Dongfeng will push Lantu Auto to go public.

On the evening of August 22, Dongfeng Motor Group Co., Ltd. (Dongfeng Group Co., Ltd., 0489.HK) announced on the Hong Kong Stock Exchange that it will promote its subsidiary Lantu Motors to list on the Hong Kong stock market through an introduction. At the same time, Dongfeng Group Co., Ltd. itself will simultaneously complete its privatization and delisting.

The announcement stated that the company's overall performance did not meet expectations, and it plans to further integrate high-quality resources into emerging industries through distribution, mergers and listings to achieve valuation reconstruction.

Lantu Auto to list on the Hong Kong Stock Exchange via introduction: valuation around 40 billion yuan

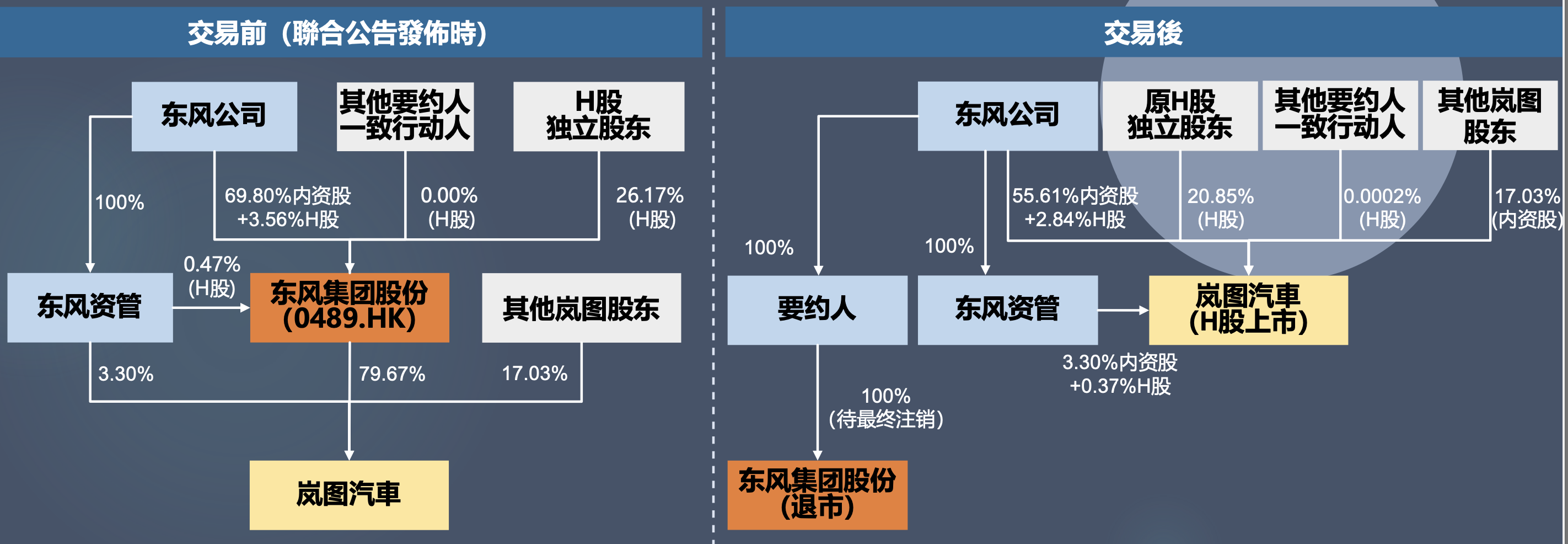

According to the announcement, this transaction adopts the "equity distribution + absorption merger" model, and the two major links are mutually premised and promoted simultaneously.

Dongfeng Motor Corporation (DGMC) will distribute its 79.67% stake in Lantu Motor to all shareholders, followed by Lantu's listing on the Hong Kong Stock Exchange via an introduction. Meanwhile, Dongfeng Motor Group (Wuhan) Investment Co., Ltd., a wholly-owned subsidiary of Dongfeng Motor Corporation (DGMC), will acquire all outstanding shares at a price of HK$10.85 per share, achieving 100% control of Dongfeng Motor Corporation (DGMC). The cash consideration is HK$6.68 per share, and the equity consideration is HK$4.17 per share.

