Inventory management has long been a thorny issue for car dealers.

In today's fiercely competitive market, where traditional sales models are under pressure, this issue has become an increasingly unavoidable challenge for dealers. Some are resorting to aggressive price cuts and promotions to maintain a healthy capital chain; some are choosing to shift channels, such as operating asset-light operations; some are trying their luck with other brands; and some, unable to withstand the pressure, are forced to withdraw from the market and cease operations.

We've witnessed the struggles of auto dealers like Zhongsheng Group, Yongda Auto, and Guanghui Auto due to inventory pressures. This situation has not only failed to be effectively resolved in recent years, but has actually worsened in both scale and severity.

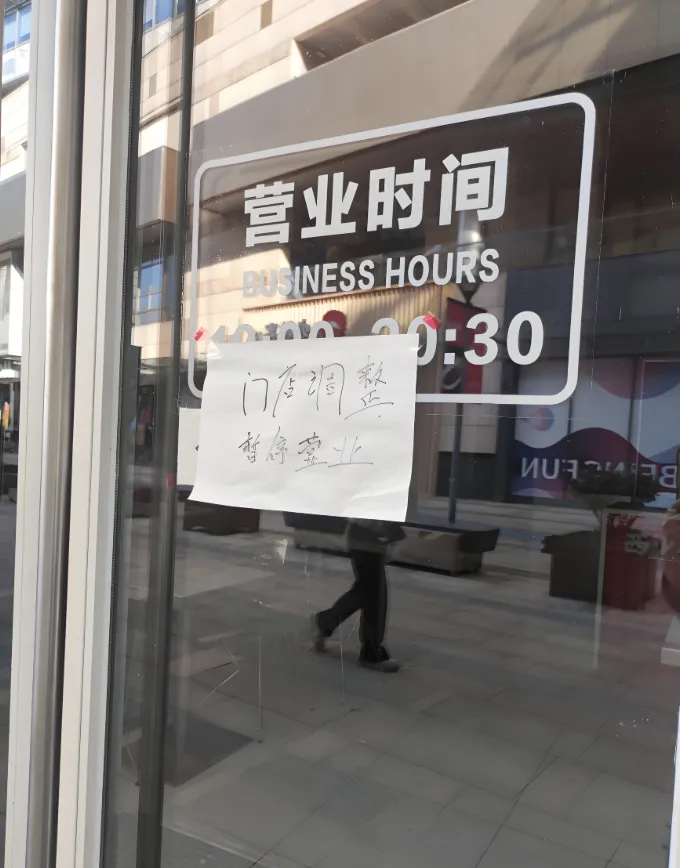

Data shows that by 2024, over 4,400 4S stores nationwide will have withdrawn from the market, equivalent to 12 stores disappearing every day. Over 50% of the industry is experiencing losses, and the scale of 4S stores has experienced negative growth for the first time since 2021. By the first half of this year, over 1,200 4S stores were on the verge of bankruptcy, with only 27.5% achieving their sales targets, and over 70% of dealers struggling to meet targets.

This year, according to the China Automobile Dealers Association's auto dealer inventory survey, the comprehensive inventory coefficient for auto dealers was 1.35 in September, up 3% month-over-month and slightly up year-over-year. While this value remains below the 1.5 threshold, total inventory nationwide has reached 3.04 million vehicles, an increase of approximately 100,000 vehicles from August.

What is more alarming is that the inventory warning index has been above the boom-bust line for many consecutive months, recording 54.5% in September, reflecting that more than half of the dealers are facing the dilemma of new car sales falling short of expectations, as well as the pressure that the automobile distribution industry is under.

Dealers under pressure, contradictory car market

"In order to clear our inventory, we offered discounts of up to 80,000 yuan per bike, but customer traffic still declined significantly."

