The global automotive industry is undergoing a structural change that has not happened in a century. On May 14, the China Electric Vehicle 100 Forum and Ries Strategic Consulting jointly released the "New Species, New Concepts, New Trends - New Energy Vehicle Consumption Insight and Forecast Report", revealing the logic of change and future evolution of China's automotive consumer market.

Structural differentiation in the era of stock competition

According to Shi Jianhua, deputy secretary-general of the China Electric Vehicle 100 Forum, by the end of 2024, the national civilian car ownership will reach 350 million, and the car ownership per thousand people will exceed 250, marking the market entering the era of stock competition after the popularization period.

It pointed out that in 2023, the replacement ratio in my country exceeded 50% for the first time, and it is expected to climb to 80% by 2030, and improvement demand will become the mainstream. Policy-driven plays a key role in the stock market. The "two new" policies implemented in 2024 (the old-for-new subsidy doubled to 15,000-20,000 yuan, and the local purchase subsidy was strengthened) directly drove the sales volume in the second half of the year to rebound by 10% year-on-year, and the annual old-for-new scale exceeded 6.8 million vehicles. In 2025, the policy will continue the loose tone, coupled with the support of the monetary environment, and the domestic market sales volume is expected to remain at 26 million vehicles for the whole year, an increase of about 3% year-on-year.

The rise of Generation Z reshapes consumption logic

Generation Z (those born after 1995 and 2000), who are both “novel-seeking and rational”, are becoming the main force in automobile consumption.

Data shows that Generation Z’s acceptance of new energy vehicles is significantly higher than that of previous generations: 70% believe that a range of 400 to 500 kilometers can meet daily needs; 30% are willing to pay a premium of more than 10,000 yuan for advanced assisted driving functions, which is 15 percentage points higher than the non-Generation Z group.

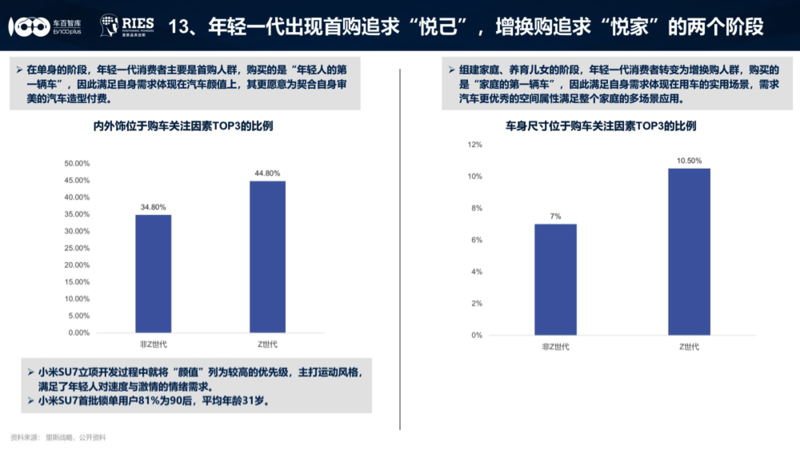

When they are single, Generation Z sees cars as a tool to please themselves, with 80% of the first batch of Xiaomi SU7 users being those born after 1990. After starting a family, their needs quickly shift to space practicality, with their focus on car body size increasing by 3.5 percentage points.

On the other hand, the report shows that Generation Z’s preference for joint venture brand new energy vehicles is only 5%, and 95% of traffic is concentrated on expert brands such as Wenjie and Xiaomi.

New energy market "sinking" and "upgrading" in parallel

According to the report, my country's third-tier and lower-tier cities are becoming new engines of growth for new energy vehicles. In 2024, the sales growth rate of new energy vehicles in the lower-tier markets will reach 63%, and the market share will climb to 40%, but the penetration rate will still be 10 percentage points lower than that in first- and second-tier cities. The market characteristics of low density of charging piles, weak after-sales network and economical pure electric models have provided expansion space for plug-in hybrid/extended-range technology. This technology route accounts for 46% in the lower-tier markets, significantly higher than that in first-tier cities. The report predicts that the sales volume of plug-in hybrid/extended-range models will exceed 8 million in 2025, forming a trend of competing with pure electric models.

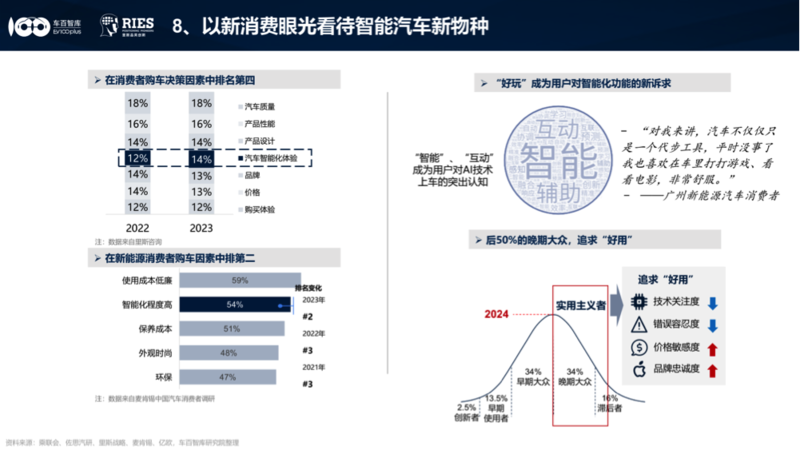

The penetration rate of L2 assisted driving will exceed 50% in the first half of 2024, and the pilot assistance function will become the focus of differentiated competition. Shi Jianhua pointed out that cars have superimposed the attributes of electronic consumer products, and the weight of intelligent factors in consumers' car purchase decisions has risen to 30%.

Breakthrough in the global competition

Chinese automakers are shifting from "market followers" to "technology definers". Overseas deployment has become a must. In 2024, China's new energy vehicle exports will increase by 68% year-on-year.

However, He Songsong, partner of Ries Strategy Consulting China, pointed out that if the current overseas expansion still relies on the "cast-net" trade model, it will be unsustainable. He suggested that automakers need to focus on potential markets, build localized organizations and channel systems, and tell good localized stories, rather than simply exporting cars overseas.

In this century-long change, Chinese automakers have seized the initiative, but the window of opportunity is narrowing. Only by continuously understanding changes in consumption, focusing on category innovation, and building global potential can they continue to lead in the second half of the intelligentization.