The Ministry of Finance and the State Administration of Taxation jointly issued an announcement on July 17, announcing important adjustments to the consumption tax policy for ultra-luxury cars. Upon approval, the new policy will be officially implemented on July 20, marking a new stage in China's tax regulation of high-end car consumption.

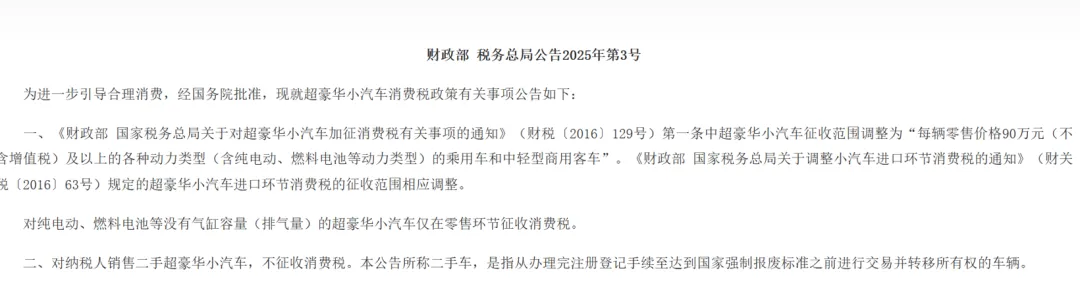

The most striking thing about this adjustment is that the threshold for consumption tax collection has been significantly lowered. The announcement clearly states that the collection standard for super luxury cars has been reduced from the original retail price of 1.3 million yuan per car (excluding VAT) to 900,000 yuan (excluding VAT). This adjustment significantly expands the scope of consumption tax coverage, meaning that more high-end models with a price range of 900,000 to 1.3 million yuan will be included in the tax scope, which is expected to affect the main sales models of many luxury car brands.

Image source: State Administration of Taxation

The new policy clearly defines the taxation rules for various types of super luxury cars for the first time, and explicitly includes passenger cars and medium and light commercial buses with new energy power such as pure electric and fuel cells in the taxation scope, filling the previous policy gap. At the same time, the policy makes differentiated arrangements for new energy vehicles: for pure electric and fuel cell super luxury cars without cylinder capacity, consumption tax is only levied at the retail stage. In contrast, traditional fuel vehicles are subject to consumption tax at both the production (import) and retail stages. This design not only reflects the fairness of taxation, but also continues the support orientation for the development of the new energy vehicle industry.

Second-hand car transactions have received a major boost. The new policy clearly stipulates that taxpayers who sell second-hand super luxury cars will no longer be subject to consumption tax, regardless of the first registration time and the original sales price. The policy clearly defines "second-hand cars": vehicles that are traded and ownership is transferred from the time the registration procedures are completed to the time they meet the national mandatory scrapping standards. This move will effectively reduce the circulation costs of high-end second-hand cars and is expected to activate related market transactions.

The announcement further regulates the tax base for the retail stage. When a taxpayer sells ultra-luxury cars, the sales amount for which consumption tax is levied includes all the prices collected from the purchaser and the fees outside the price. In particular, all fees collected for various reasons such as providing vehicle decoration, configuration upgrades, and after-sales services fall into the category of "fees outside the price" and must be included in the sales amount for calculating consumption tax. This regulation is intended to plug tax collection and management loopholes and ensure the integrity of the tax base.

To ensure the uniform implementation of tax policies, the consumption tax collection standard for super luxury cars at the import stage is also adjusted to 900,000 yuan (excluding value-added tax). The announcement emphasizes that the consumption tax policy for imported vehicles will be consistent with that for domestically produced vehicles.

The policy adjustment this time is significant, reflecting the country's clear intention to guide automobile consumption in a more rational and sustainable direction through tax levers. On the one hand, lowering the threshold has expanded the tax base and strengthened the regulatory effect on high-end and luxury automobile consumption; on the other hand, including new energy vehicles in the tax scope reflects that the tax policy keeps pace with the pace of industrial technological changes, while retaining support for its development through tax exemption in the production link. The abolition of taxation on second-hand car transactions is aimed at promoting the effective circulation of stock resources. The overall policy design takes into account both the reasonable adjustment of fiscal revenue and the actual needs of the transformation and upgrading of the automobile industry.

With the official implementation of the new policy on July 20, the sales structure, pricing strategy and consumer purchasing decisions of the ultra-luxury car market will face a reshaping. In particular, the market performance of models in the price range of 900,000 to 1.3 million yuan and high-end new energy vehicles will be directly affected by the profound impact of this tax policy adjustment. The industry urgently needs to adapt to the new tax environment, and consumers also need to re-evaluate the purchase cost.