When Auto Commune visited a 4S store of a German joint venture brand in Pudong, Shanghai, the general manager of the store said this. He said, "Even though the price reduction is large, the inventory cycle in the store has been extended from 45 days last year to 68 days." At the same time, he admitted that the squeeze from new energy brands and consumers' wait-and-see attitude have greatly weakened the premium ability of traditional joint venture brands.

In another investigation, Auto Commune visited a domestic brand 4S dealership in Wuhan. A sales representative stated that despite facilitating over 40 sales through the auto show in September, inventory remained dire. "Fuel vehicles are sluggish, and new energy vehicles are facing pressure to upgrade. Some older models can only be sold at cost, resulting in no profit."

It's worth noting that the feedback from the two surveys mentioned above fully aligns with the month-over-month increase in inventory coefficients for joint venture and domestic brands in September, reaching 1.38 and 1.3, respectively. However, the inventory coefficient for high-end luxury and imported brands decreased to 1.42.

This differentiation reflects that in the current market environment, different brands face different supply and demand relationships and sales pressures.

Furthermore, regional market observations reveal varying inventory warning indices across China. The southern region has the highest index, reaching 61.9%, while the northern and eastern regions are above the national average. The western region is the only region to fall below the boom-bust line, at 49.3%.

During a recent visit to the third-tier city of Xinyang, a sales representative at a showroom revealed that the inventory warning index for September was approaching 70%. "The purchase tax exemption for fuel vehicles is about to expire, but consumers are becoming even more hesitant," she explained. Some models, which have been in inventory for over six months, are tying up over 10 million yuan in capital, while manufacturers are continuing to stockpile inventory as planned, leading to a near-break in cash flow.

The significant disparities between regions also suggest that dealer inventory pressures have regional characteristics. Of course, amidst the pessimistic overall environment, there is also a "survivor bias."

Previously, Auto Commune investigated a Japanese brand 4S dealership in Jiujiang. Thanks to lower competition in the western district, the dealership maintained an inventory coefficient of around 1.1. Despite this, sales representatives remained concerned: "Price wars in surrounding cities have spread to our region. Without increased promotions in October, inventory pressure will remain."

Meanwhile, a survey by the China Automobile Dealers Association showed that more than half of dealers reported that new car sales in September fell short of their expectations. This data is undoubtedly unsatisfactory, as it occurred during the traditional "Golden September" peak season.

We all know that the slight increase in the inventory coefficient is related to dealers actively replenishing inventory to cope with the "Golden September and Silver October" sales season, but the performance on the sales side has not fully matched the increase in inventory, resulting in inventory pressure still existing.

On the one hand, dealers' inventories are under pressure, but the total inventory remains at around 3.04 million vehicles, an increase from August; on the other hand, terminal sales are rising driven by multiple favorable factors. It is estimated that terminal sales of passenger cars in that month will reach 2.25 million vehicles, showing an upward trend compared with the data in August and the first half of the year, making the Chinese auto market in September quite contradictory.

Challenges under market changes

Behind the inventory pressure on dealers are deep-seated changes and challenges in the automotive market.

First, sluggish customer traffic growth has become a widespread phenomenon. Surveys show that declining organic in-store traffic and low online lead conversion rates are both challenges facing dealers. This is partly due to intensified market competition and brand differentiation, but also reflects changing consumer purchasing habits—more and more consumers are turning to online channels, but the efficiency of converting online leads is difficult to guarantee.

Secondly, profit pressures caused by price competition persist. Against the backdrop of slowing market demand, major brands are increasing promotional efforts to maintain market share. This forces dealers to engage in price wars, even at a loss, to meet manufacturer-set sales targets or face greater penalties.

Furthermore, the supply and demand dynamics in the automotive market have undergone fundamental changes. With the rapid adoption of new energy vehicles, traditional fuel-powered vehicles are facing increasing market pressure. Consumers' wait-and-see attitude during the transition period has further exacerbated the difficulty of clearing inventory. Furthermore, the disconnect between OEM production plans and end-market demand is also a significant factor contributing to high dealer inventories.

