At 24:00 today (July 15), a new round of price adjustment for domestic refined oil will open. Institutions generally predict that domestic refined oil prices may be reduced for the sixth time this year.

During this pricing cycle, international crude oil prices rebounded within a narrow range, recovering part of the losses in the previous round.

Wang Luqing, a refined oil analyst at Zhuochuang Information, said that since this round of pricing cycle, international crude oil prices have fluctuated, and the average crude oil has declined month-on-month. Affected by this, the domestic reference crude oil change rate fluctuated negatively. As of the close of July 11, the 9th working day in China, the reference crude oil change rate was -2.90%, and gasoline and diesel were expected to drop by 125 yuan/ton. This reduction in the retail price limit of refined oil is a high probability event. According to the current range, it is expected that a full tank of 50L of 92 gasoline will save about 5 yuan.

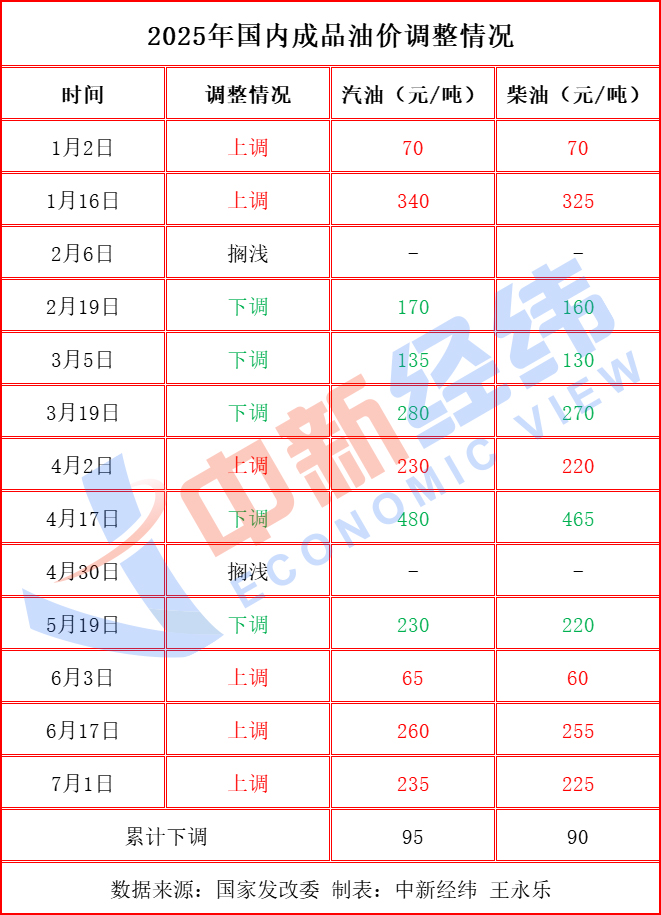

Since the beginning of this year, domestic refined oil prices have undergone 13 rounds of adjustments, showing a pattern of "six increases, five decreases and two stagnations". After the increases and decreases offset each other, the domestic gasoline and diesel prices have dropped by 95 yuan and 90 yuan per ton respectively compared with the end of last year. If the current round of oil price reduction, it will end the trend of three consecutive rounds of increases, and the price adjustment situation in 2025 will become "six increases, six decreases and two stagnations".

According to the "ten working days" principle, the next round of retail price adjustment window for refined oil will open at 24:00 on July 29, 2025.

Looking ahead to the future market, Liu Ting, a refined oil analyst at Longzhong Information, said that from the supply side, although OPEC+ will most likely maintain a significant production increase in August and September, the United States may take new sanctions against Russia, and potential supply risks may still increase.

From the demand side, the current summer travel peak in the United States is still progressing. The traditional peak season boosts fuel demand, and the seasonal demand trend continues. In addition, market concerns about US tariff negotiations have also eased.

Liu Ting concluded that the traditional peak season for fuel consumption in the United States is still here, supply-side risks have not been eliminated, and there is some support from the fundamentals. It is expected that the next round of refined oil price adjustment will be more likely to increase.

Gao Mingyu, chief energy analyst at SDIC Futures, believes that the impact of OPEC+'s rapid production increase on oil prices in the third quarter is temporarily limited. On the one hand, the actual production of some oil-producing countries has far exceeded the target production, and there are also constraints on the production reduction compensation plan. The actual monthly production increase of OPEC+ is less than the increase in the production target; on the other hand, the third quarter is the seasonal peak season for gasoline and jet fuel demand, and this round of production increase can still be well taken up by the demand side in the summer. After the peak season in the third quarter, if the US "reciprocal tariff" policy continues, the return of OPEC+ production will have a more direct negative pressure on the fundamentals. Under the scenario where the geopolitical situation in the Middle East remains controllable, the center of gravity of oil prices will face the possibility of further downward movement.