As Chinese automakers have taken advantage of the technological revolution to catch up, they are increasingly being benchmarked, disassembled, and analyzed by the global automotive industry. But so far, even if professional consulting companies have figured out how Chinese automakers have achieved success, their automakers have found it difficult to "replicate" this success in a short period of time.

Recently, Reuters published a report titled "How China's New Auto Giants Leave GM, Volkswagen and Tesla Behind", which pointed out that Chinese automakers such as BYD and Chery have reshaped the global competitive landscape with unprecedented agility. They have found ways to shorten the development time of new cars to less than half of that of foreign competitors, which has fueled their explosive growth.

For example, in October 2023, Chinese automaker Chery ordered engineers and parts suppliers to rush to a test site in Zhaoyuan, Shandong. They planned to use the weekend to completely reshape the suspension and steering systems for the Chinese version of the Chery Omoda 5 SUV for Europe, a key market for its global expansion. The reason is that the car was originally designed for China's flat, slow-moving streets, but now it must adapt to Europe's winding and rugged roads with higher average speeds.

Just six weeks later, Chery began delivering European-spec Omnda 5s, which were equipped with new steering systems, traction control systems, brakes, shock absorbers and tires. "You wouldn't think a European carmaker could do something like this so quickly," said Riccardo Tonelli, a senior vehicle dynamics expert at Chery who led the transformation. "It's simply impossible," added the expert, who has worked for Italian carmakers and Korean tire makers. He estimated that it would take more than a year for Western manufacturers to push similar improvements through their relatively bureaucratic organizations.

To some extent, it is not only fighting against the rugged roads in Europe, but also racing against the stringent regulatory system. The EU's mandatory two-stage pedestrian protection device, the 56-kilometer offset collision standard, and the upcoming intelligent speed limit system (ISA) constitute a series of technical barriers that traditional car companies need years to cross. But Chinese engineers took only six weeks. Instead of becoming a shackle, the harsh regulatory environment has been transformed into a melting pot for forging core competitiveness.

A formidable rival for overseas car companies

Chery’s transformation of the Omenta exemplifies the revolutionary speed and agility that Chinese automakers have shown in wresting control of the world’s largest home market from once-dominant foreign rivals. Now, as those rising Chinese auto giants race to expand globally, Chery is a leading exporter.

Industry executives say China's largest automaker, electric vehicle giant BYD, poses a greater long-term competitive threat.

China’s newfound dominance in the auto industry is largely due to a unique manufacturing feat: cutting vehicle development time by more than half, to just 18 months for a new or redesigned model. Consulting firm AlixPartners found that the average “age” of an electric or plug-in hybrid model sold domestically by Chinese brands is 1.6 years, compared with 5.4 years for foreign brands. The pace has shocked traditional automakers, which update passenger car models roughly every five years and pickup trucks every 10 years.

The United States and Europe have imposed tariffs to protect their auto industries, claiming that China has unfairly subsidized electric vehicles. However, the auto industry has gradually realized that the rapid development of Chinese automakers is not a so-called "low-price offensive", but a huge advantage in cost and technology over global competitors. Industry executives and experts say that shortening the vehicle development cycle by several years saves capital, reduces prices, and ensures that Chinese companies have the latest models during the technological revolution.

At BYD, the urgency of getting work done is baked into its structure to speed up design and production. Taking advantage of China’s lower labor costs, BYD employs about 900,000 people, nearly as many as Toyota and Volkswagen combined. At its headquarters, BYD encourages a work-centered lifestyle with company-subsidized housing, transportation and schools.

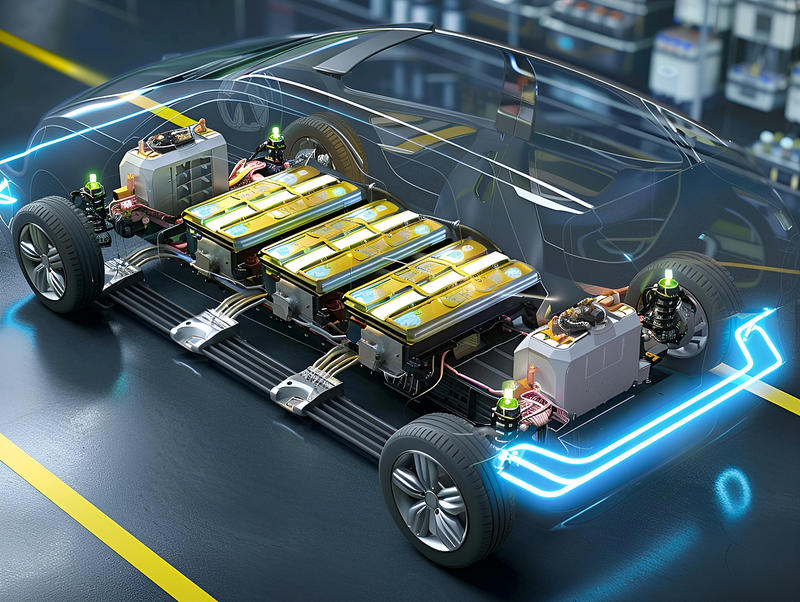

Unlike most automakers, BYD makes most of its own components rather than relying on suppliers, another key factor in its ability to speed up development and reduce costs.

