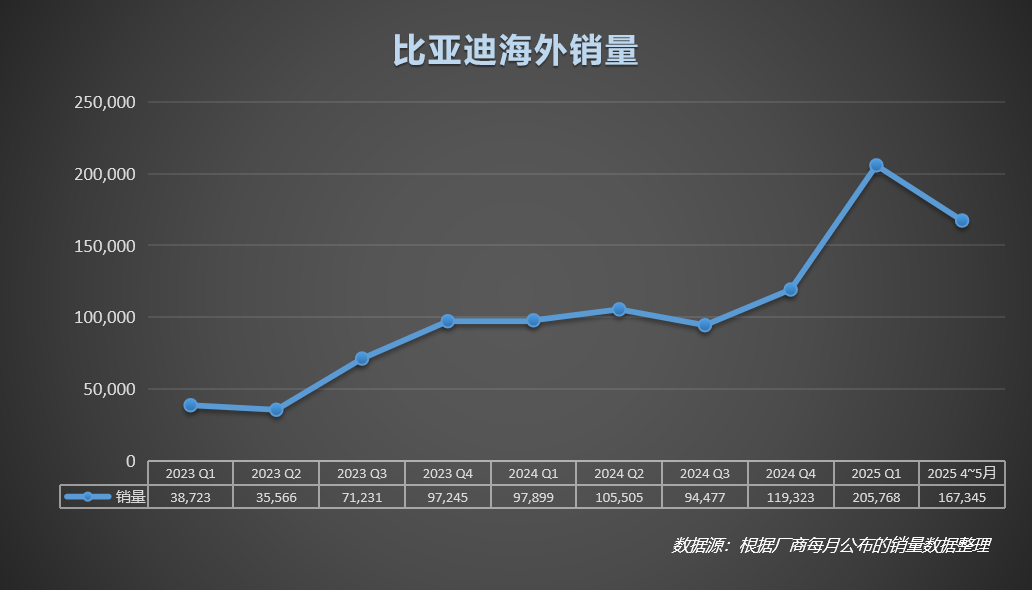

BYD has become a global phenomenon. In China, BYD has achieved scale effect through vertical integration, suppressed joint venture cars, and carried the banner of the Chinese auto market. Abroad, especially in Europe, BYD has made new breakthroughs. According to data from the authoritative organization JATO, in April 2025, BYD's pure electric vehicle registrations in the European market exceeded Tesla for the first time. This move has attracted heated attention, and foreign media commented that "this will become a watershed moment for the European auto market."

