As market competition intensifies, the performance differentiation among listed automakers has widened.

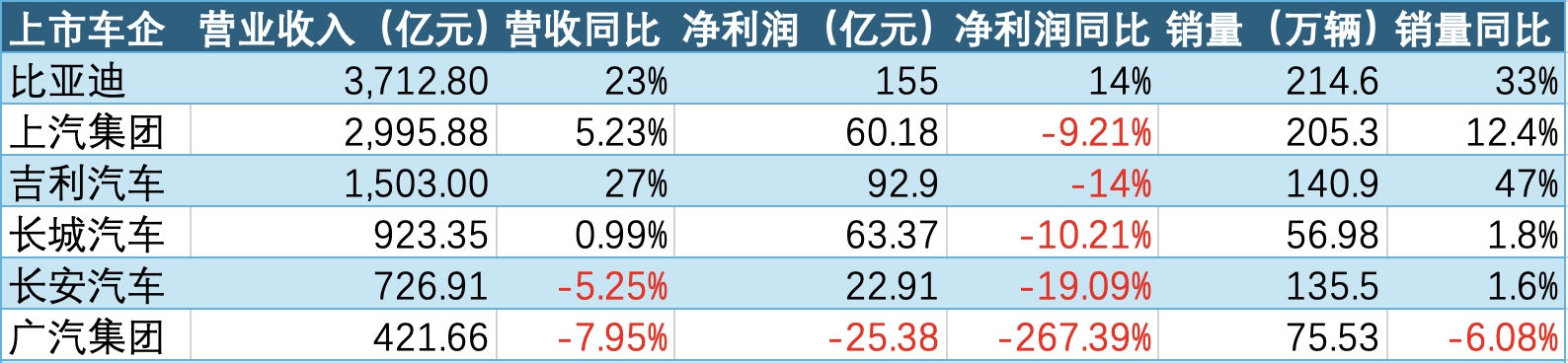

The performance of listed car companies in the first half of 2025 has been announced. BYD (002594.SZ; 01211.HK) still has a huge leading advantage, ranking first in both revenue and net profit; GAC Group (601238.SH) is at the bottom in all data and has turned from profit to loss.

While the market continues to grow, the money earned by automakers has not increased significantly: in terms of revenue, many automakers have achieved growth, among which BYD and Geely (0175.HK) have both achieved record high revenue; but in terms of net profit, only BYD has maintained its growth momentum, but its automobile gross profit margin has also fallen by two percentage points.

BYD ranked first in both revenue and net profit, while several automakers achieved revenue growth

The financial report shows that BYD achieved revenue of 371.28 billion yuan in the first half of the year, a year-on-year increase of 23.3%; net profit attributable to shareholders of listed companies was 15.51 billion yuan, a year-on-year increase of 13.79%.

As sales hit bottom and rebounded, SAIC Motor (600104.SH)'s performance rebounded, with consolidated operating revenue reaching 299.588 billion yuan in the first half of the year, a year-on-year increase of 5.23%; and net profit attributable to shareholders of the parent company reaching 6.018 billion yuan, a year-on-year decrease of 9.21%.

Thanks to the significant increase in sales, Geely Auto recorded the highest revenue growth among the six automakers: total revenue in the first half of 2025 reached 150.3 billion yuan, a year-on-year increase of 27%, setting a historical high; net profit attributable to shareholders was 9.29 billion yuan, a year-on-year decrease of 14%.

The semi-annual report disclosed by Great Wall Motor (601633.SH) shows that in the first half of 2025, the company achieved operating income of 92.335 billion yuan, a slight increase of 0.99% year-on-year; the net profit attributable to shareholders of listed companies was 6.337 billion yuan, a year-on-year decrease of 10.21%.

Both Changan and GAC saw revenue decline.

Newly-established state-owned enterprise Changan Automobile (000625.SZ) announced that its operating revenue in the first half of 2025 was 72.691 billion yuan, a year-on-year decrease of 5.25%; its net profit attributable to shareholders of the listed company was 2.291 billion yuan, a year-on-year decrease of 19.09%.

All the data of GAC Group are at the bottom: in the first half of 2025, the operating income was 42.166 billion yuan, a year-on-year decrease of 7.95%; the net loss attributable to shareholders of listed companies was 2.538 billion yuan, and the net profit in the same period last year was 1.516 billion yuan, turning from profit to loss year-on-year, with a drop of 267.39%.

Competition intensified, and gross profit margins generally declined

Several automakers noted in their financial reports that while vicious price wars have been curbed, industry competition continued to intensify in the first half of the year. BYD also noted in its financial report that competition in the Chinese market is becoming increasingly fierce.

