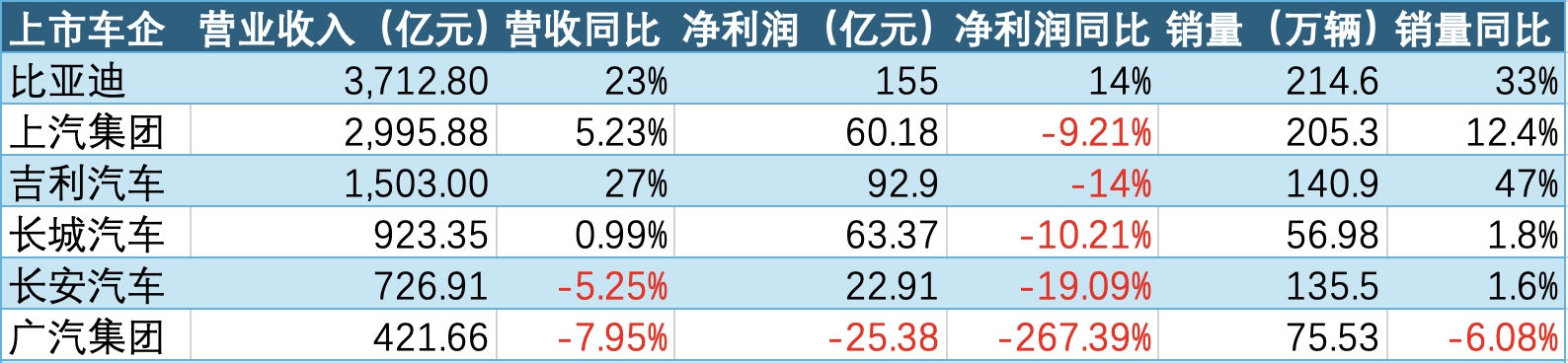

GAC Group's performance continues to be sluggish.

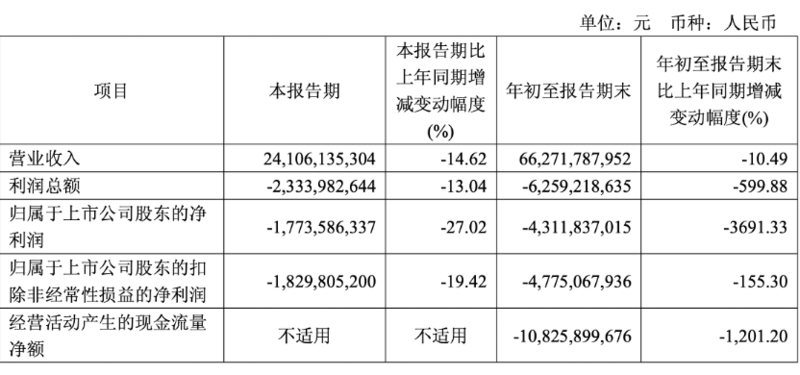

On October 24, Guangzhou Automobile Group Co., Ltd. (GAC Group, 601238) released its third-quarter report for 2025, showing that the company achieved operating income of 24.106 billion yuan in the third quarter of this year, a year-on-year decrease of 14.62%; net profit attributable to shareholders of listed companies was -1.774 billion yuan, a year-on-year decrease of 27.02%; basic earnings per share was -0.17 yuan.

Regarding the continued expansion of losses, GAC Group explained in the report that it was mainly due to the fierce competition in the domestic automobile industry and the rapid upgrading of the demand structure, which led to a decline in automobile sales and profits, and a year-on-year decrease in net profit.

In the first three quarters of this year, GAC Group's net profit attributable to shareholders of listed companies was -4.312 billion yuan, a year-on-year decline of 3691.33%. However, it should be noted that this significant increase in losses was not only due to declining vehicle sales, but also due to the valuation premium resulting from the listing of GAC's Ruqi Mobility on the Hong Kong Stock Exchange in the same period last year.

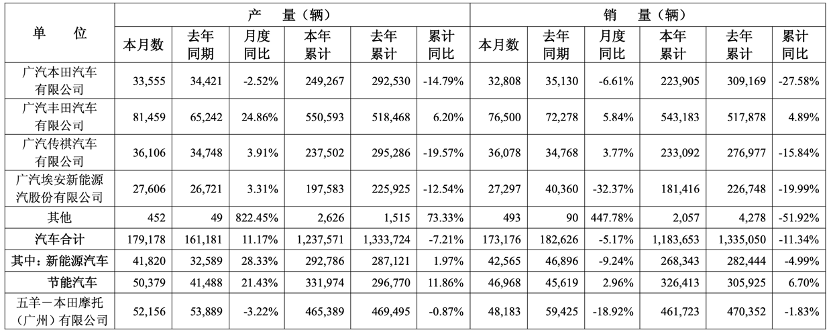

In recent years, GAC Group's car sales have been on a downward trend.

The production and sales report shows that GAC Group sold a total of 1.1837 million vehicles from January to September this year, a year-on-year decrease of 11.34%.

Specifically, among GAC's joint venture brands and independent brands, only GAC Toyota achieved growth in the first three quarters of this year, with an increase of 4.89%; GAC Honda declined by 27.58% year-on-year, GAC Trumpchi declined by 15.84% year-on-year, GAC Trumpchi declined by 19.99% year-on-year, and others declined by 51.92% year-on-year.

Exports are an important growth market. GAC Group is accelerating its international expansion and sees overseas markets as the key to breakthroughs.

Data shows that from January to September this year, GAC's overseas terminal sales increased by 36.5% year-on-year. Its business has covered 85 countries and regions, with more than 570 sales outlets, 5 overseas factories and 7 transit warehouses.

In key markets such as Europe, GAC entered the UK, Poland, Portugal, and Finland in the third quarter, and announced plans to deliver two global strategic models, the AION V and AION UT, in Europe in the first quarter of 2026. GAC plans to achieve full European market coverage by 2028 and advance the development of localized production and technology R&D centers.

In addition, GAC is actively expanding its "circle of friends".

The GAC-Huawei collaboration has made significant progress. In August of this year, the project began recruiting dealers nationwide, planning to establish a "1+N" (user-centered + experience-centered) channel strategy. In September, the two parties officially announced the launch of their jointly developed high-end smart electric vehicle brand, "Qijing," and appointed Liu Jiaming, a veteran of 25 years in the automotive industry, as CEO to accelerate the project's implementation. The design of the first model has been finalized, with a launch slated for mid-2026.

In October this year, GAC, JD.com and CATL jointly launched the "National Good Car" Aion UT super, which is defined based on user scenarios. It is the first to be equipped with the "GAC Huawei Cloud Car Machine" and is based on CATL's Chocolate Battery Swap technology. It is the first car in its class to be equipped with a large battery with a range of 500km and supports battery swapping in 99 seconds. It is planned to be launched during the "Double 11" event in 2025.

GAC said that this cross-border cooperation will jointly innovate the automobile consumption model by integrating GAC's intelligent manufacturing, safety and R&D advantages, JD.com's supply chain and digital ecological resources, and CATL's power battery and battery swap ecological technology, and is expected to allow users to achieve a one-stop car-buying experience where "buying a car is as convenient as buying a mobile phone."

At the close of the market on the 24th, GAC Group fell 0.38% to close at 7.81 yuan per share, with a total market value of 66.5 billion yuan.