Recently, Wei Jianjun, chairman of Great Wall Motors, said that "the 'Evergrande' of the auto industry has already appeared, but it has not exploded yet", which hit the sensitive nerves of the market like a heavy hammer. This statement not only reflects the anxiety of some companies in the deep waters of new energy transformation, but also brings core issues such as the asset-liability structure and profitability of automobile companies to the forefront.

In fact, there is a significant cognitive bias in simply comparing the automotive industry to the high-leverage model of real estate. As a technology-intensive manufacturing industry, its survival logic is rooted in continuous technological iteration, supply chain efficiency, and product capabilities, rather than relying on asset bubble games based on financial leverage.

Is the automotive industry really too indebted ?

As we all know, Evergrande once rapidly expanded its scale during the upward cycle of the real estate industry through the "high turnover + high debt" model. When the industry turning point came, Evergrande's capital chain quickly broke, and huge losses followed. Wei Jianjun's remarks about "Evergrande in the automobile industry" also drew outside attention to the debt of the automobile industry.

Compared with other industries, China's mainstream passenger car companies generally have a higher debt-to-asset ratio. However, those who criticize the auto industry for its so-called high debt-to-asset ratio clearly lack understanding of the industry.

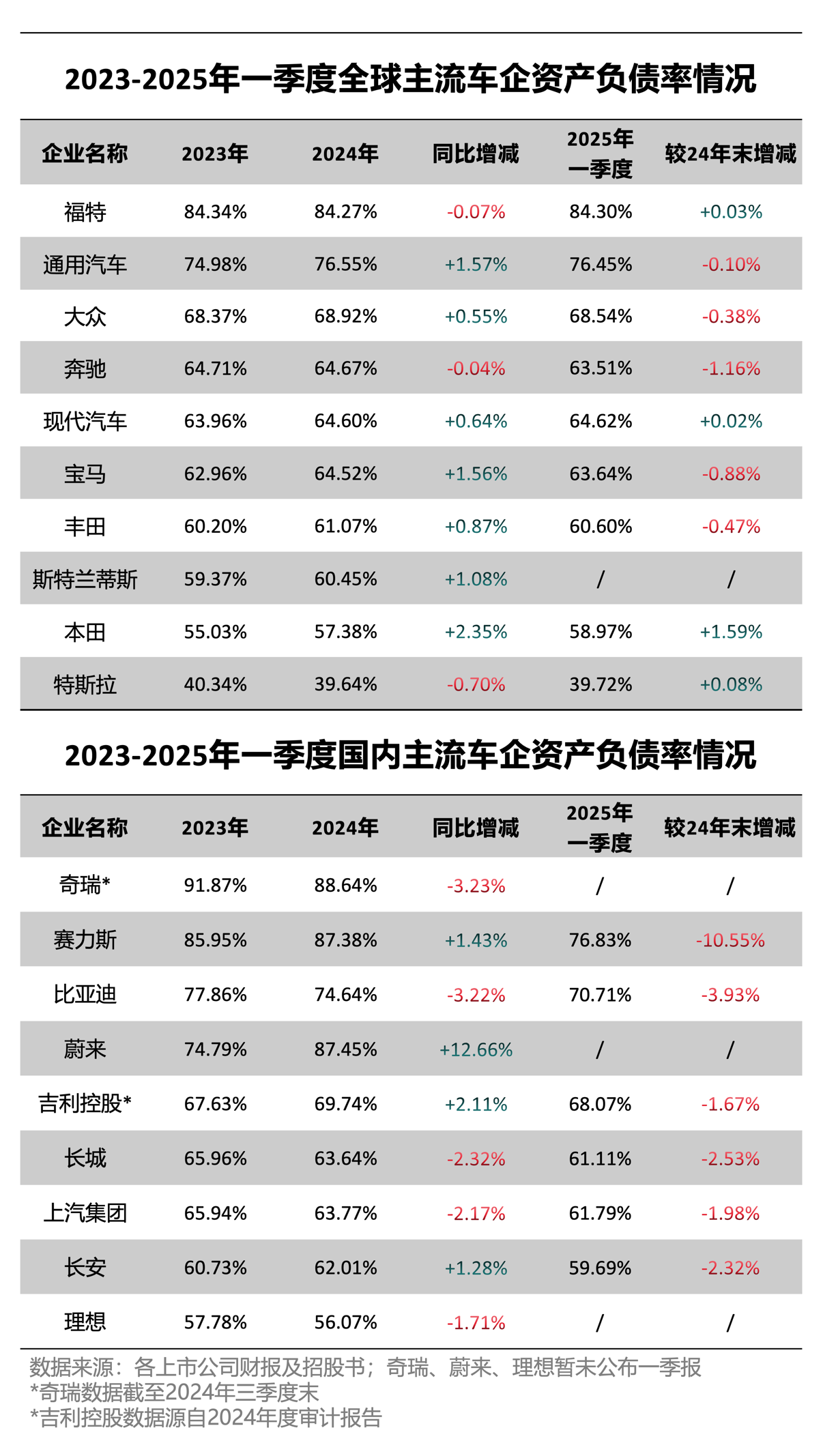

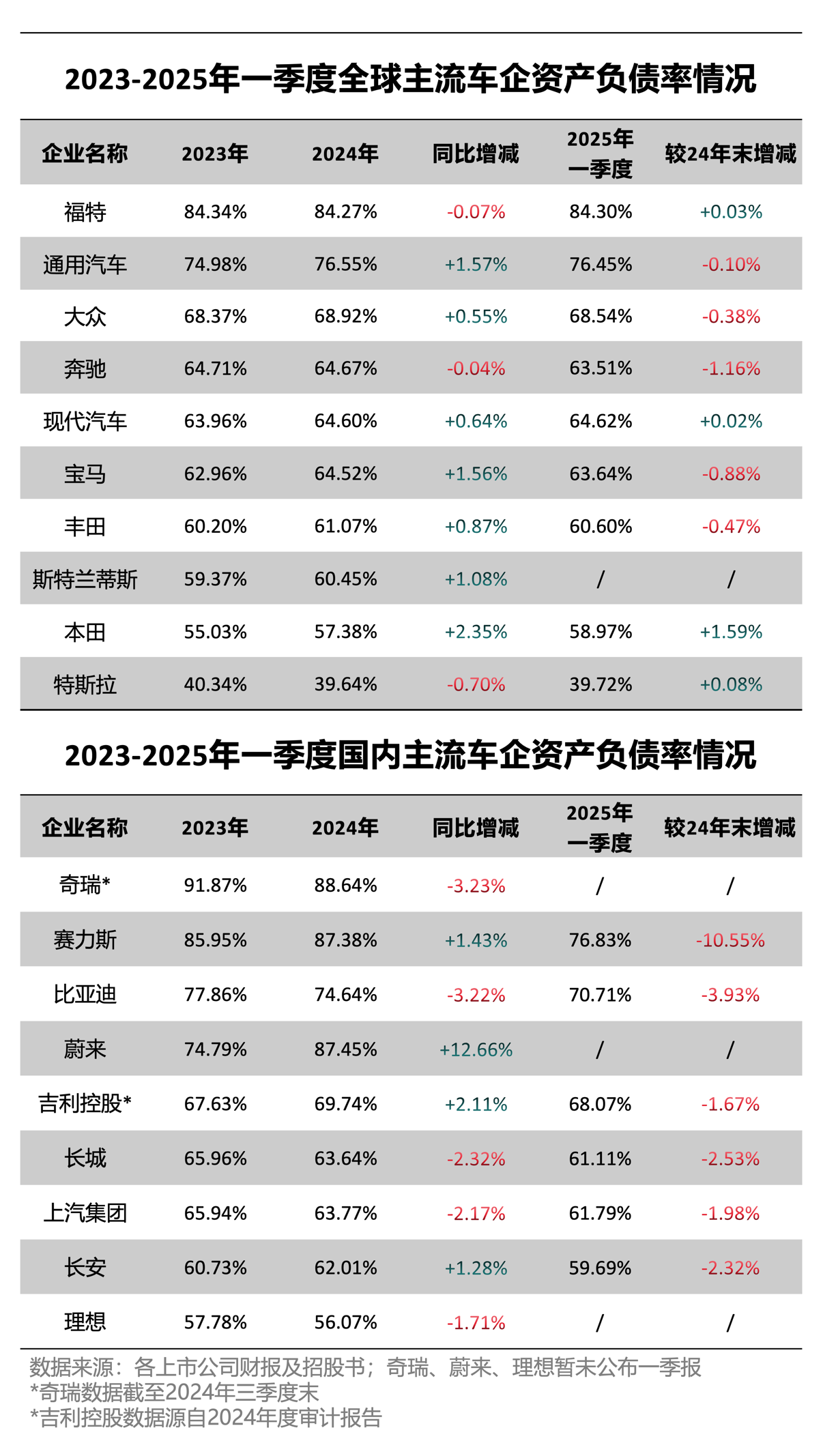

According to the financial reports and prospectuses of various companies, the asset-liability ratios of mainstream domestic automakers will generally exceed 60% in 2024: Chery 88.64%, SERES 87.38%, NIO 87.45%, BYD 74.64%, Geely Holding 69.74%, Great Wall 63.64%, SAIC Group 63.77%, Changan 62.01%, and Li Auto 56.07%. In the first quarter of 2025, the asset-liability ratios of the above-mentioned automakers mostly declined.

However, it should be pointed out that a high debt-to-asset ratio does not necessarily mean that the company is facing financial risks.

As a typical asset-heavy industry, the automobile industry requires a large amount of capital investment in the early stages for production line construction, technology research and development, etc. Therefore, high debt is the norm in the industry.

Compared with major global automakers, according to the financial reports of listed companies, in 2024, Ford's debt-to-asset ratio will be 84.27%, General Motors will be 76.55%, Volkswagen Group will be 68.92%, Toyota will be 61.07%, and Honda will be 55.03%. High debt ratio is a common phenomenon in the automotive industry.

In addition, the debt structure of domestic automakers is different from that of international automakers, mainly reflected in the proportion of interest-bearing liabilities.

Interest-bearing liabilities refer to debts for which a company needs to pay interest, such as bank loans and bonds, while interest-free liabilities include operating liabilities such as accounts payable and contractual liabilities, which usually do not require interest payments. For car companies, the proportion of interest-bearing liabilities can better reflect their actual debt repayment pressure.

Specifically, in 2024, Changan's interest-bearing liabilities accounted for only 0.9%, SERES 0.8%, BYD 5%, and Ideal 9%, all of which are at a relatively low level.

Traditional giants such as Toyota and Ford generally have more than 50% of their interest-bearing debt, and are under significant pressure from interest costs. In contrast, domestic automakers can be said to be leading the world in the management of interest-bearing liabilities. By dominating with interest-free liabilities (accounts payable, etc.), they minimize financial costs and provide sufficient funds for capacity expansion and technological research and development.

In addition, among the liabilities of the automobile industry, operating liabilities such as accounts payable and contractual liabilities account for a high proportion, which is a reflection of the bargaining power of the industrial chain and is fundamentally different from the financial leverage of real estate.

The new energy vehicle industry is booming, and the system's competitiveness can survive the cycle

The stable operation of leading companies also confirms the healthy development of the automotive industry.