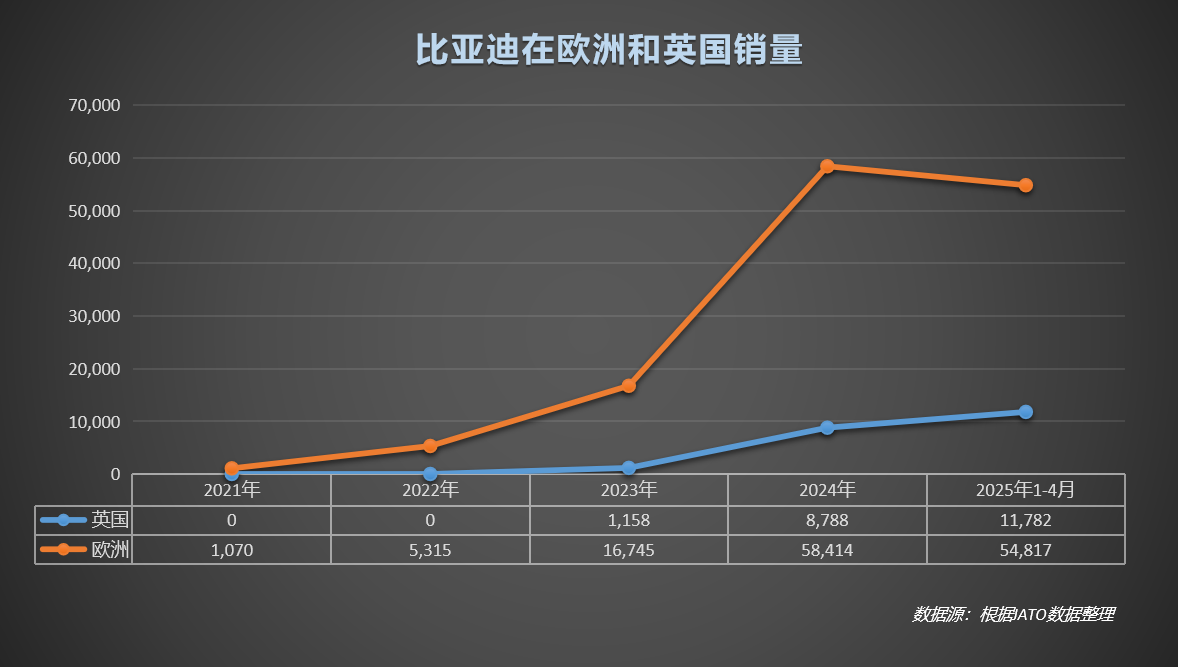

This is the result of BYD's proactive adjustment of its European strategy. In April 2025, the number of electric vehicle registrations by Chinese automakers in Europe increased by 59% year-on-year to nearly 15,300 vehicles; among them, BYD's sales in Europe soared by 359% year-on-year. Not only did it surpass Tesla, it also stood out among a number of traditional European car brands. For example, in the UK, BYD's sales exceeded Fiat, Dacia and Seat. It is worth noting that this growth even occurred before its new Hungarian plant went into production.

Admittedly, Chinese brands still have a long way to go before they gain a significant share of the European market. But it’s still a memorable milestone, especially for BYD. And it may just be the beginning.

BYD has finally gained a place in the European electric car market, which has been led by Tesla for many years. From monthly sales of less than 1,000 units when it first entered Europe, to monthly sales of over 10,000 units; from being criticized for "lack of brand awareness" in the early days to continuous breakthroughs in market share. Behind the counterattack is BYD's long march of blood and tears, and also the ten years of sharpening the sword of Made in China.

Outstanding overseas performance: sales in five European countries soared, and seven Asian countries were in full bloom

Back in 2021, when BYD's new energy vehicles first entered Europe, its monthly sales in the UK, France, Germany, Italy and Spain were only a few dozen to a hundred units. Four years later, BYD has delivered a brilliant answer in these five core markets in Europe: monthly sales reached 10,199 units. Among them, in Germany, a battlefield known as the "bridgehead of European automobiles", BYD's sales soared 824% year-on-year; the UK market increased by 408%, and monthly sales have exceeded the 3,000 mark.

Affected by EU tariffs and the pricing and competitiveness of pure electric vehicles, BYD is shifting its European strategy from focusing on pure electric models to increasing its product line of plug-in hybrid models. Since the beginning of this year, sales of hybrid vehicles in Europe have surged, with a market share of 35.3%, and they are still the first choice for EU consumers. BYD plans to provide European consumers with both pure electric and plug-in hybrid versions for each important new car to meet the needs of European consumers.

At the same time, an independent European analyst who studies the prospects of Chinese brands in Europe pointed out that companies like BYD, with its strong model lineup, can also attract a wider customer base. Currently, BYD has launched ten models in Europe, with a diversified product matrix ranging from affordable urban commuter sedans to high-performance luxury models.

According to S&P Global Mobility Forecast, BYD's sales in Europe will double to 186,000 vehicles by 2025, and will more than double again to nearly 400,000 vehicles by 2029.

BYD is making great strides not only in Europe but also in Asia. In Singapore, BYD has been the top seller of all brands from January to May 2025; in Malaysia, BYD has surpassed Tesla in sales; even in the relatively conservative Japanese market, BYD has entered the top ten imported car sales for the first time with the Hiace 07EV.

From monthly sales of 100 units to 10,000 units, this was a long journey of blood and tears that lasted four years

Behind BYD's impressive performance is actually a difficult four-year counterattack from being ignored to becoming a leader. It should be noted that BYD did not officially start business outside Norway and the Netherlands until the end of 2022. When BYD first entered Europe, the heartland of the automotive industry, German dealers shook their heads and told BYD: "Europeans only recognize local brands."

