Announcement from the Ministry of Industry and Information Technology of the People's Republic of China

No. 12, 2025

In accordance with the Administrative Licensing Law of the People's Republic of China, the Decision of the State Council on Establishing Administrative Licensing for Administrative Approval Items That Must Be Reserved, the Notice of the Ministry of Finance, the State Administration of Taxation, the Ministry of Industry and Information Technology, and the Ministry of Transport on Preferential Policies for Energy-Saving and New Energy Vehicles and Vessels to Enjoy Vehicle and Vessel Tax (Finance and Taxation [2018] No. 74), the Announcement of the Ministry of Industry and Information Technology, the Ministry of Finance, the State Administration of Taxation on Adjusting the Technical Requirements for Energy-Saving and New Energy Vehicles to Enjoy Vehicle and Vessel Tax Preferential Conditions (No. 10 of 2024), the Announcement of the Ministry of Finance, the State Administration of Taxation, the Ministry of Industry and Information Technology, the Ministry of Science and Technology on Exemption from Vehicle Purchase Tax for New Energy Vehicles (No. 172 of 2017), and the Notice of the Ministry of Finance, the State Administration of Taxation, the Ministry of Industry and Information Technology, and the Ministry of Science and Technology on Exemption from Vehicle Purchase Tax for New Energy Vehicles (No. 172 of 2017). In accordance with the "Announcement of the State Administration of Industry and Information Technology on the Continuation and Optimization of the Vehicle Purchase Tax Exemption Policy for New Energy Vehicles" (No. 10 of 2023), "Announcement of the Ministry of Industry and Information Technology, the Ministry of Finance and the State Administration of Taxation on Adjusting the Technical Requirements for New Energy Vehicle Products with Vehicle Purchase Tax Exemption" (No. 32 of 2023) and other relevant regulations, the licensed "Road Motor Vehicle Production Enterprises and Products" (395th batch) and the "Catalogue of Energy-Saving and New Energy Vehicle Models Enjoying Vehicle and Vessel Tax Exemption" (74th batch) and the "Catalogue of New Energy Vehicle Models with Vehicle Purchase Tax Exemption" (18th batch) approved by the State Administration of Taxation are now announced.

appendix:

1. Road motor vehicle manufacturers and products (395th batch)

2. Catalogue of energy-saving and new energy vehicle models that enjoy vehicle and vessel tax exemptions (74th batch)

3. Catalogue of new energy vehicle models exempted from vehicle purchase tax (18th batch)

Ministry of Industry and Information Technology

June 19, 2025

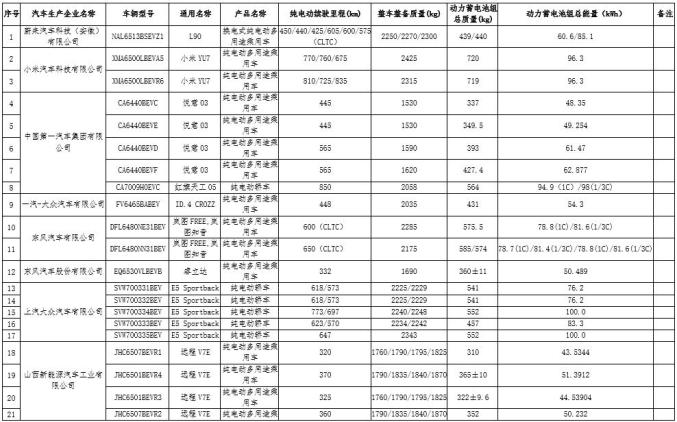

The catalogue of new energy vehicles exempted from vehicle purchase tax (the eighteenth batch) pure electric vehicles-passenger vehicle models are as follows:

Original title: Buy these new energy vehicles and enjoy purchase tax exemption →