"Listing by Introduction" is a special listing path that does not involve the issuance of new shares or the raising of funds. The core is that the company only lists its existing issued shares on the stock exchange to achieve "transition from a non-public status to a public trading status." Its essence is "listing and circulation" rather than "financing and listing," which is fundamentally different from an IPO that requires the issuance of new shares to raise funds.

Overview of the transaction plan, from Dongfeng Motor Corporation's investor presentation

Lantu Auto is a high-end new energy brand independently developed by Dongfeng, and is also known as the "second generation of entrepreneurs" in the automotive industry.

Dongfeng has long had plans to take Lantu public. As early as June 2021, Lantu Motors announced the establishment of an independent legal entity, launched an employee stock ownership plan, and explicitly pledged to "extensively utilize capital market platforms." Lantu Motors has since publicly discussed the possibility of an IPO. In 2023, Lantu Motors CFO Shen Jun stated that if monthly sales could reach around 10,000 vehicles, the company would be eligible for a listing.

On July 16th of this year, Dongfeng Motor Corporation (DGMC) announced that it and Dongfeng Asset Management Co., Ltd. had entered into a capital increase agreement with Lantu Motors and other shareholders. On August 11th, Dongfeng Motor Corporation (DGMC) announced a temporary trading halt, pending the release of an announcement containing internal information.

The announcement revealed that Dongfeng's capital increase in Lantu was completed on July 23, 2025, and Lantu's restructuring is expected to be completed around September 2025. Upon completion of the restructuring, Lantu will become a joint-stock company, of which Dongfeng Group will hold approximately 79.67%.

In addition, the announcement showed that Lantu's valuation ranged from 36.786 billion yuan to 41.884 billion yuan, with a median of 39.335 billion yuan.

Dongfeng's performance fell short of expectations, while Lantu's losses continued to narrow.

The announcement stated that the company's overall performance fell short of expectations due to factors such as the transformation of the automotive industry and intensified market competition. Dongfeng Motor Corporation plans to further consolidate its high-quality resources towards emerging industries through dividends, mergers, and listings, thereby restructuring its valuation.

The announcement stated that through the proposed transaction, Dongfeng Motor Corporation will focus on developing the new energy vehicle industry and promote the transformation and upgrading of fuel vehicles to new energy vehicles.

"Before the merger was completed, due to multiple factors such as intensified industry competition, the price of our company's H shares was undervalued for a long time and basically lost its financing function as Dongfeng Motor Corporation's H-share listing platform," Dongfeng Group Co., Ltd. emphasized.