Hard work pays off. Three years later, BYD has impressed Europeans with its rich product matrix and precise product definition. Its latest Dolphin Surf (equivalent to the European version of Seagull) launched in Europe immediately set off a boom in the European small car market. The size of the Dolphin is just right for most European cities, and it has more configurations than some European small electric cars. Foreign media said it was "worth the money".

It is not easy to gain a foothold in Europe, where many old brands gather. Lack of brand awareness is just one of the many difficulties. In 2023, a European anti-subsidy investigation made BYD's European expansion plan even worse. The EU announced that it would impose a 27% punitive tariff on BYD, in addition to a 10% standard car import tariff. However, all this did not stop BYD's determination to move forward in Europe. BYD responded flexibly and chose to fight to the end.

It is better to say that tariffs have provided greater impetus for Chinese electric vehicle manufacturers such as BYD to achieve localized production in Europe. At the end of 2023, BYD completed the foundation laying of the Szeged plant built in Hungary. The Szeged plant is also the first passenger car base built by a Chinese automaker in the European Union. The Hungarian factory not only marks BYD's official entry into the European market, but also lays a solid foundation for its production and sales in Europe. In addition, BYD has built its own lifeline and invested heavily in building a fleet of 8 ro-ro ships, among which the "Shenzhen" is the world's largest car carrier, which can carry 9,200 vehicles. BYD plans that by 2030, one in every two cars it sells will be sold outside the domestic market. Last year, this ratio was only one in ten.

"Some people once said that BYD has 'no presence' in Europe," said a BYD overseas manager, pointing to the early negative reports from self-media. Now, BYD is fighting back with its hard power: its market share of new energy vehicles in Europe will exceed 6% in 2025; its sales from January to April reached 55,000 units, close to the total for the whole year of 2024; in the UK, BYD's sales in the first four months have exceeded 10,000, and in Germany, BYD has suppressed Tesla for two consecutive months.

BYD is rewriting the industrial landscape. Behind its success in Europe is the global leap of Chinese manufacturing

Europe, as the birthplace of the global automobile industry, has long been dominated by German and American cars. However, this situation is changing. BYD has surpassed Tesla in sales in Germany, which is known as the bridgehead of the automobile industry. BYD's rise in Europe is by no means the success of a single company, but a microcosm of the overall upgrading of China's manufacturing industry.

Over the past decade, China's role in the global value chain has evolved like a miniature history of the industrial revolution. The label of "world factory" is being replaced by the golden name card of "innovation center", and this transformation is particularly eye-catching in the field of China's automobile industry. According to data from the China Association of Automobile Manufacturers, China's automobile exports will exceed 5.859 million units in 2024, a year-on-year increase of 19.33%; in the first four months of 2025, China's automobile exports have reached 1.937 million units. This continuous growth curve that crosses the million level vividly interprets the energy level leap of China's manufacturing industry.

This counterattack is far more than just sales volume, it is also a transformation of identity. Chinese automakers, led by BYD, are breaking the label of followers and leading the trend as standard setters.

Unlike previous Chinese automakers that relied on low-price strategies to enter overseas markets, BYD has gradually established a foothold in the European market with its independently developed core technologies such as blade batteries, e-platform 3.0, and CTB. By establishing a research and development center in Hungary, BYD will export cutting-edge technologies on intelligence and electrification to Europe. In addition, BYD is actively planning to establish a megawatt-level flash charging network in Europe, which may help Europe accelerate the upgrade of charging infrastructure. As CNBC said: "BYD is using technology and ecology to reshape the global industrial logic."

BYD's major breakthrough in the European market is the best example of the qualitative change of China's manufacturing industry. It proves that Chinese companies can not only produce cost-effective products, but also lead the global industrial transformation through technological innovation. There is no doubt that the global leap of Chinese manufacturing is unstoppable and is writing a new chapter on the international stage.