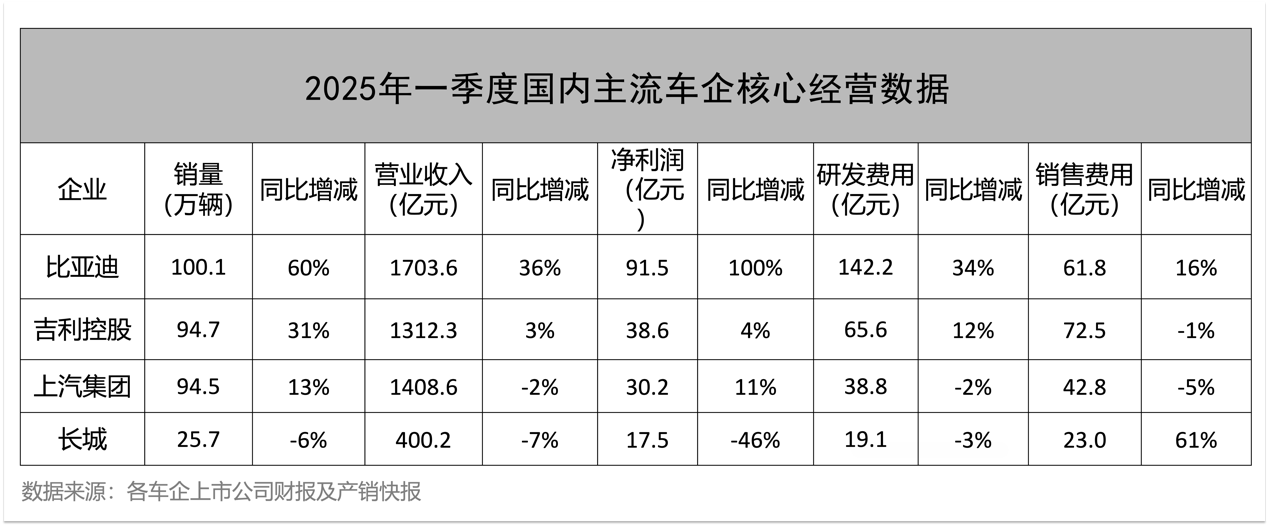

In the first quarter of 2025, the leading automakers showed strong financial performance. The net profits of BYD, Geely, SAIC and Changan increased by 100%, 264%, 11.39% and 16.81% respectively, highlighting the resilience of industry leaders.

The practice of leading companies has proved that companies that invest heavily in research and development, do a good job in supply chain management, and stick to the essence of car manufacturing can survive cycles through system competitiveness even in the face of short-term pressure.

However, there is a trend of differentiation within the industry. Some automakers saw a decline in net profits in the first quarter. In the fiercely competitive Chinese automobile market, "reducing costs and increasing efficiency" has become the core proposition for automobile companies to break through. Judging from the signals released at the performance briefings of leading companies, optimizing marketing expenses is becoming a key battlefield in the fight against cost reduction. If high sales expenses are not successfully converted into sales volume and market share, they will instead erode profits.

However, it should be pointed out that the short-term difficulties of some companies, such as high sales expenses and falling profits, are actually temporary challenges faced by individuals due to lagging strategic adjustments and unbalanced resource allocation in the fierce market competition, and cannot represent the overall situation of China's automobile industry.

Just as Evergrande’s sudden collapse is closely linked to the overall downward trend of the real estate industry. After a long period of rapid development, the real estate industry has seen its market gradually become saturated and the demand side has shrunk significantly. Against this backdrop, Evergrande relied excessively on a high-leverage, high-debt business model and expanded wildly. The scale of its debt was staggeringly large, seriously affecting the stability of the upstream and downstream industrial chains, home buyers, and the financial market.

However, the new energy vehicle industry is completely different and is currently in a booming growth phase.

Judging from market data, in 2024, China's automobile industry will reach a new level: automobile production and sales will both exceed 31 million units, of which new energy vehicle production and sales will both exceed 12.8 million units, ranking first in the world for 10 consecutive years. At the policy level, in order to achieve energy conservation, emission reduction and energy transformation goals, governments around the world have strongly supported the new energy vehicle industry, providing favorable policies such as car purchase subsidies, tax incentives, and construction of charging pile infrastructure. Technically, battery life continues to improve and intelligent driving technology continues to iterate, and consumers' acceptance and recognition of new energy vehicles are also increasing.

Through an in-depth analysis of the 2024 industry financial reports and key financial indicators, it can be seen that the Chinese automobile industry as a whole maintains a steady development tone, and leading companies have built a safety margin in core dimensions such as profitability and cash flow quality.

We must indeed be wary of potential risks brought about by improper strategies of some companies, and we should also start from the essence of manufacturing and rationally examine the underlying logic of the industry's financial health - data shows that the "health code" of the automotive industry has been demonstrated in the solid financial performance of leading companies. The so-called "Evergrande theory in the auto industry" will eventually be shattered in the face of solid financial data and industry resilience.