The direct impact of high inventory on dealers is tight capital chain.

As high-priced commodities, automobile inventory ties up a significant amount of capital. Assuming an average price of 150,000 yuan per vehicle, the 3.04 million vehicles in inventory represent a whopping 456 billion yuan in capital tied up. Much of this capital comes from financing channels such as bank loans, and the continued interest payments continue to erode dealers' already slim profits.

What is more serious is that in order to recover funds as quickly as possible, dealers have to increase their promotional efforts, falling into a vicious cycle of "price reduction - loss - further price reduction".

Currently, price inversion has become a common phenomenon in the industry, where the sales price is lower than the purchase cost. In this situation, the more they sell, the greater the loss, but in order to obtain subsequent benefits such as after-sales service, financial insurance, etc., dealers have to continue selling.

To make matters worse, inventory pressures have also strained the relationship between dealers and OEMs. To meet sales targets, OEMs often pass inventory pressures on to dealers, while dealers struggle to absorb excess inventory. This tension is particularly acute during market downturns, even leading some dealers to withdraw or switch brands.

However, from an industry perspective, ongoing inventory pressures are also accelerating a reshuffle in the auto distribution sector. Specifically, small and medium-sized dealers with weaker risk tolerance face elimination, while large dealer groups continue to expand by leveraging their scale advantages and financial strength, leading to a gradual increase in industry concentration.

Opportunities and transformation

Faced with increasingly serious inventory problems, dealers need to seek breakthroughs.

First and foremost, sound inventory planning is fundamental. The China Automobile Dealers Association recommends that dealers rationally estimate actual market demand and manage inventory levels appropriately based on actual conditions. This means dealers need to abandon their past practice of blindly pursuing sales volume and instead focus on operational quality and profitability.

For example, we can accurately forecast demand based on historical sales data, market trends, seasonal factors, and formulate reasonable inventory plans. At the same time, we can strengthen communication with OEMs to strive for more reasonable sales targets and more flexible inventory adjustment mechanisms.

In addition, dealers should shift their focus from a sales-driven to a service-driven approach. Given the slim profit margins on new car sales, dealers should prioritize after-sales service and derivative businesses.

Data shows that in mature auto markets, after-sales service typically contributes over 50% of a dealer's total profits. By improving service quality and expanding their service scope, dealers can reduce their reliance on profits from new car sales and enhance their resilience to risks.

At the same time, leverage policy dividends to mitigate risks. Currently, the fourth round of national trade-in subsidies will be distributed in October. Combined with the vehicle purchase tax exemption policy expiring at the end of the year, this is expected to stimulate the market. Dealers should increase publicity for trade-in and scrappage replacement policies and boost consumer confidence by strengthening services.

Despite current inventory pressures on dealers, the industry as a whole remains cautiously optimistic about the fourth quarter market outlook. A survey shows that 44.4% of dealers are optimistic about fourth-quarter sales growth, predicting a 5% to 10% year-on-year increase.

In the short term, supported by the traditional "Golden September and Silver October" peak season and local subsidy policies, coupled with the National Day holiday's customer attraction and year-end sales promotions, market sales are expected to see a modest recovery. However, in the long term, the challenges facing auto dealers will not disappear anytime soon. This is because increasing market saturation, the popularity of new energy vehicles, and the emergence of direct sales models are constantly reshaping the automotive distribution landscape.

In this new environment, traditional dealers must proactively seek change to survive and thrive. This includes exploring new business models. For example, derivative businesses like used cars, auto finance, and insurance still have room for development and could become new growth points for dealers.

It's foreseeable that as the auto market continues to evolve, the roles and functions of dealers will also undergo transformation. Inventory pressure is only one manifestation of this transformation, underlying which lies the restructuring and reinvention of the entire auto distribution sector. Therefore, dealers must confront challenges head-on and proactively transform to seize new development opportunities amidst this market reshuffle.