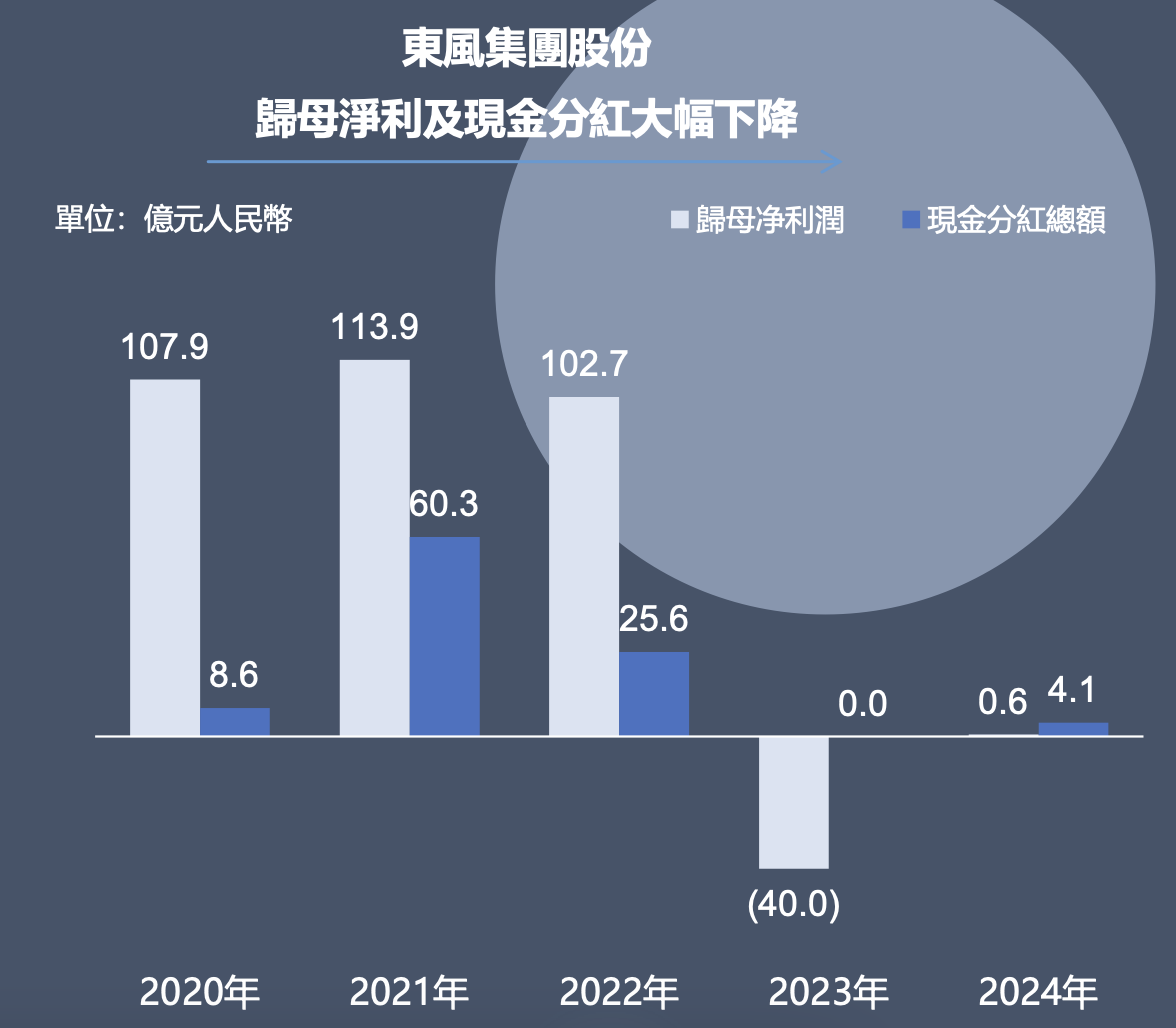

In terms of performance, Dongfeng Group shares have been in a long-term slump.

On the evening of the 22nd, the semi-annual report released by Dongfeng Motor Corporation showed that the group achieved sales revenue of 54.533 billion yuan in the first half of the year, a year-on-year increase of 6.6%; the gross profit margin reached 13.9%, an increase of 2.3 percentage points year-on-year; the net profit attributable to shareholders of listed companies was 55 million yuan, a year-on-year plunge of 91.96%.

In terms of sales, the company sold approximately 823,900 vehicles in the first half of the year, a year-on-year decrease of 14.7%. Sales of new energy vehicles reached 204,400 units, a year-on-year increase of 33%. Joint venture brands continued to decline, with sales of Dongfeng Nissan and Dongfeng Honda falling by 23.5% and 37.4%, respectively.