In the first half of this year, the auto market saw a relatively subtle price war, often taking the form of price cuts and increased features on new models. This, in turn, had a significant impact on automakers' gross profit margins. Overall, listed automakers' gross profit margins were significantly better than the industry average, but most experienced a decline. BYD was no exception.

In the first half of the year, BYD achieved revenue of 371.28 billion yuan and operating costs of 304.415 billion yuan. Based on this calculation, BYD's main business gross profit margin was 18.01%, a slight decline from 18.78% last year.

According to the financial report, BYD's automotive business gross profit margin was 20.35%, a year-on-year decrease of 1.99 percentage points.

However, it should be pointed out that the financial report stated that the statistical scope of the company's main business data was adjusted during the reporting period. After the adjustment, its automobile gross profit margin was as high as 22.34%, an increase of 1.67% year-on-year.

The reason for the change in scope is: according to "Interpretation No. 18 of Enterprise Accounting Standards", the quality assurance of the guarantee type originally listed in "sales expenses" will be changed to be listed in "operating costs", and the comparative data of the financial statements will be adjusted accordingly.

BYD is facing significant pressure in its domestic market. Its financial report shows that BYD's gross profit margin overseas increased by 2.59 percentage points year-on-year, or 9.13 percentage points after adjustment. Meanwhile, its gross profit margin in China fell by 2.47 percentage points to 16.97%, or 2.25 percentage points to 19.44% after adjustment.

A Soochow Securities research report suggests that intensified domestic competition and the increased costs of intelligent driving are key factors contributing to BYD's declining gross profit margin. Starting in the second quarter of this year, the proportion of BYD's intelligent driving models increased to nearly 80%, resulting in an increase in average vehicle costs of approximately 5,000 yuan. Furthermore, preferential discounts and dealer rebates also contributed to the decline in gross profit margin.

Great Wall Motor's gross profit margin in the first half of the year was 18.38%, a year-on-year decrease of 1.57 percentage points.

In the first half of the year, Geely Auto achieved operating revenue of 150.285 billion yuan, a year-on-year increase of 27%; the total gross profit reached 24.7 billion yuan, and the gross profit margin of the main business was calculated to be 16.4%.

Changan Automobile's gross profit margin increased from 13.87% in the same period last year to 14.58%.

SAIC and GAC's gross profit margins failed to reach above 10%.

SAIC Motor achieved revenue of 294.336 billion yuan in the first half of the year, with operating costs of 269.863 billion yuan. Based on this calculation, its gross profit margin was 8.3%, a slight decrease of 0.2 percentage points year-on-year.

GAC Group, which turned to losses in the first half of the year, saw its gross profit margin plummet 7.06 percentage points to -3.1%. The gross profit margin for complete vehicles fell 8.08 percentage points to -7.03%. The gross profit margins of parts, finance, and other businesses remained positive, further demonstrating that GAC Group was under severe pressure in its new vehicle sales.

Product structure significantly affects performance, with overseas markets becoming a hot commodity.

For the six major automakers included in the statistics, their production and sales volume have all reached above scale. The factors that have the greatest impact on their performance are sales volume and product structure.

GAC Group and Great Wall Motors are the two companies that have performed the worst in the new energy transition, and their sales have also been significantly affected.

With the decline of Japanese cars in China, GAC Group's sales continued to decline, its new energy transformation stalled, and its independent brands showed no improvement, resulting in a "double decline in volume and profit", and the gap with leading automakers continued to widen.

Although Great Wall Motors is an independent brand, its transition to new energy is clearly lagging behind, and the competitiveness of its star products has declined.

The production and sales report shows that from January to June 2025, Great Wall Motors sold 569,800 vehicles, a year-on-year increase of 1.81%, far lower than the growth rate of the auto market during the same period. Of this total, 160,400 were new energy vehicles, with 197,700 sold overseas.

In terms of products, Great Wall Motor's flagship Tank brand sold 103,700 units, a year-on-year decrease of 10.67%, while the ORA brand sold 13,900 units, a year-on-year decrease of 56.19%.

The impact of product structure on profits is more significant in Geely.

In the first half of the year, Geely's revenue hit a record high, but its net profit fell by 14%. The decline was mainly due to its product structure problems: sales of low-priced models increased significantly in the first half of the year, and even took a considerable market share from BYD. However, high-gross-profit models such as Zeekr performed poorly and failed to contribute enough profits.

With the domestic market slowing, automakers are turning their attention to overseas markets. In their financial reports, each automaker highlights its overseas expansion strategy as a key focus. Data from the China Association of Automobile Manufacturers shows that from January to July 2025, my country exported 3.68 million vehicles, a year-on-year increase of 12.8%. BYD, SAIC, Changan, Geely, and Great Wall are among the top ten exporters. Overseas markets have become a major source of growth for Chinese automakers.