Peter Matkin, chief engineer for Chery's international brands, said Chinese automakers' employees often work 12 hours a day, six days a week. "Foreign automakers have no idea what they are up against," he said.

Market share increases and decreases

BYD and Chery's global sales rose about 40% in 2024, while U.S. electric vehicle pioneer Tesla suffered its first annual sales decline, largely due to its aging model lineup. Tesla's sales have continued to decline this year as Chief Executive Elon Musk alienated many customers with his right-wing political activities. Musk said last year that Chinese automakers could "destroy" competitors.

The growth of Chinese automakers has come at the expense of global competitors. Data provided by consulting firm Automobility shows that between 2020 and 2024, the combined annual sales of passenger cars in China by the five largest foreign automakers in China - Volkswagen, Toyota, Honda, General Motors and Nissan - will fall from 9.4 million to 6.4 million. The combined sales of the current five largest automakers in China - BYD, SAIC, Geely, FAW and Changan - have more than doubled from 4.6 million in 2020 to 9.5 million last year.

Volkswagen, China's leading foreign automaker, is working with Xpeng Motors, China's fast-growing electric car maker, to develop vehicles. Other global automakers, including Toyota and Stellantis, have sought similar partnerships with Chinese counterparts to learn how they operate.

CEOs and other executives of global automakers, including Ford, Volkswagen, Stellantis, General Motors, Renault and others, have publicly acknowledged the fierce competitive threat posed by Chinese rivals and often mention their speed of development.

At the Shanghai Auto Show in April, Ralf Brandstetter, head of Volkswagen China, praised employees' efforts to speed up model development to compete with Chinese electric vehicles, saying the goal was to be "as fast and as competitive as Chinese startups."

From imitation to innovation

A huge shift is underway. About a decade ago, Chinese automakers often copied foreign rivals, with Chery making cars that looked like Chevrolet and BYD copying Toyota. The Chinese auto industry then began to pore over competitors’ engineering processes and devise its own unique and faster path to market, said Han Zhiyu, a professor of automotive studies at Tongji University in Shanghai who previously worked at Ford and two Chinese automakers. Chinese engineers essentially concluded that the global industry-standard verification process was “a waste of excessive quality pursuits,” Han said.

Industry executives and experts say Chinese automakers are rapidly bringing “good-enough” models to market, using far fewer prototypes than traditionally done and adopting a philosophy of rapid iteration that mirrors the approach of Silicon Valley tech startups.

They rely more on simulation and artificial intelligence than on-site safety and durability testing, view the launch of a model as the “starting point” rather than the “end point” of development, and make frequent updates based on customer feedback.

Fierce competition and price wars

The sense of urgency stems in part from a fiercely competitive environment in which far more carmakers fail than succeed: 93 of the 169 carmakers operating in China have a market share of less than 0.1%, according to research firm JATO Dynamics.

Few are profitable, and overcapacity is exacerbating the situation. China's auto assembly lines can produce 54 million vehicles a year, almost double last year's 27.5 million, according to Gasgoo Automotive Research Institute. The oversupply has forced automakers to cut prices.

“The survivors will be extremely powerful,” said Gu Hongdi, president of Xpeng Motors. “But it will be a very cruel and competitive process.”

China's electric car price war reached a fever pitch in May after BYD announced price cuts for 20 models. Wei Jianjun, chairman of Great Wall Motors, called the current state of the industry "unhealthy," specifically mentioning the increasingly popular practice in China of dumping excess new cars at a steep discount as "used cars" with zero kilometers on the road. He also pointed out, "What kind of industrial product can be reduced by 100,000 yuan in one fell swoop and still guarantee quality?"

To make up for the losses, Chinese automakers are racing to expand exports, selling to overseas markets the production capacity that can’t be absorbed at home. In many countries, the prices of their vehicles are already on par with those of other automakers, about double the retail price in China.

“Traditional automakers can’t compete on price because the Chinese will always win,” said Phil Dunn, managing director of Stax, a consultancy that has worked with global and Chinese automakers. But in markets such as Europe, well-established global automakers “still understand local customers better, they’re investing heavily in new models and their products are constantly improving.”