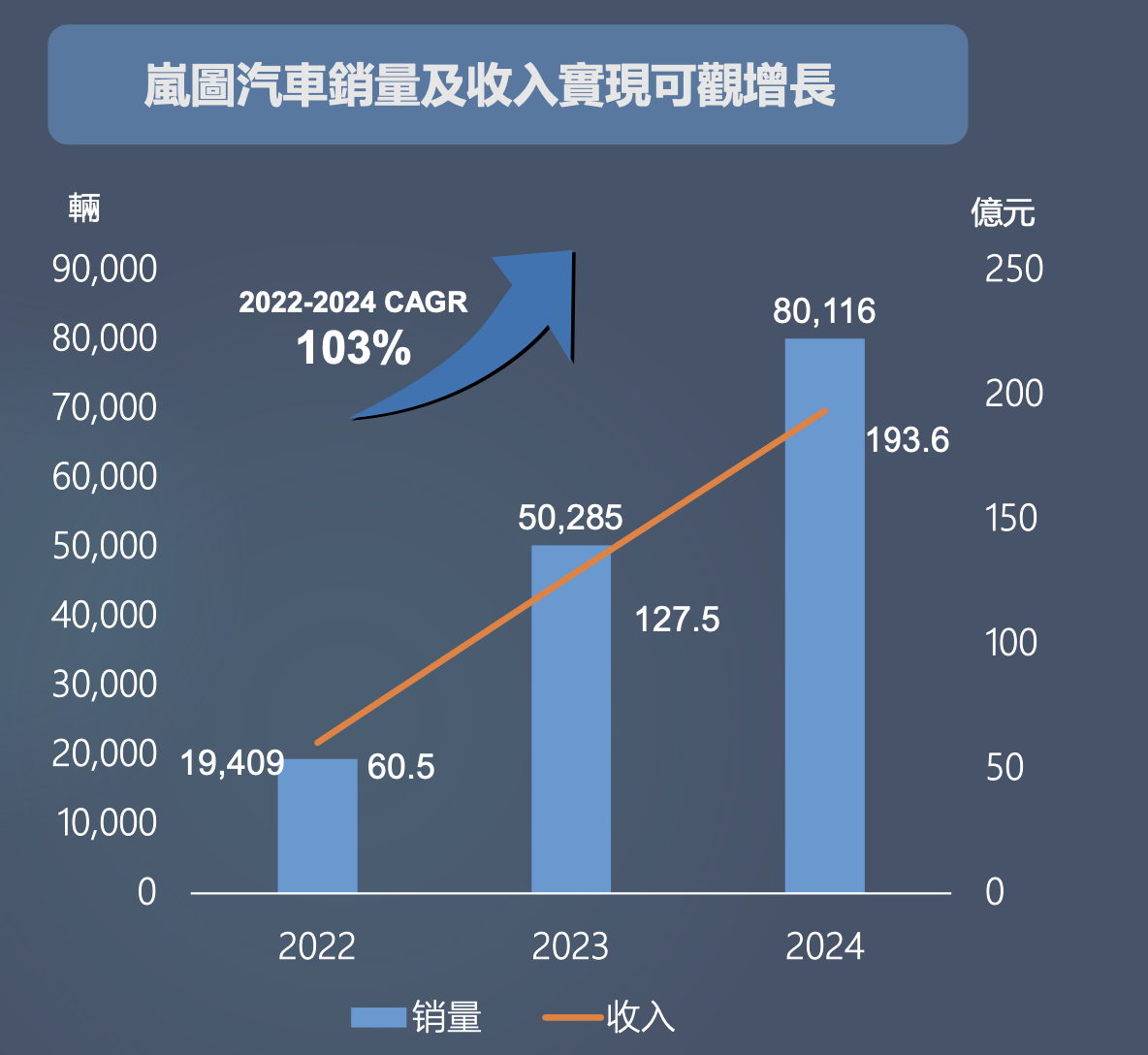

Lantu has seen some improvement in recent years, with monthly sales finally breaking the 10,000 mark. In the first half of this year, Lantu Auto sold 56,100 vehicles, a year-on-year increase of 84.8%. However, it still only achieved 28% of its annual sales target, and achieving the sales target remains a significant challenge.

Regarding its performance, the announcement showed that Lantu achieved revenue of 6.052 billion yuan, 12.749 billion yuan, and 19.361 billion yuan from 2022 to 2024, respectively; the corresponding annual losses were 1.538 billion yuan, 1.496 billion yuan, and 90 million yuan, respectively.